James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Related Equity Performance

Cannabis Equity Index Returns - "The Rescheduling Effect"

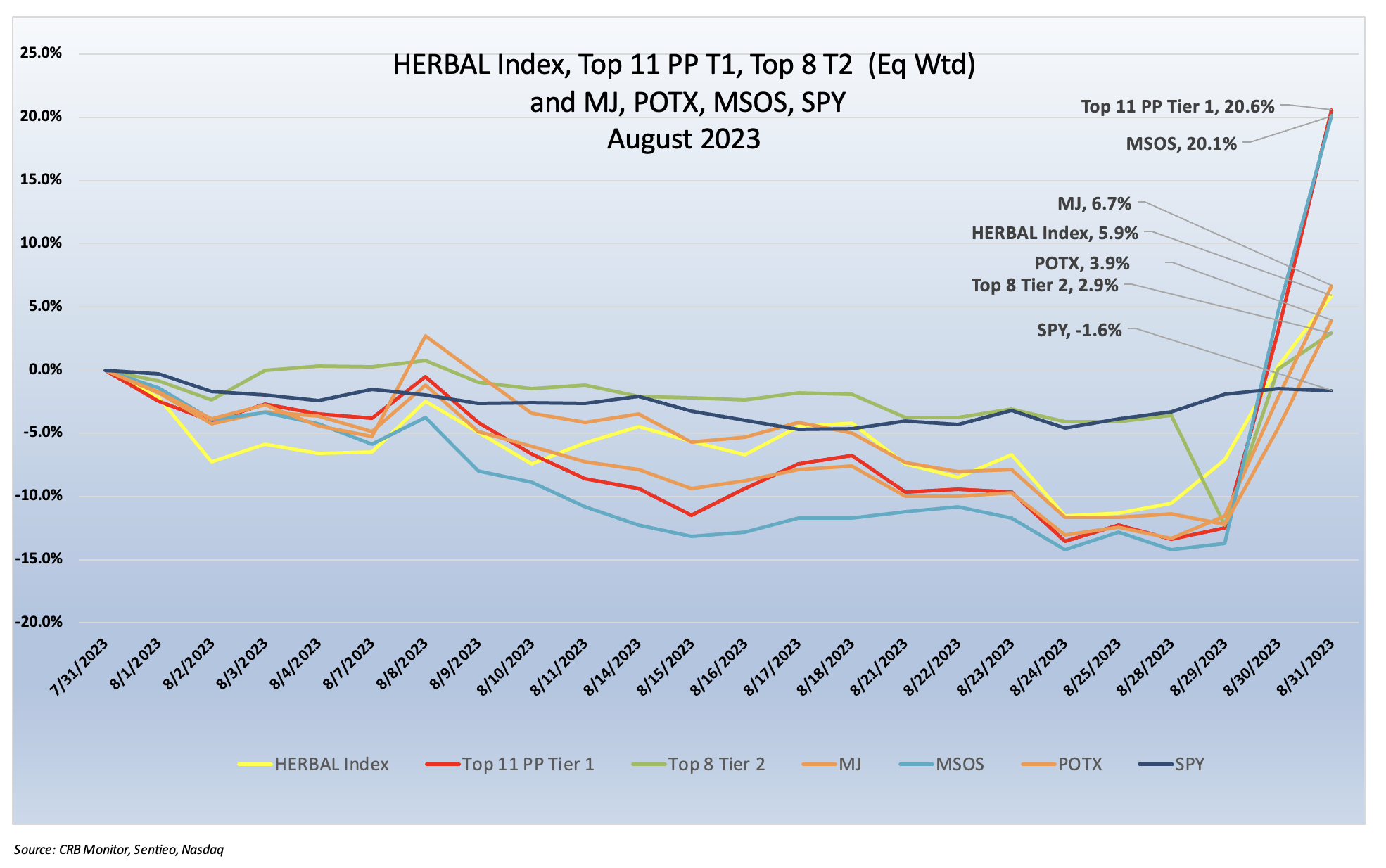

Wow...Looking at the chart above one might think they are looking a map of a canyon hitting up against a sheer, technical rock face. But not so fast - we are looking at 4 weeks of falling cannabis prices followed by two days of euphoria, brought on by one major announcement by a government agency. The announcement that the US Department of Health and Human Services recommended rescheduling cannabis to Schedule III from Schedule I was covered by major networks and news agencies around the world, and it could change the complexion of the cannabis industry permanently. And while the specific impact on individual CRBs, or CRBs which hold particular cannabis license types, or operate in specific regions, is not fully understood, there has been much speculation. Needless to say, the idea of moving medical cannabis to Schedule III is a positive move for both operators and consumers and we wait with great anticipation the short and long term impact on cannabis equities, particularly Tier 1 and Tier 2 CRBs.

These frothy returns can be attributed in large part to a few factors, namely 1) sudden investor euphoria combined with 2) anxious short covering and 3) lack of liquidity and 4) wide spreads. Conventional fundamentals were not a factor, as the fundamentals that these companies had in mid-August still exist today. With that said, we will find out what these largely beaten-down stocks are made of once the dust settles on the whole HHS/DEA episode. It is safe to assume that this roller coaster ride is far from over.

[For a more in-depth look at all the implications of cannabis rescheduling, CRB Monitor has published an excellent summary of the HHS recommendation and the various impacts it would have on CRB Monitor’s range of database users: Taking Cannabis Down to Schedule III: What Does It Really Mean?.]

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), finished the month competitive with its peers in August 2023. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a positive 5.9% return in August 2023 and finished ahead of its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (+3.9%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al) as well as rules for inclusion.

HERBAL trailed the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+6.7%) and finished significantly behind the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which closed out August with a return of +20.1%.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due its unusual composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases non-CRB) holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. Additionally, In 2022 MJ added and maintains close to a 50% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure. MJ also carries a large balance (10%) in a cash vehicle, which will serve as a persistent performance drag if maintained at that level.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can deviate materially from HERBAL’s as well (as it did in August), largely due to its holdings of CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap steamrolled into month end, +20.6% for August 2023, buoyed by the abovementioned revelations from HHS. Returns were mostly strong across the board with very few exceptions (see the table below).

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap finished the month lagged behind the Tier 1 CRB basket, posting a positive 2.9% return in August. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time.

US equities were slightly down in August as inflationary fears persisted and gas prices inched higher at summer’s end. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a negative 1.6% for the month, underperforming the cannabis indexes for the second month in a row.

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – August 2023 Returns

CRB Monitor Tier 1

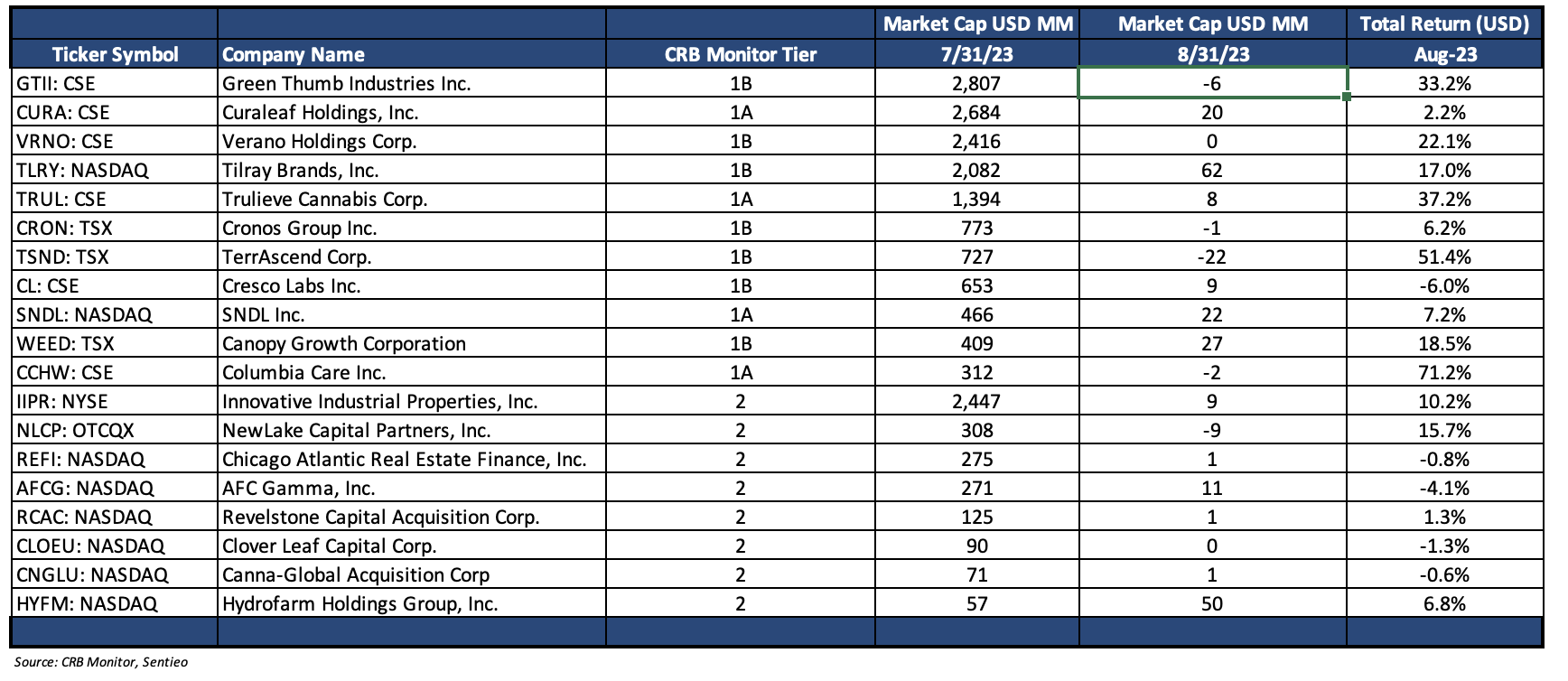

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities returned +20.6% for August 2023, with both the Canadian and MSO groups benefitting from the optimism that cannabis would, could, or might be rescheduled in the future. While this revelation is far from implementation - experts believe it could take a year or longer to become a reality - any positive cannabis-related news is likely to cause an investment feeding frenzy across this largely beaten-down industry.

We frequently see the Canadian (non-US plant-touching) group deviate from the US multistate operator MSO group, given their individual sensitivities to various factors, with the most profound of these factors being the progress toward US federal legalization.

The “legal” Canadian CRB basket gave investors a few surprises in the month of August. Tilray Brands, Inc. (Nasdaq: TLRY) (+17.0%) rallied in the last week, after returning more than 60% in July on the back of its Q4 and Full Fiscal Year earnings report that significantly beat expectations. Meanwhile, Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+7.2%) and Tier 1B Cronos Group Inc. (TSX: CRON) (+6.2%) finished strong at month end.

A frequent target of intense scrutiny for investors, Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) turned in a very respectable +18.5% for the month (this followed a +27% return in July). While this might be a cause for celebration in any other industry, we would need to see a return of this magnitude several times over for most CRBs to claw back all they have lost since 2021. As we wrote in July, the S&P TSX announced that due to its low share price, Canopy Growth would be dropped from S&P/TSX Composite Index, Canada's equivalent of the S&P 500.

Now a quick look at the MSO basket: This group soared at the end of the moth, led by Tier 1A Columbia Care Inc. (CSE: CCHW) (+71.2%) and Tier 1B TerrAscend Corp. (TSX: TSND) (+51.4%). Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) (+37.2%) carried its strong momentum from July into August. The largest Tier 1 pure play CRB by market cap, Green Thumb Industries Inc. (CSE: GTII) (+33.2%) kept pace with its peers in August, posting a lackluster return through August 29th then lifting off with the rest of the MSOs.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 2.9% return for August 2023, which underperformed the equally-weighted Tier 1 basket by 17.7%. Because these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically; however, we also feel that there is no need to try to game them as a strategy. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict. And furthermore, the costs required to rebalance these illiquid baskets could eat up any meaningful profits.

Performance across the Tier 2 basket was mixed in August 2023. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (+10.2%), was positive for the third month in a row; however, like essentially all Tier 1 and Tier 2 cannabis equities, IIPR has a long road ahead if it is to recoup all of its investors’ losses. On August 2nd IIPR reported its 2nd quarter results, with the following highlights (they appear to be righting the ship):

- “Generated total revenues of approximately $76.5 million in the quarter, representing an 8% increase from the prior year’s quarter.

- Recorded net income attributable to common stockholders of approximately $40.9 million for the quarter, or $1.44 per diluted share.

- Recorded adjusted fund from operations (AFFO) of approximately $64.0 million, or $2.26 per diluted share, increases of 6% and 5% from the prior year’s quarter, respectively.

- Paid a quarterly dividend of $1.80 per common share on July 14, 2023 to stockholders of record as of June 30, 2023. The common stock dividends declared for the twelve months ended June 30, 2023 of $7.20 per common share represent an increase of $0.70, or 11%, over dividends declared for the twelve months ended June 30, 2022.”

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (+6.8%) posted its second positive return in a row. On August 9, HYFM announced its 2nd quarter results, which featured a significant drop (-$34mm) in sales but a slight increase in profit due to a reasonable drop in expenses. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day, as it did in August. With its price now trading higher (now in the $1.20’s) HYFM could possibly avoid the need for consolidation/restructuring, but time will tell.

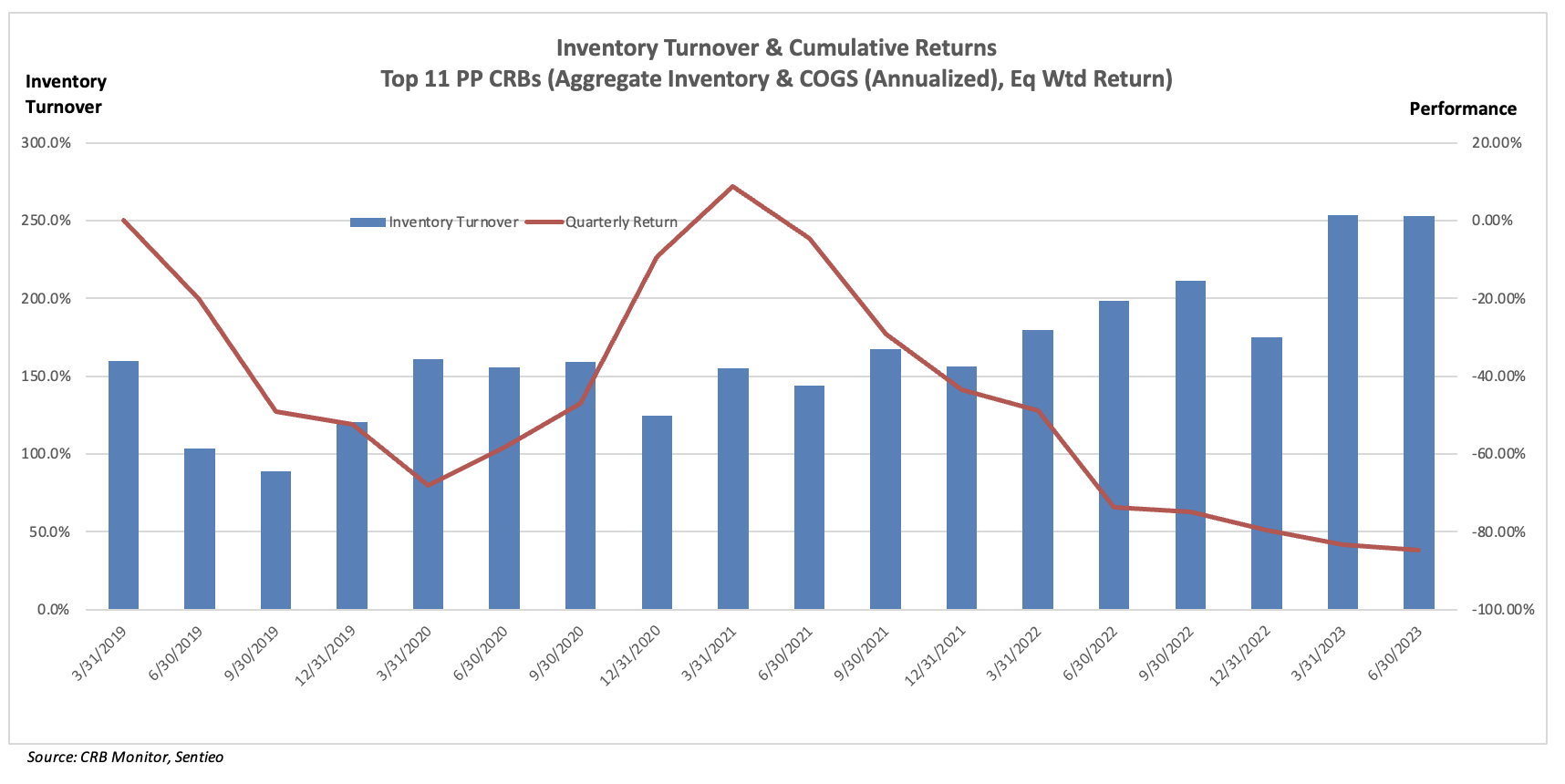

Chart of the Month: Inventory Turnover

In our quest for all the answers related to these curious, sometimes-legal cannabis-linked businesses, we direct our attention to a common multiple: inventory turnover. Quite simply, inventory turnover is the ratio of cost of goods sold (COGS) to average inventory for a particular period. In the words of Investopedia.com, here is a summary of what inventory turnover is useful for:

- “Inventory turnover measures how efficiently a company uses its inventory by dividing the cost of goods sold by the average inventory value during the period.

- Inventory turnover ratios are only useful for comparing similar companies, and are particularly important for retailers.

- A relatively low inventory turnover ratio may be a sign of weak sales or excess inventory, while a higher ratio signals strong sales but may also indicate inadequate inventory stocking.

- Accounting policies, rapid changes in costs, and seasonal factors may distort inventory turnover comparisons.”

Inventory turnover is an area of focus for the entire cannabis industry and it is referenced in essentially all company financials. Here is an excerpt from Tier 1B Lifeist Wellness’s (TSXV: LFST) most recent Management Discussion and Analysis:

“The Company continues its forward-looking inventory management strategy, designed to: 1) reduce the amount of slow-moving inventory; 2) improve inventory turnover; and 3) leverage existing technology to further reduce the inventory risk.”

Similarly we have this statement that can be found in Tier 1B MSO Ayr Wellness Inc.’s (CSE: AYR.A) Q2 2023 Financials:

“Pennsylvania is a similar story to Nevada, where, in a steady market, we maintained our improved margins, thanks to our optimization efforts in the state. This is a market where we see the opportunity to improve inventory turnover to generate cash and will be increasing our internalization efforts.”

For this exercise, we summed the quarterly values in order to calculate the aggregate inventory for each period and COGS (annualized) for the top 11 pure play Tier 1 CRBs (refer to the performance table above for the list). Performance for this basket is the red line while the blue bars represent the aggregate inventory turnover ratio for the basket. While we do feel it’s useful to look at this data on a company-by-company basis, it also works to view it in the aggregate. Aggregating the data serves to smooth it out over the periods and we feel that the basket is so focused in its theme that combining the numbers into one total value is appropriate.

Now for the useful part of this exercise as we take a look at the chart. It appears that, while Rome has been burning, cannabis has been selling - not spectacularly, but respectably (1.5 - 2.5X). Now don’t be fooled, this is not a pretty picture, particularly as we witness this breathtaking, downward spiral of the industry group. However, what we also see is these companies surviving via their ability to turn over their inventories.

While it is obvious that publicly-traded CRBs are far from out of the woods - let’s face it, nearly 90% of pure play Tier 1 market cap has evaporated over the last 30 months - the companies that continue to expand operations and are mindful of expenses will survive. And the fact that marijuana legalization and decriminalization is expanding to include (dare I say) red states, the cannabis industry has legs - and lots of new revenues, and jobs, and economic opportunities for struggling communities.

Another important fact that favors this industry is that the vast majority of cannabis licenses are not held by publicly-traded CRBs (either directly or through subsidiary businesses). Of the more than 200,000 cannabis licenses tracked globally by CRB Monitor, just over 10,000 (5%) are connected to publicly-traded Tier 1 companies. Hence, there is plenty of room for these companies to expand, particularly the multistate operators.

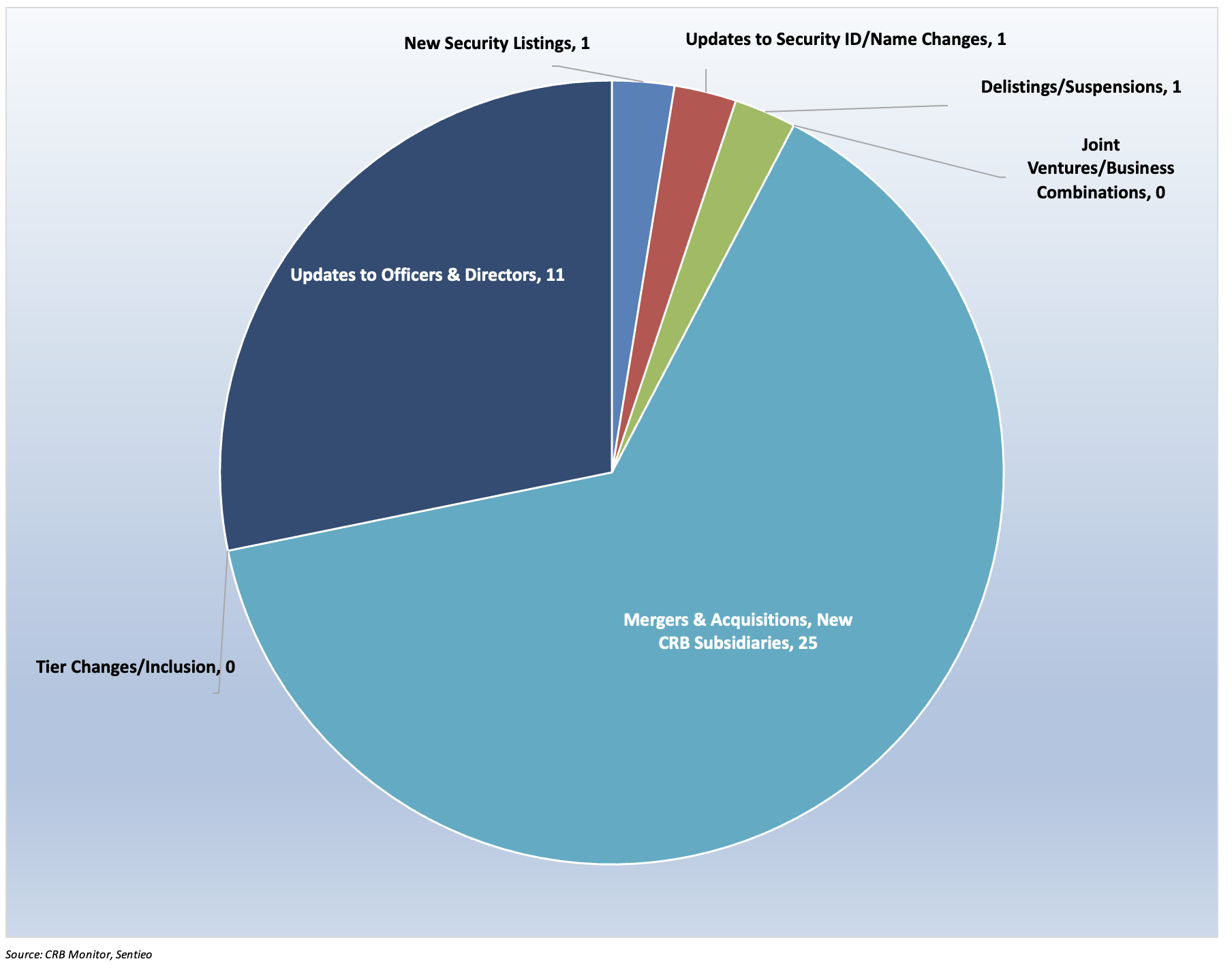

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for August 2023:

Cannabis Business Transaction News - August 2023

August was a quiet month in terms of M&A activity, as the cannabis industry continued to lick its wounds following the failure in July of Cresco Labs Inc. (CSE: CL) to close their acquisition of Columbia Care Inc.(CSE: CCHW). [An excellent epilogue to the Cresco/Columbia Care adventure, “Failed Cresco-Columbia Care Merger Ices Combs’ Cannabis Deal”, can be found on the CRB Monitor website.] With that said, CRBs (particularly MSOs) with cash to spend continue to expand their operations with the purchase of new licensed subsidiary businesses. And with the latest revelations regarding HHS’s recommendation for rescheduling, there is a ray of hope that M&A activity could find a second wind.

Tier 1B MSO Avicanna Inc. (TSX: AVCN) announced in August that it closed its previously announced acquisition of the Medical Cannabis by Shopper’s Business from Shoppers Drug Mart® and that it has launched an all-new medical cannabis care platform, MyMedi.ca. The platform's features include:

- "Medical Cannabis Marketplace: A diverse medical cannabis marketplace featuring approximately 200 unique products supplied by a network of 35 brands from various leading Canadian licensed producers.

- Pharmacist-Led Patient Care Services: Pharmacist-led fully bilingual (English and French) patient care service programs including pharmacovigilance, compassionate pricing, and insurance adjudication in compliance with standards established by private and public payers.

- Patient Education: Patient education programs and informational resources, including harm reduction strategies and risk mitigation.

- Education for Healthcare Professionals: Medical education, training, and resources available to health care practitioners, hospitals, clinics, and institutions, along with potential collaboration opportunities, through the Company’s Medical Affairs department"

What’s also significant here is that when this deal closes it would signify the departure of Tier 1B non-pure play CRB Loblaw Companies Limited (TSX: L) from the cannabis industry. Shoppers Drug Mart, a long-time subsidiary business of Loblaw’s, began selling medical cannabis in 2019. All of its cannabis business will now be taken over by Avicanna.

Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) announced that that it would open RISE Dispensary Las Vegas on Craig, the Company's 84th retail location in the nation, will open on August 2nd. Green Thumb, the largest pure play Tier 1 CRB by market cap, has been in a continuous state of expansion even as the markets have fallen. With this new licensed dispensary, GTII controls, through its subsidiaries,100 cannabis licenses in 16 states that cover essentially all phases of operation.

Also in August, Tier 1B MSO Jushi Holdings Inc. (CSE: JUSH) issued a press release announcing that its sixth medical cannabis dispensary in Virginia, Beyond Hello™ Woodbridge would begin serving Virginia medical cannabis patients and registered agents on Wednesday, August 23rd. In the words of the press release, “Along with offering convenient transaction processing through the Company’s industry-leading online reservation platform, beyond-hello.com, Jushi designed Beyond Hello™ Woodbridge to serve Virginia’s growing patient population. Beyond Hello™ Woodbridge patients will also have access to five of Jushi’s in-house brands, including Sèchè, The Bank, Tasteology Fruit Chews, The Lab, and Nira + Medicinals – all locally grown at Jushi’s nearby grower-processor facility in Manassas. Additionally, this new location will offer dry leaf, concentrates, cartridges, tinctures, topicals, edibles, capsules, pills, and various ancillary products such as approved batteries and devices.” Jushi now holds, through its subsidiary businesses 59 (active or pending approval) cannabis licenses across 7 states.

Not to be outdone, it was reported in August that Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) opened a new dispensary in Manchester, Connecticut. This opening expands Curaleaf’s Connecticut footprint to 4 licensed dispensaries that sell adult-use cannabis. With that said, Curaleaf made it clear that it continues to prioritize its medical marijuana customers. “Curaleaf will continue to prioritize medical patients at each of its Connecticut locations. To ensure medical patients receive proper support, existing medical patients will have dedicated staff and check-out lines for expedited patient service. Additionally, medical patients will continue to have access to Curaleaf's Compassionate Care Plan, outstanding pharmacy team and patient consult rooms.” With this opening, Curaleaf’s active license count (held either directly or through its subsidiaries) is now 153, and the company operates in 18 states, the District of Columbia, as well as Spain, Portugal, and Germany.

Finally, Tier 1B mega-dispensary operator Planet 13 Holdings Inc. (CSE: PLTH) announced that it entered into a purchase agreement on Aug. 28 for the ownership interests of Jacksonville-based VidaCann LLC. In the words of the Orlando Business Journal article, “The proposed deal includes 26 VidaCann dispensaries, including two in Orlando and one in Clermont, as well as a distribution and growing facility that can support 60 dispensaries. The deal is valued at $48.9 million and includes 78.46 million base shares of Planet 13, a closing cash payment and promissory notes. The former equity holders of VidaCann and its 9496 7346 Quebec Inc. adviser will have an approximately 26.09% pro forma ownership in Planet 13.” Following this Florida acquisition, Planet 13 holds 26 cannabis licenses that are either active or pending approval, across 4 states (NV, CA, FL, IL).

Select CRB Business Transaction Highlights:

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

Stock Suspensions/Delistings |

|||

|

New Sec ID/Name Change |

Agra Ventures Announces Details of Share Consolidation, Name Change, and Ticker Symbol Change |

||

|

New Listings |

MTL CANNABIS CORP. COMMENCES TRADING ON CSE UNDER THE SYMBOL MTLC |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Action |

CRBM Tier/Sector |

|

Added to DB |

Tier 2/Pharma & Biotech |

||

|

Added to DB |

Tier 1B/Owner/Investor |

||

|

Downgraded from Tier 1B to Tier 2 |

Tier 2/CBD - Personal Products |

Cannabis Regulatory Updates - August 2023

We begin with the latest shot heard ‘round the world: In late August it was reported in Marijuana Moment that the Head of the US Department of Health and Human Services (HHS) issued a recommendation to the US Drug Enforcement Administration (DEA) “officially recommending that marijuana be moved from Schedule I to Schedule III under federal law”. The significance of this rescheduling cannot be understated; however, there are several questions that will need to be answered before the industry can fully understand the implications. With that said, if and when this change takes effect, the cannabis industry might very well never be the same. In the words of the August 30 article:

“After completing a scientific review into cannabis under a directive from President Joe Biden last year, HHS is now telling the Drug Enforcement Administration (DEA) that it believes marijuana should be placed in Schedule III of the Controlled Substances Act (CSA). The recommendation is not binding, and DEA has the final say, but the scientific analysis combined with growing political support for cannabis reform may well influence DEA to make the change.”

[For a more in-depth look at all the implications of cannabis rescheduling, CRB Monitor has published an excellent summary of the HHS recommendation and the various impacts it would have on CRB Monitor’s range of database users: Taking Cannabis Down to Schedule III: What Does It Really Mean?]

Next, the latest out of Ohio: Early in the month, it was reported that activists turned in their final signatures to put marijuana on the ballot in November. According to a story in Marijuana Moment, “Ohio activists have turned in a final batch of signatures to put a marijuana legalization initiative on the November ballot after falling short in a prior submission. The new batch includes more than 6,000 additional signatures on the petition, which a GOP congressman newly told Marijuana Moment he would’ve signed in order to let voters decide on the reform.” This affirms the overwhelming popularity of legalization in yet another state, and while cannabis-related reforms at the US Federal level continue to go through fits and starts, even red states are starting to understand the benefits of legal cannabis.

A number of key measures could appear on the November ballot, including a 2.5-ounce limit for possession, a 12-plant per household limit on growing, and a 10% sales tax on all cannabis sales.

In an article in the Green Market Report John Schoyer wrote that an attorney at the U.S. Food and Drug Administration, Howard Sklamberg is now involved in federal cannabis policy on behalf of multistate operator Columbia Care Inc. (CSE: CCHW). According to Mr. Schoyer, “Sklamberg recently spoke with Green Market Report about the ongoing federal review of cannabis as a Schedule 1 drug – which he believes will result in the Biden administration rescheduling the plant and its derivatives this year or early in 2024.” While we believe that re-scheduling would represent a critical step in the path toward to Federal legalization, it is hard to imagine that it could happen without Congressional action.

It would appear that the motivation for re-scheduling is more economic than anything else, and in in the words of the article, “As long as cannabis is moved at least to Schedule 3, section 280E of the tax code would no longer apply to the industry, and marijuana businesses could claim standard business tax deductions. That would provide a needed boost to profitability for many operators.”

Now from the State of Israel: It was reported in mid-August that “The Health Ministry published the outlines of its new reform in the use of medical cannabis, which will come into effect in December and would allow more patients to have access to the drug and remove bureaucratic obstacles currently in place. The ministry said it would review the matter in one year and may expand access to more potential users.” The article from Ynetnews.com must come as a relief for those who are hoping for any steps toward full legalization, which seem to resemble the slow crawl at the US Federal government. The article goes on to report: “According to the ministry, patients suffering from cancer, Crohn's disease, dementia, autism, multiple sclerosis (MS), or HIV, and terminally ill patients who are not expected to live more than six months, will be able to receive prescriptions from their doctors and not have to go through the process of obtaining a license.” With that said, the ministry’s statement intentionally left out conditions that could have been included, much to the dismay of critics, who “slammed the reform for ignoring the many who suffer from PTSD and those suffering chronic pain including fibromyalgia, among other ailments, who would still be required to obtain a license or rely on traditional pain medication that could cause addiction.”

And a shot fired across the bow in Maine: In August it was reported in Marijuana Moment that The governor of Maine has signed a bill “to allow licensed marijuana businesses to take state tax deductions as a partial workaround to the Internal Revenue Service (IRS) code known as 280E that prohibits such deductions at the federal level.” Governor Janet Mills (D) gave the final approval to Sen. Theresa Pierce (D) to use “part of the tax revenue it receives from marijuana sales to make up for lost revenue resulting from the new tax deductions that will be available for ‘business expenses related to carrying on a trade or business as a registered caregiver, a registered dispensary or a manufacturing facility,’ as well as ‘a cannabis establishment or testing facility’ as of January 1.” This common-sense change to the tax code represents a major improvement in economics for cannabis operators, who have been at a distinct disadvantage since Maine legalized the sale of cannabis in 2016. In the words of Maines Office of Cannabis Policy, the new code “will allow licensees to take business expense deductions on their Maine tax returns like any other legal business and improves parity between the state’s medical and adult use cannabis businesses.”

Finally, major cannabis news out of Australia: a story in the National Tribune reported that Greens Senator Shoebridge introduced The Greens Legalising Cannabis Bill 2023 “to permit the adult recreational use of cannabis across the country.” If this bill gets the support in both houses of Parliament, it would “create a legal home grow and commercial cannabis market across the country.” In the words of Greens Senator and Justice Spokesperson Shoebridge: “With just a sprinkling of political courage and collaboration mixed with a truckload of common sense we can make this law and end the war on cannabis...It’s time to stop pretending that consumption of this plant, consumed each year by literally millions of Australians, should still be seen as a crime. Everyone knows that it is not a matter of if we legalise cannabis in Australia, it’s a matter of when, and today we’re taking a huge step forward.”

CRBs In the News

The following is a sampling of highlights from the August 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"