James B. Francis, CFA

Chief Research Officer, CRB Monitor

During times of market uncertainty, as we are currently experiencing, asset managers tend to preoccupy themselves with the state of their asset allocations, from both a strategic (SAA) and a tactical (TAA) perspective. And as they perform their analyses, they consider whether or not their current mix of investments is the most appropriate to maximize their risk-adjusted performance, in both the near term and into the future.

With SAA, traditional asset classes such as equities, fixed income, real estate and commodities are assigned portfolio weightings based on their individual and collective sensitivities to historic real world scenarios. The goal of SAA is to establish an optimal policy asset mix that meets the long-term objectives of the investor.

Conversely, TAA is the process by which a portfolio manager makes interim adjustments to the strategic asset mix based on forecasted, near term exposure to risk factors. The TAA process frequently involves rebalancing within each asset class (e.g. over- or under-weighting municipal bonds, emerging markets equities, natural gas futures, etc.) as the model sees fit.

Question: Where would cannabis investments fit in a typical asset allocation?

Let’s discuss.

Cannabis equities could be described as a sub-asset class and one component of the allocation to global equities. The introduction of cannabis equities, therefore, would be part of the tactical asset allocation (TAA) rebalance process. And given that cannabis equity is, by market capitalization, not a particularly large component of global equity, why should we care about it? An excellent point, and let’s think about that.

A handful of facts make cannabis unlike any other sub-asset class of equities:

- Cannabis is, at least for now, illegal in the eyes of the US Federal Government.

- Transacting in cannabis, even in states where it is has been legalized, is considered a money laundering activity by the US Federal Government.

- Given limitations in interstate commerce, many cannabis companies operate as “vertically integrated” businesses, meaning that they are licensed for operations that represent two or more stages of production. This can be suboptimal for companies that are better suited specializing in one area.

- Licensed Cannabis companies operating in “legal” states face significant headwinds from the illicit market, which provides comparable products at lower prices.

Are all these positives for Cannabis equity? They quite possibly could be.

Due to its current status in the US as a schedule 1 narcotic, many large financial institutions’ internal guidelines prohibit investment and transacting in cannabis related businesses. With the enactment of legalization at the federal level, these institutions would have more flexibility to custody and transact CRBs on behalf of their clients, which would likely increase demand in the market.

Furthermore, with the passage of the SAFE Banking Act, financial institutions would be permitted to process cannabis-related transactions without fear of penalty from the US federal government. We might also see, in the not-so-distant future, transactions of cannabis products occurring across state lines, which would allow CRBs to focus on their particular strengths and maximize profitability. All of these developments would be bullish for cannabis equities, but investors will need to be patient as these developments gradually unfold.

Moreover, the cannabis market has the following unique, positive features, emphasizing the diversification of the ecosystem:

- Cannabis businesses, across all risk tiers represent a diverse basket of sub-industries, such as agriculture, pharmaceuticals, nutritional supplements, recreational products (like alcohol & tobacco) and health and beauty aids.

- Cannabis plants include both marijuana and hemp, which yield a very different, diverse set of products that appeal to a wide range of consumers.

Question: At their current prices, are cannabis equities cheap?

That is not for us to decide, but things are looking historically undervalued these days. The Nasdaq CRB Monitor Global Cannabis (HERBAL) index of 24 Pure Play cannabis-related businesses has returned a negative 30% since the beginning of 2022. This is not an anomaly, as cannabis equities have not recovered from the recent pandemic that hit all aspects of the cannabis ecosystem.

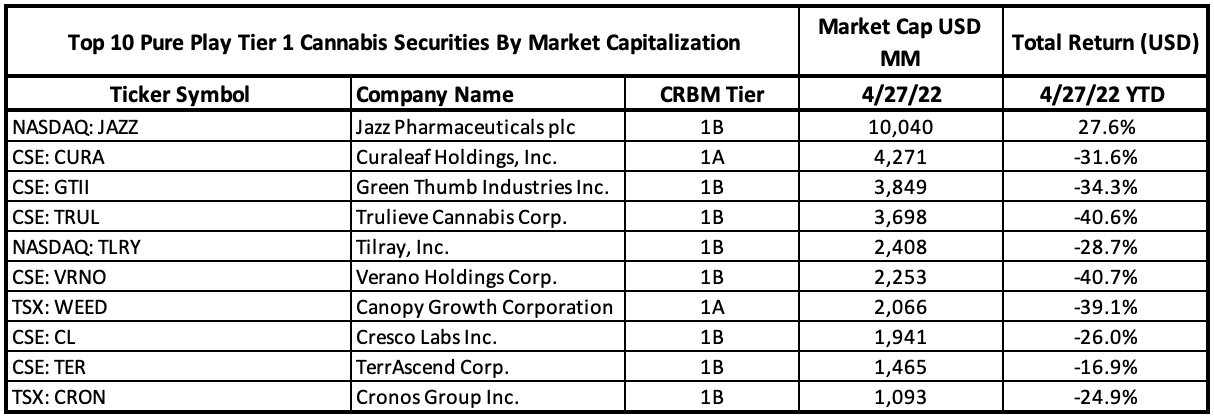

In the following table, notice that the only Tier 1 Pure Play CRB with a positive return, Jazz Pharmaceuticals plc (Nasdaq: JAZZ), is also a company that sells the only FDA-approved Cannabis product worldwide. [JAZZ is a unique case, as it will have minimal sensitivity to the regulatory environment due to their cannabis product being legal.] With that said, it’s been a bit of a bloodbath for the rest of the industry.

Source: CRB Monitor, Sentieo

And looking at valuations, here are the price-to-book value numbers for the last two years, indicating general cheapness across the space:

Source: Sentieo

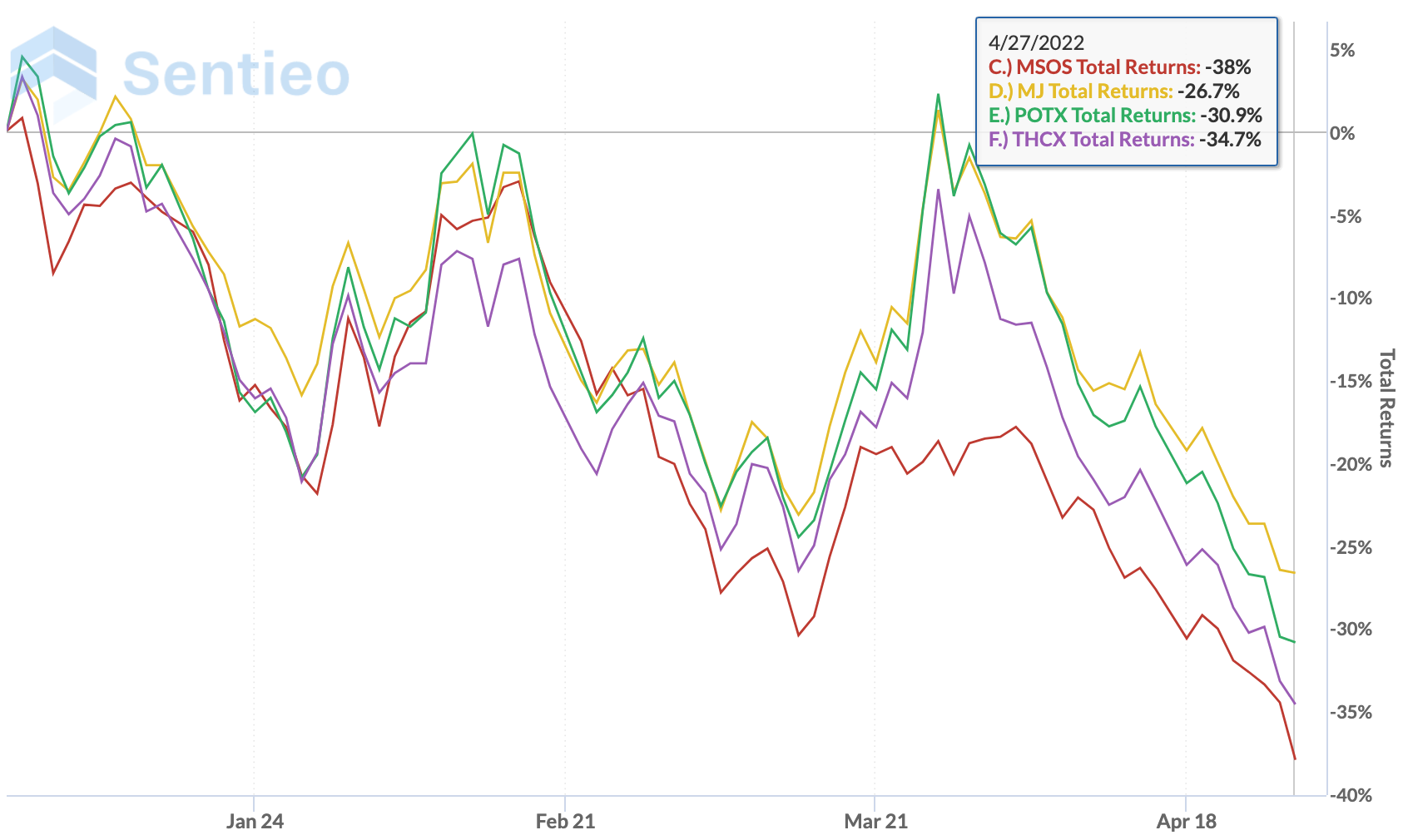

As for fund performance, it should not be surprising that we see similar results across the cannabis-themed ETF space. Four of the largest ETFs have performed anywhere from -26.7% to -38% YTD.

Source: Sentieo

And so we believe the answer to the question, “Is this the right time to invest in cannabis equities?” is yes, but investors should proceed with some degree of caution and a lot of patience.

As the “gold standard” for cannabis market intelligence, CRB Monitor has its finger on the pulse of the entire cannabis ecosystem. We perform deep research on more than 60,000 cannabis-related businesses (CRBs), including a global universe of more than 1,400 public cannabis-related companies.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"