James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Related Equity Performance

Cannabis Equity Index Returns - Stay on or Get off?

As we continue to follow the slow crawl in the US Congress toward the passage of any version of a cannabis reform bill - SAFE Banking Act (S.1323) (HR2891) or otherwise - cannabis equities still struggle to find themselves. With Tier 1 pure play CRBs' market caps now a shadow of their former selves, institutional investors are likely to avoid these micro’s until they claw back a significant portion of the 80-90% of their caps that have evaporated over the last two years, rather than try to buy a meaningful-sized holding. The sad truth is that, in spite all of the lachrymose prose about sinking prices in past CRB Monitor newsletters, investors are still not finding enough expected return to pull the trigger. Why is that? In recent months we have compared publicly-traded CRBs to long-dated call options, where investors could essentially hold them as “lottery tickets” in hopes to cash in at some later date. Our word selection notwithstanding, cannabis was about as popular in June as the chaperone guarding the punch bowl at a senior prom.

With that said, there are some rays of hope...if you look hard enough.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), finished in June in line with or ahead of its competitors in the cannabis-themed index space. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

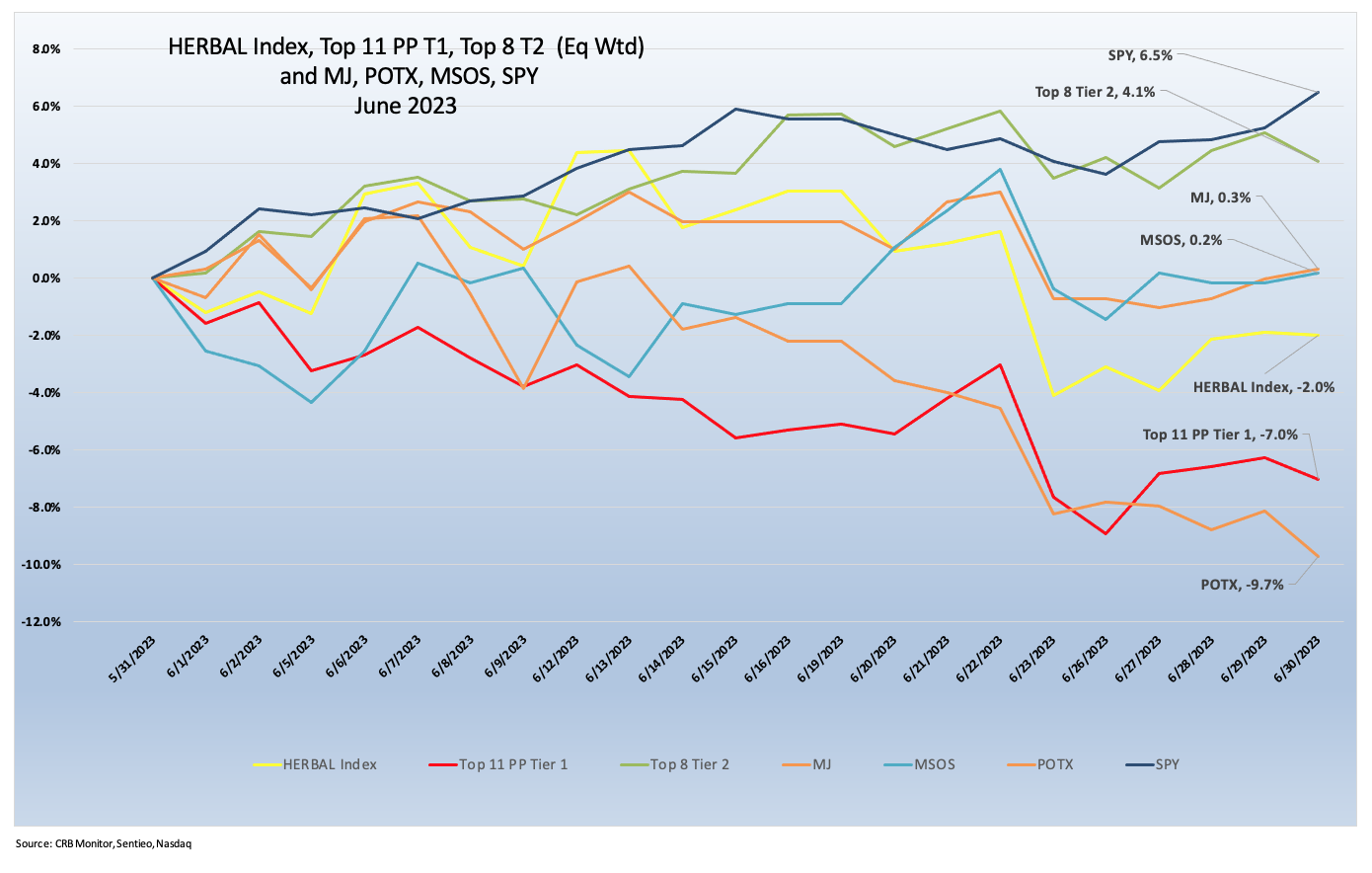

The HERBAL index fell by 2.0% in June 2023 and finished significantly ahead of its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (-9.7%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al).

HERBAL finished a little behind the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (-0.3%) and similarly behind the Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which finished June at -0.2%.

MJ’s performance is likely to deviate from HERBAL’s due to a significant percentage of non-Pure Play cannabis holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. And more recently, MJ added a 20% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can deviate materially from HERBAL’s as well, largely due to its holdings of CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

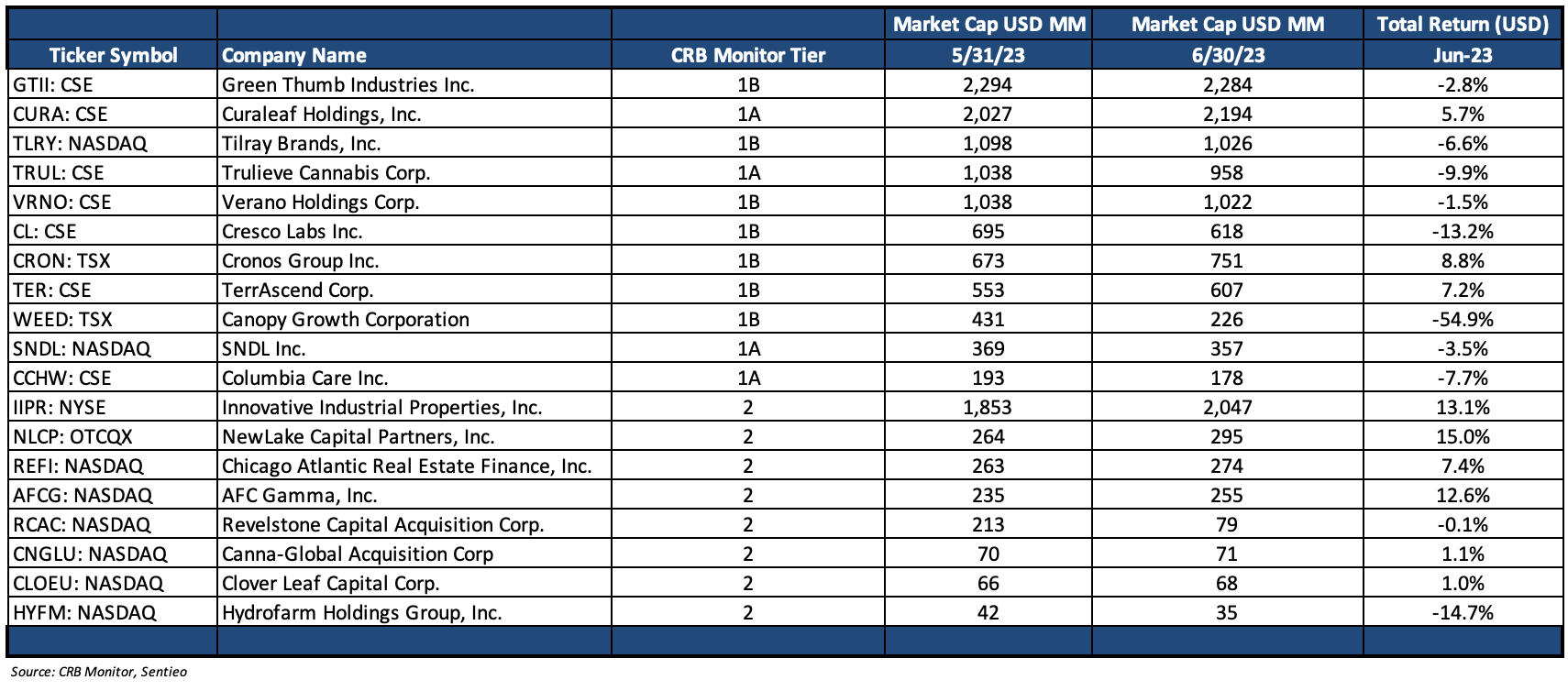

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap was -7.0% in June 2023, with the basket once again being more negatively affected by the Canadian (non-MSO) component than the MSO basket, with the MSOs having a better month in June. Looking at the table below, we see how the CRBs without US touchpoints provided the drag on the basket for the month. A more detailed analysis of Tier 1 CRB performance can be found below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap finished the month significantly ahead of the Tier 1 CRB basket, posting a positive 4.1% return. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term (as they did in June 2023), their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. We’ll take a closer look at these later in this newsletter.

US equities were up in June amid optimism that the economy might be stabilizing in spite of historically low unemployment data. With that said there is an air of caution given that the Fed has indicated that they are not finished tightening and we will likely see two additional rate hikes by year end. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a positive 6.5% for the month, outperforming the cannabis indexes for the month of June.

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – June 2023 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities returned -7.0% for June 2023, with a wide range of returns where this time the main determinant of success could not be defined by the US/Canada border.

CRB equities were overall lower in June, and the above-mentioned wide range of returns provided investors with little optimism, particularly those who are invested in the fallen hero Canopy Growth Corporation (TSX: WEED) (-54.9%). We frequently see the Canadian (non-US plant-touching) group deviate from the US multistate operator MSO group, given their individual sensitivities to various factors, with the most profound of these factors is the progress toward US federal legalization. [With that said, this time around the results were a mixed bag and we will take a closer at Canopy Growth in a few paragraphs.]

Curaleaf Holdings, Inc. (CSE: CURA) (+5.7%) and TerrAscend Corp. (TSX: TSND) (+7.2%) were the best performing CRBs in the MSO basket. Curaleaf announced its Q1 earnings in mid-May, which likely contributed to investors’ optimism. They reported net revenues of $336.5 million, which represented a 14% year-on-year increase. On top of that, Curaleaf breathed a sigh of relief in April after the New Jersey Cannabis Regulatory Commission reversed an earlier decision and has now approved the multi-state operator's adult-use license renewal. As for TerrAscend, their big news came toward the end of June, when it was announced that they were granted a listing on the Toronto Stock Exchange (TSX) under the new ticker symbol TSND. How was this possible, given TerrAscend’s US marijuana touchpoints? In order to meet the TSX’s strict requirement for a company to be in compliance with the Controlled Substances Act, TerrAscend has agreed to segregate all of its US businesses and spin them out, via a series of private placements.

In the words of Jason Wild, Executive Chairman of TerrAscend, “Today is an incredible day for TerrAscend and our stakeholders. We believe our TSX listing will provide the Company greater access to a broader group of institutional and retail investors looking for attractive opportunities in the cannabis space. With all of the fundamental progress that we have made over the past twelve months, combined with this TSX listing, we believe we have achieved our goal of truly becoming independent of the need for regulatory reform”.

On a less happy note, Columbia Care Inc. (CSE: CCHW) (-7.7%), Green Thumb Industries Inc. (CSE: GTII) (-2.8%), Trulieve Cannabis Corp. (CSE: TRUL) (-9.9%), and Cresco Labs Inc. (CSE: CL) (-13.2%) all finished in negative territory in June. The big news regarding Cresco and Columbia Care was the expiration of their planned merger, which had been in the works for over a year. Investors were left with more questions than answers on June 30 when the expiration date for the merger came and went, with Cresco and Columbia Care’s leadership providing an open-ended plan going forward. In the words of the June 30, one-sentence joint press release, Cresco and Columbia Care “today announced that they will not be able to complete the divestitures necessary to secure all necessary regulatory approvals to close the pending transaction by the outside date of June 30, 2023 that is specified in the arrangement agreement dated March 23, 2022 and amended on February 27, 2023. At this stage, Cresco and Columbia Care are working amicably with respect to the next steps in relation to the transaction and will provide further updates in the near future.”

The “legal” Canadian CRB basket featured mixed returns for the month of June. Tilray Brands, Inc. (Nasdaq: TLRY) (-6.6%) and SNDL, Inc.(Nasdaq: SNDL) (-3.5%) finished negative, while Cronos Group Inc. (TSX: CRON) (+8.8%) was impressive in June, coming off its historic lows early in the month.

But the big story of the month, and not a happy one, was regarding Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (-54.9%), who’s stock price was at its low of CAD 0.51 on June 30. And for those who are keeping score, WEED hit its high (no pun intended) of CAD 67.67 back on 4/1/2019. That translates into a loss to investors of more than 99% over the 3+ year period. Another way of illustrating this impact: WEED’s market capitalization in April of 2019 edged higher than $22 Billion; the market cap of that very same company briefly dipped below $300 million by the end of June 2023. That is nearly 100% of the value of the company evaporating in just 3 years. What on earth has happened? The bombshell of sorts was the June 23 report of Canopy’s Q4 and Fiscal 2023 Financial Results, which featured a healthy dose of doom and gloom, but the general theme could be characterized by two words: “losses” and “restructuring”. At this point, Canopy is now committed to cost reduction and realignment of business lines, but apparently this did not inspire investors, who allowed Weed’s price to drop to historic lows. So low, in fact, that the S&P TSX announced that due to its low share price, Canopy Growth would be dropped from S&P/TSX Composite Index, Canada's equivalent of the S&P 500.

What a shame. Five years ago, one might characterize Canopy Growth as the “Microsoft of Cannabis” given its industry-high market cap and expansive operational footprint. But fast forward to this year, and Canopy Growth has been doing very little but downsizing its operations and cutting costs wherever possible.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive and somewhat respectable 4.2% return for June 2023, which outperformed the equally-weighted Tier 1 basket by 11.2%. because these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically; However, we also feel that there is no need to try to game them as a strategy. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict. And furthermore, the costs required to rebalance these illiquid baskets could eat up any meaningful profits.

Performance across the (now down to an 8-company) Tier 2 basket was largely positive in June. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (+13.1%), had a nice turn-around after three negative months. By their own admission, IIPR is “an internally-managed real estate investment trust ("REIT") focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” IIPR’s price chart has resembled a treacherous mountain range, with as many valleys as it has had peaks and overall, the volatility of this stock has been breathtaking. In June, IIPR declared its quarterly dividend ($7.20 per share), which followed its May 8th positive earnings report. Apparently investors were pleased with these announcements, hence the positive return.

Also posting a positive double-digit return in June was Tier 2 CRB NewLake Capital Partners, Inc. (OTCQX: NLCP). By its own admission, NewLake Capital Partners, Inc. “is an internally managed triple-net lease REIT that purchases properties leased to state-licensed U.S. cannabis operators. NewLake currently owns a geographically diversified portfolio of 27 properties across 10 states with 8 tenants, comprised of 17 dispensaries and 10 cultivation facilities.” NewLake’s share price spiked in June, following the declaration of its $1.56/share dividend, which was an 11% increase year-over-year.

Finally, we are witnessing the collapse in real time of Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (-14.2%) which had a difficult June. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day, as it did in June. With its price now oscillating around 80 cents, HYFM is now in the midst of consolidation and restructuring, and we believe we have seen the exodus of most investors, who took their optimism with them.

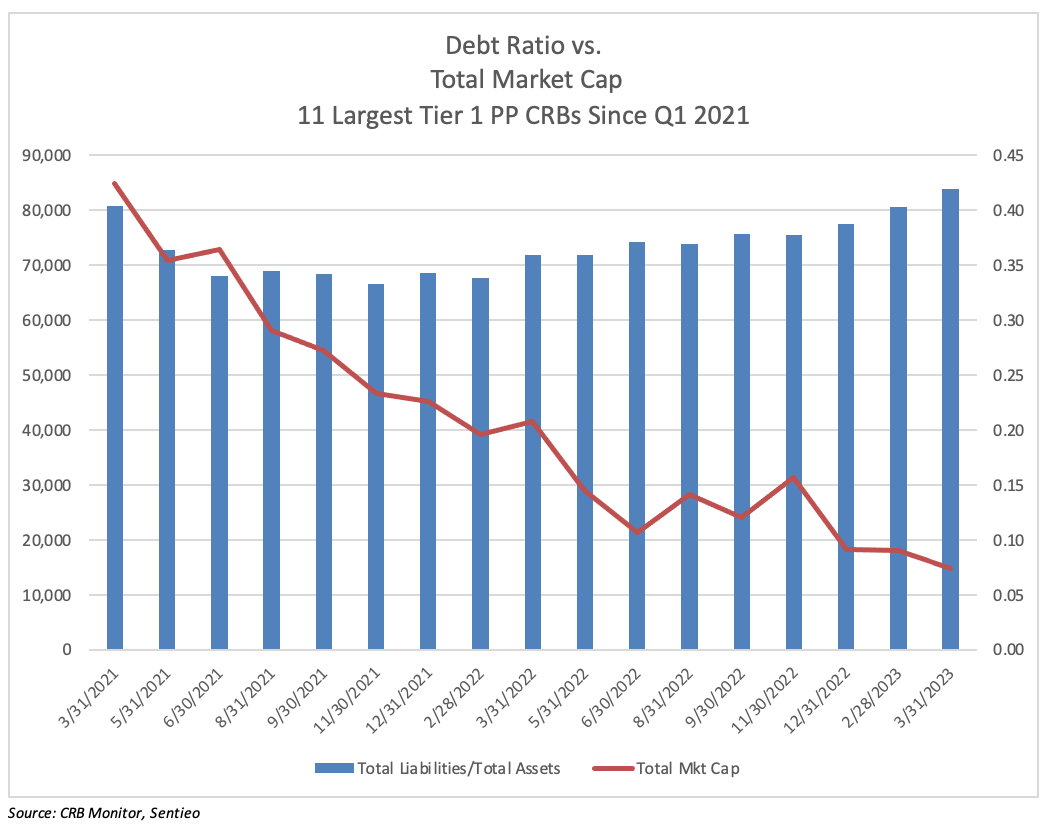

Chart of the Month: Debt Ratio

This month we take a look at the balance sheet once again, as our fascination continues when it comes to managing the financials for a business that is technically illegal. Add to that a business that (in the eyes of the stock market) appears to be collapsing with every new performance period and you have unlimited discussion topics. And so this time we look at the ratio of Liabilities to Assets, also known as the Debt Ratio. For companies that are struggling, the trend in the Debt Ratio is a key indicator, as in the words of Investopedia.com:

- A debt ratio measures the amount of leverage used by a company in terms of total debt to total assets.

- This ratio varies widely across industries, such that capital-intensive businesses tend to have much higher debt ratios than others.

- A company's debt ratio can be calculated by dividing total debt by total assets.

- A debt ratio of greater than 1.0 or 100% means a company has more debt than assets while a debt ratio of less than 100% indicates that a company has more assets than debt.

The chart below highlights the dramatic, even breathtaking drop over the recent 2-year period in the total market cap of the 11 largest publicly-traded Tier 1 Pure Play cannabis-related companies (they can be found in the performance table above and this number is indicated by the red line); and the trend in the Debt Ratio of those same 11 CRBs over total market cap of the 11 over the same period (the blue bars). The Debt Ratio varies across these companies, but for this exercise we are using the average, given that they are essentially in the same business, which has been hamstrung by the slow crawl toward US legalization for the same period of time.

We see that over the last two years, while Rome has been burning, the debt ratio recently hit its high of 0.42. [As a comparison Tier 3 CRB Amazon.com, Inc. (Nasdaq: AMZN)’s Debt to Asset ratio for 12/31/2022 was 0.19 as reported by Stock Analysis On Net. Microsoft Corp (Nasdaq: MSFT)’s is 0.18, reported by the same source.]

Similar to last month’s chart which looked at Cash and Cash Equivalents, this ratio is another interesting measure of liquidity, which should give us some insight into the viability of not just these household-name companies, but for the cannabis industry as a whole. Does this trend look healthy, as the debt ratio hits its two-year high of 0.42? This will be interesting going forward, with interest rates already frothy and the Fed projecting two near-term interest rate increases. It is anybody’s guess if these CRBs can sustain an industry-wide debt ratio of over 0.5, but we shall see. And it bears repeating that the legal cannabis industry currently employs more than 400,000 workers, so it is here to stay for years to come, in some form.

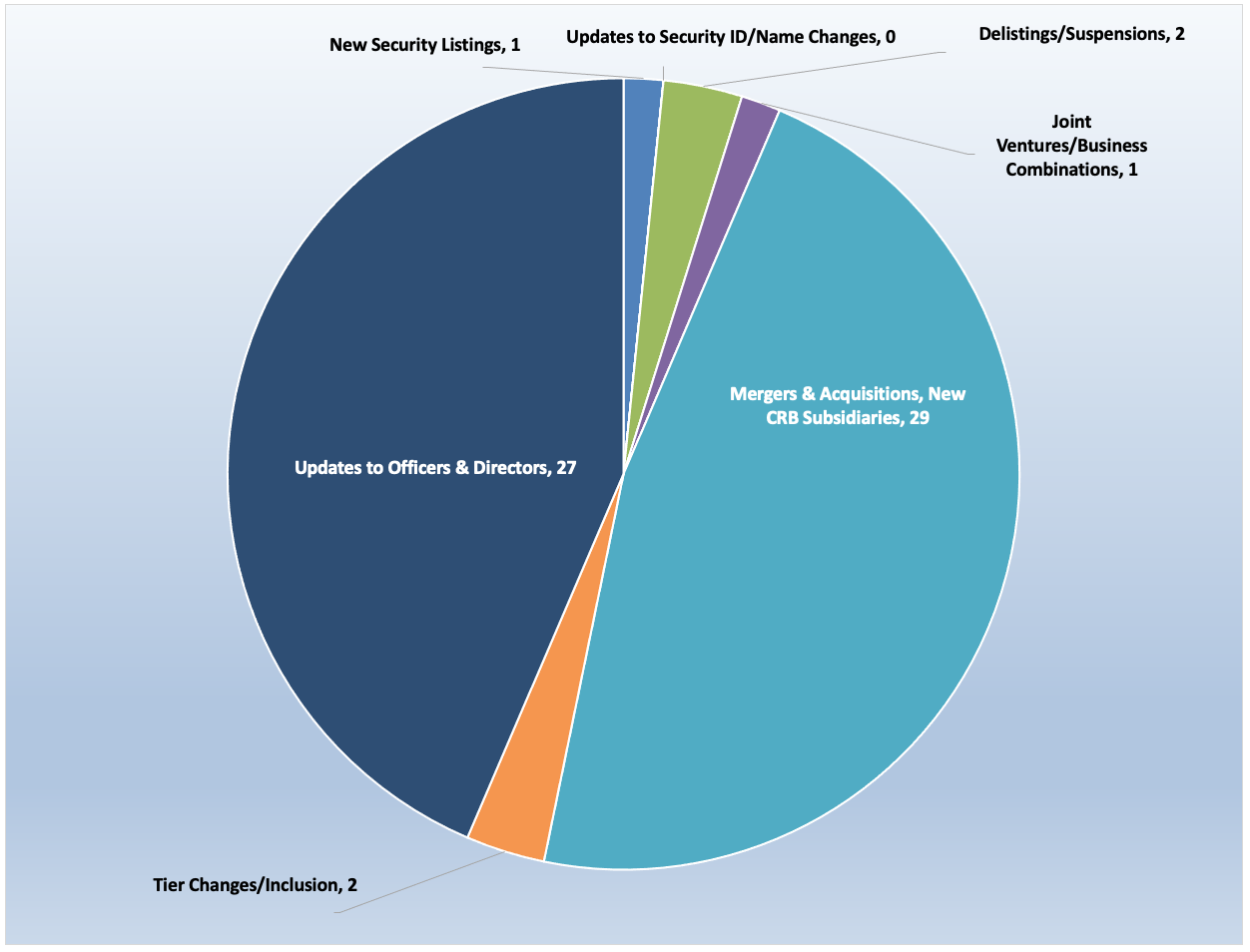

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for June 2023:

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News - June 2023

Since the announcement of the complicated, yet-to-be-closed (and perhaps permanently on hold, please see updates above) Cresco Labs/Columbia Care acquisition more than a year ago, M&A activity has effectively ground to a halt except for a few smaller, single-digit-$million deals. With that said, operational expansion, particularly across the US, marches on. Here are some of the June highlights:

Tier 1B CRB Lifeist Wellness Inc. (TSXV: LFST), announced in early June that it entered into a definitive share purchase agreement whereby they will acquire 100% of 1000501971 Ontario Inc. (“Zest”) for $3,411,707.90. According to the June 1 press release, the acquisition is an all-stock transaction which marks “another significant milestone for Lifeist’s expansion strategy.” According to Lifeist’s CRB Monitor profile, “Lifeist Wellness Inc., formerly Namaste Technologies Inc., is an online platform for cannabis products, accessories, and responsible education. The company's everything cannabis store, CannMart.com, provides customers with a diverse selection of hand-picked products from a multitude of federally licensed cultivators, all on one convenient site.” Lifeist currently holds 7 active cannabis licenses to operate in 3 Canadian provinces.

Canadian Tier 1A CRB SNDL Inc. (NASDAQ: SNDL) issued a press release announcing that they have named Alberto Paredero-Quiros as their new Chief Financial Officer (“CFO”). In the words of the press release, “Mr. Paredero-Quiros brings more than 25 years of management experience in the consumer goods and pharmaceutical industries, with demonstrated leadership and financial expertise in world-class global organizations. He has held senior management roles for companies such as Mondelez International Inc., Novartis, Newell Brands Inc., and Procter & Gamble Company, bringing extensive experience in public company reporting, mergers and acquisitions, internal controls and general financial and operational management. Mr. Paredero-Quiros’ appointment will take effect on July 1, 2023.” SNDL currently a top-10 pure play Tier 1 CRB by market cap and holds (directly or through its subsidiaries) 150 active cannabis licenses to operate in 8 Canadian provinces.

Also in June top-10 pure play Tier 1A CRB Curaleaf Holdings, Inc. (CSE: CURA) added another notch to its ever-expanding belt of dispensaries, announcing that it will begin adult use cannabis sales at all four of the company’s Maryland dispensaries beginning July 1, the official first day of legal, adult use sales in the state. In the words of the June 29 press release, “Curaleaf has been serving the Maryland medical market since 2017. Welcoming adult use customers into Curaleaf’s Maryland locations will not alter the company’s commitment to its community of patients. Each Curaleaf dispensary will give medical patients priority service with quicker check-ins, team members dedicated to medical patients, and access to a separate “medical only” check-out line.” Curaleaf’s license tally is 146 that are held either directly or through subsidiary businesses and they now operate in 19 states plus Spain, Portugal, and Denmark.

And not-yet-acquired Tier 1A CRB Columbia Care Inc (CSE: CCHW) is also “locked and loaded” in Maryland. It was announced in a June press release that Columbia Care Inc. “is set to begin adult use sales in its three Maryland retail locations, Columbia Care Chevy Chase, gLeaf Rockville and gLeaf Frederick, on Saturday, July 1.” In spite of the uncertainty regarding Columbia Care’s acquisition by Cresco Labs, CCHW’s expansion continues in earnest. In the words of Jesse Channon, Chief Growth Officer, “The start of adult use sales in Maryland is a truly momentous occasion for our customers and for the industry as a whole. We continue to see some states taking immediate action on ballot initiatives across the country and working diligently to put a framework together to build a broader, safer and more inclusive cannabis marketplace with the introduction of adult use sales. This swift action, and inclusion of existing operators who understand the landscape, shows a commitment from state leaders to help connect the power of the cannabis plant to those who need and want it...We are proud to be a part of the initial adult use framework and look forward to continuing to serve the medical community as we have for years.” With these new openings, CCHW’s license count is now at 117 across 14 United States plus the District of Columbia.

Select CRB Business Transaction Highlights:

Security/Exchange Highlights:

| Company Name |

Ticker Symbol |

EVENT Type |

Result |

| Stock Suspensions/Delistings |

|||

| Stock Suspensions/Delistings |

|||

| New Listings |

Select New Additions to CRB Monitor:

| Name |

Ticker Symbol |

CRBM Action |

CRBM Tier/Sector |

| Added to DB |

Tier 3/Financial Services |

||

| Moved to Watchlist |

Tier 3/Personal Products |

||

| Moved to Watchlist |

Tier 2/Personal Products |

||

| Moved to Watchlist |

Tier 2/IT Services & Software |

Cannabis Regulatory Updates - June 2023

Here are some of the cannabis-related regulatory highlights from June 2023:

First, the main event is finally taking place in an article in Marijuana Moment, effective immediately, simple possession and personal cultivation are legal as the majority of existing medical cannabis dispensaries have opened their doors to adult consumers for the first recreational sales. As we wrote above, two of the largest publicly-traded CRBs (Curaleaf and Columbia Care) are already licensed via their subsidiary businesses and we expect more to follow. In the words of the report, “...a separate law also took effect on (July 1) that prevents police from using the odor or possession of marijuana alone as the basis of a search. Yet another law going into force makes it so the lawful and responsible use of cannabis by parents and guardians cannot be construed by state officials as child ‘neglect.’”

Now on to New York, where illegal dispensaries have become a veritable epidemic over the last year. According to a June article in the New York Post, New York Governor Kathy Hochul has vowed to “weed out NYC’s illegal pot shops”. The story reports that “New York State regulators raided seven unlicensed Manhattan smoke shops for illegally selling flowered marijuana and other cannabis products”. One might consider this a drop in the bucket, given the hundreds of unlicensed dispensaries that have appeared in Manhattan over the last year. But it’s a start. In the words of the article, “Inspectors with the Office of Cannabis Management and Tax Department seized all the marijuana and THC-infused products at the seven shops on Wednesday and issued notices of violation and orders to cease unlicensed activity...The illicit operators face daily fines of up to $10,000 in administrative hearings, and regulators have the power to petition the state Supreme Court to padlock the premises if they fail to stop selling cannabis.”

Also in June in Colorado, legislation became law permitting online sales of retail cannabis products. In a story published on norml.org, it was reported that Democratic Gov. Jared Polis has signed legislation (House Bill 23-1279) into law repealing the ban on the online sale of cannabis products. In the words of the report, “The law allows licensed retailers, for the first time, to ‘accept payment online for the sale of retail marijuana and retail marijuana products’...Consumers are required to provide proof of age when making online purchases, and all purchases must be picked up in person at the retailer’s physical location.”

And on our very own website, crbmonitor.com, we reported in June that Minnesotans who are 21 and older will be able to possess, grow and use marijuana legally beginning Aug. 1, but retail sales of adult-use cannabis aren’t expected to start until the first quarter 2025. Why the 18-month wait for the law to take effect? The article notes that the 23rd and and the newest state to legalize marijuana for recreational use will need to go through several steps before legal sales can be implemented. In the words of Maria Brosnan Liebel, CRB Monitor News, “The legislation creates the Office of Cannabis Management (OCM), which will establish program regulations. The current medical cannabis program will move from the state health department to OCM, and a Division of Social Equity will be created. Additionally, a 38-member advisory council will meet quarterly to review policy, take public testimony and make recommendations to the OCM.”

Also published on our website in June, from the Commonwealth of Massachusetts: CRB Monitor reported on June 8th that Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) is leaving Massachusetts “after months of scrutiny over labor practices, including the death of cultivation worker Lorna McMurrey.” According to the article, competition for recreational cannabis sales has become fierce following the opening of hundreds of new dispensaries across the state. “Trulieve is leaving the oldest adult-use market in the northeast. Adult-use sales in Massachusetts started in 2018. Since that time, hundreds of dispensaries have opened leading to a drop in prices making the state less appealing to larger brands that have the option of opening in newer markets, such as New Jersey and Connecticut, where prices remain comparatively high.” One of the largest CRBs by market cap, Trulieve (through its subsidiaries) will still control more than 130 cannabis licenses across 15 states and 2 Canadian provinces following its exit from Massachusetts.

A discussion among our leaders at the US Federal Government regarding rescheduling of cannabis moves ahead in earnest. On that note, it was reported in Marijuana Moment in June that Secretary Xavier Becerra, the head of the U.S. Department of Health and Human Services (HHS), plans “to present President Joe Biden with a federal cannabis scheduling decision ‘this year’ as agencies work ‘as quickly as we can’ to complete an administrative review.” The article goes on to report that the Food and Drug Administration (FDA) under HHS “is carrying out an eight-step scientific review into marijuana to determine whether it should be rescheduled, de-scheduled or remain in Schedule I, which is reserved for the most strictly controlled drugs under the Controlled Substances Act (CSA).” As a reminder, any commercial activity in substances on the DEA’s Schedule 1 Narcotics List is illegal in the United States and is regarded as money laundering. This action by the FDA is a key step in the path toward not only legalization of marijuana, but would be far-reaching in its impact on the entire cannabis ecosystem, including the implications on financial transactions as well as interstate and international cannabis trade.

And finally, we have our first cannabis-related item coming out of Ukraine. On June 28th it was reported in Marijuana Moment that Ukrainian President Volodymyr Zelensky is calling for “the legalization of medical marijuana to help Ukrainians cope with trauma amid the ongoing war with Russia.” According to this account, In a June address to the Ukrainian Parliament, Zelensky said “all the world’s best practices, all the most effective policies, all the solutions, no matter how difficult or unusual they may seem to us, must be applied in Ukraine so that Ukrainians, all our citizens, do not have to endure the pain, stress and trauma of war.” The president went on to state that “providing access to medical cannabis could provide a therapeutic option for citizens who have endured more than a year of intensive conflict after Russia first invaded the country in February 2022.”

CRBs In the News

The following is a sampling of highlights from the June 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

-

- Altria Completes Acquisition of NJOY Holdings, Inc.; Updates 2023 Full-Year Earnings Guidance (Tier 1B)

- Lifeist Wellness to Acquire Fast-Growing ‘Zest’ Brand (Tier 1B)

- CANADABIS CAPITAL APPOINTS NICOLE BACSALMASI LL.B TO THE BOARD (Tier 1B)

- Steep Hill Announces CFO Change (Tier 1A)

- Acreage Announces Leadership Transition of Chief Executive Officer (Tier 1B)

- SCHWAZZE PROMOTES NIRUP KRISHNAMURTHY TO CHIEF EXECUTIVE OFFICER (Tier 1A)

- Britannia Mining Solutions Accelerates Lab Build-Out Plan with Strategic Acquisition of Paragon Geochemical Laboratories Inc. (Tier 1A)

- FIRE & FLOWER FILES FOR CCAA PROTECTION (Tier 1B)

- Britannia Life Sciences Announces Strategic Investment in Cosmetics Lab Ltd. (Tier 1A)

- CSE Bulletin: Delist - Eden Empire Inc. (EDEN) (Tier 1B)

- Red White & Bloom and Aleafia Health Execute Binding Letter Agreement for Business Combination (Tier 1B)

- Lobe Sciences Appoints Baxter Phillips III, MBA as Chief Operating Officer (Tier 1B)

- One World Products Appoints Joerg Sommer as President (Tier 1B)

- SNDL Appoints New Chief Financial Officer (Tier 1A)

- Eat & Beyond Appoints Young Bann as CEO, Michael Aucoin to Transition to Senior Advisory Role (Tier 1B)

- SOL Global Announces Board Changes and Business Update (Tier 1B)

- ALIMENTATION COUCHE-TARD APPOINTS FILIPE DA SILVA AS CHIEF FINANCIAL OFFICER TO SUCCEED CLAUDE TESSIER (Tier 1B)

- Agra Ventures Appoints Jonathan Hirsh to its Board of Directors (Tier 1B)

- TILT Holdings Announces Board Changes (Tier 1B)

- CANOPY GROWTH LAUNCHES EXPANDED PRODUCT PORTFOLIO FOR THE QUEBEC MARKET (Tier 1B)

- NOTICE - CHEMISTREE CONVERTIBLE DEBENTURE INTEREST PAYMENT (Tier 1B)

- Blackhawk Growth Corp CEO Issues Letter to Shareholders (Tier 1B)

- IM Cannabis Receives NASDAQ Notification of Regaining Compliance with Nasdaq's Minimum Bid Price Requirement (Tier 1B)

- CBD of Denver to Expand into German Cannabis Market and Provide Updates During Shareholder Call (Tier 1B)

- Eat & Beyond’s Portfolio Company, Purpose ESG, Targets Growing CO2 Reduction Sector Through Investment in Carbon Upcycling Technologies (Tier 1B)

- Delta 9 Awarded Grow Pod Contract for Cultivation Facility in British Columbia (Tier 1B)

- Numinus Appoints New Chief Financial Officer (Tier 1B)

- Columbia Care Announces Resignation of Philip Goldberg as Director (Tier 1A)

- Charlotte’s Web Comments on Letter from Joel and Jesse Stanley (Tier 1B)

- Pineapple Inc. Acquires CBD Wellness Company Pineapple Wellness Inc. (Tier 1B)

- Trulieve Opening New Dispensary in Phoenix, Arizona (Tier 1A)

- Organto Announces Appointment of Industry Veteran Bob Kouw as Chief Operating Officer, Global Operations (Tier 1B)

- The Parent Company Shareholders Approve Proposed Business Combination with Gold Flora (Tier 1B)

- MedMen Announces Resignation of Chief Financial Officer (Tier 1B)

- Agra Ventures Amicably Exits Unprofitable Joint Venture (Tier 1B)

- Acreage Further Streamlines Leadership and Oversight in Preparation for Expected Acquisition by Canopy USA (Tier 1B)

- Cosmos Health Successfully Closes Acquisition of Assets from I. Bikas GP; Annual Revenue Projected to Grow by over $10 Million (Tier 1B)

- Indiva and Canopy Announce Closing of Private Placement (Tier 1B)

- Trulieve Announces Appointment of Tim Mullany as Chief Financial Officer (Tier 1A)

- PERVASIP ANNOUNCES FIRST OREGON ARTIZEN TOP-SHELF FLOWER HARVESTS FOR AUGUST (Tier 2)

- Resonate Blends Executes a Binding Merger Agreement to Acquire Pegasus Specialty Vehicles (Tier 1B)

- EAT & BEYOND ANNOUNCES SIGNING OF AGREEMENT FOR ACQUISITION OF 50% OF GOLDBLOOM ENTERPRISES INC. (Tier 1B)

- 1933 Industries Announces Appointment of Curtis Floyd as Director (Tier 1B)

- InvestmentPitch Media Video Discusses THC BioMed’s Launch of State-of-the-Art Medical Dispensary in Thailand (Tier 1B)

- ALIMENTATION COUCHE-TARD ANNOUNCES THE ACCEPTANCE BY TOTALENERGIES OF THE FIRM OFFER TO ACQUIRE CERTAIN EUROPEAN RETAIL ASSETS (Tier 1B)

- MediPharm Labs Announces Change of Auditor (Tier 1B)

- CannaPharmaRx Appoints Dean Medwid as New CEO (Tier 1B)

- Xebra Brands Appoints Erick Ponce to the Board of Directors (Tier 1A)

- The Parent Company Receives Approvals for Proposed Business Combination with Gold Flora (Tier 1B)

- MediPharm Labs Announces Change of Auditor (Tier 1B)

- ANNUAL REPORTFOR THE YEAR ENDED 31 MARCH 2023 (Tier 3)

- Atlas Global Provides Update on Liquidation of Subsidiaries Pursuant to Organizational Restructure to Accelerate Growth (Tier 1B)

- Acreage Announces Appointment of Chief Financial Officer (Tier 1B)

- Trulieve Announces Opening of Medical Cannabis Dispensary in Newnan, GA (Tier 1A)

- All Curaleaf Retail Locations in New Jersey Have Elected to Unionize With UFCW Local 360 (Tier 1A)

- Curaleaf Celebrates Launch of Adult Use Cannabis Sales in Maryland (Tier 1A)

- Cybin Inc. Announces Appointment of Aaron Bartlone as Chief Operating Officer (Tier 1A)

- Canopy Growth Appoints PKF O’Connor Davies as Auditor (Tier 1B)

- Columbia Care to Begin Adult Use Sales in Three Maryland Retail Locations on July 1 (Tier 1A)

- Lifeist Wellness Announces Agreement with Singular Narrative Management Ltd. (Tier 1B)

- Lobe Sciences Announces Additional Details Regarding the Acquisition of Altemia(TM) & Company (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"