James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Related Equity Performance

Source: CRB Monitor, Sentieo, Nasdaq

Source: CRB Monitor, Sentieo, Nasdaq

Cannabis Index Returns - More of the Same, Sad Song

It is no easy task coming up with new ways to say that the cannabis industry continues to fall one month after another. Perhaps we could start producing this newsletter in a new language, which might provide us with new ways of saying phrases like “precipitous drop” and “downward spiral”. All international phraseology aside, the reality is that cannabis equities are becoming more like the third class passengers on the Titanic, jockeying for their position on the lower decks as the ship eases its way toward the ocean floor. But, as we have said on several occasions, there is hope. The latest news out of Washington regarding the bipartisan SAFE Banking Act (S.1323) (HR2891) is that a deal in Congress is imminent, in spite of the fact that this version of the Act does not remove THC from the DEA’s Schedule 1 Narcotics List. This gentler SAFE Banking Act merely provides a safe harbor for financial institutions that process cannabis-related transactions. In addition to protections for banks, the latest SAFE Banking Act protects the consumer as well. In the words of a recent article on Abrigo.com, “The SAFE Banking Act also promotes the safety of millions of consumers who patronize state-legal cannabis markets. The multi-billion-dollar state-legal marijuana market operating mainly as a cash-only business makes CRBs more vulnerable to theft and more difficult to audit. It risks their customers’ safety and welfare, as patrons must carry significant amounts of cash on their person to make legal purchases at retail facilities. Similarly, it needlessly jeopardizes the safety of retail staffers, who are susceptible to robbery.”

With that said, the progress with legislation notwithstanding, cannabis equities continue to struggle as investors wait in earnest for some good news out of Congress.

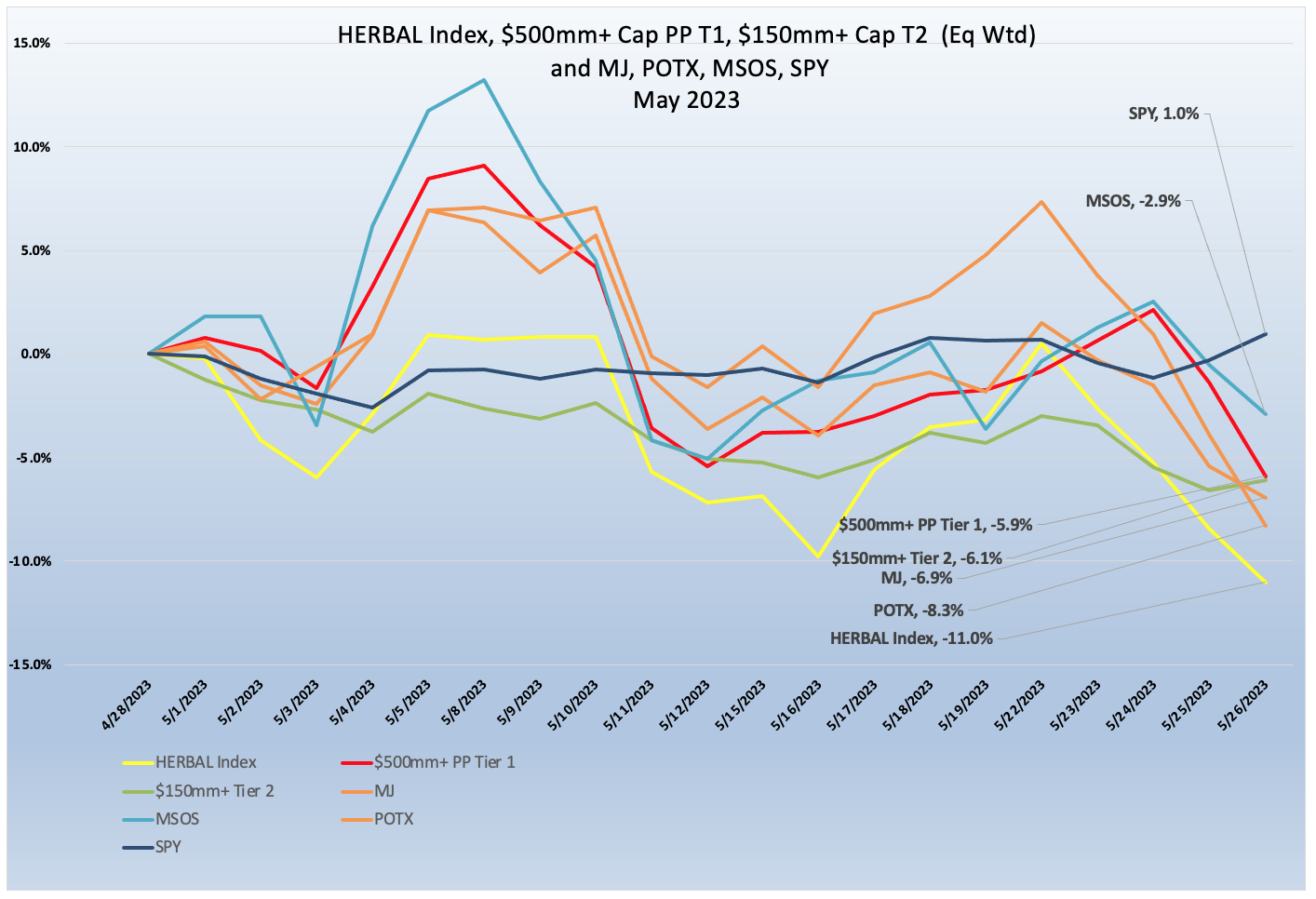

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), limped to the finish line in May behind the pack of cannabis-themed indexes, which was a reversal from the last few months. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index fell by 11.0% in May 2023 and for the first time in three months trailed its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (-8.3%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al).

HERBAL also finished behind the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (-6.9%) and behind the Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which finished May at -2.9%.

MJ’s performance is likely to deviate from HERBAL’s due to a significant percentage of non-Pure Play cannabis holdings, more specifically tobacco stocks with either very small or even no cannabis exposure at all. And more recently, MJ added a 20% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can deviate materially from HERBAL’s as well, largely due to its holdings of CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

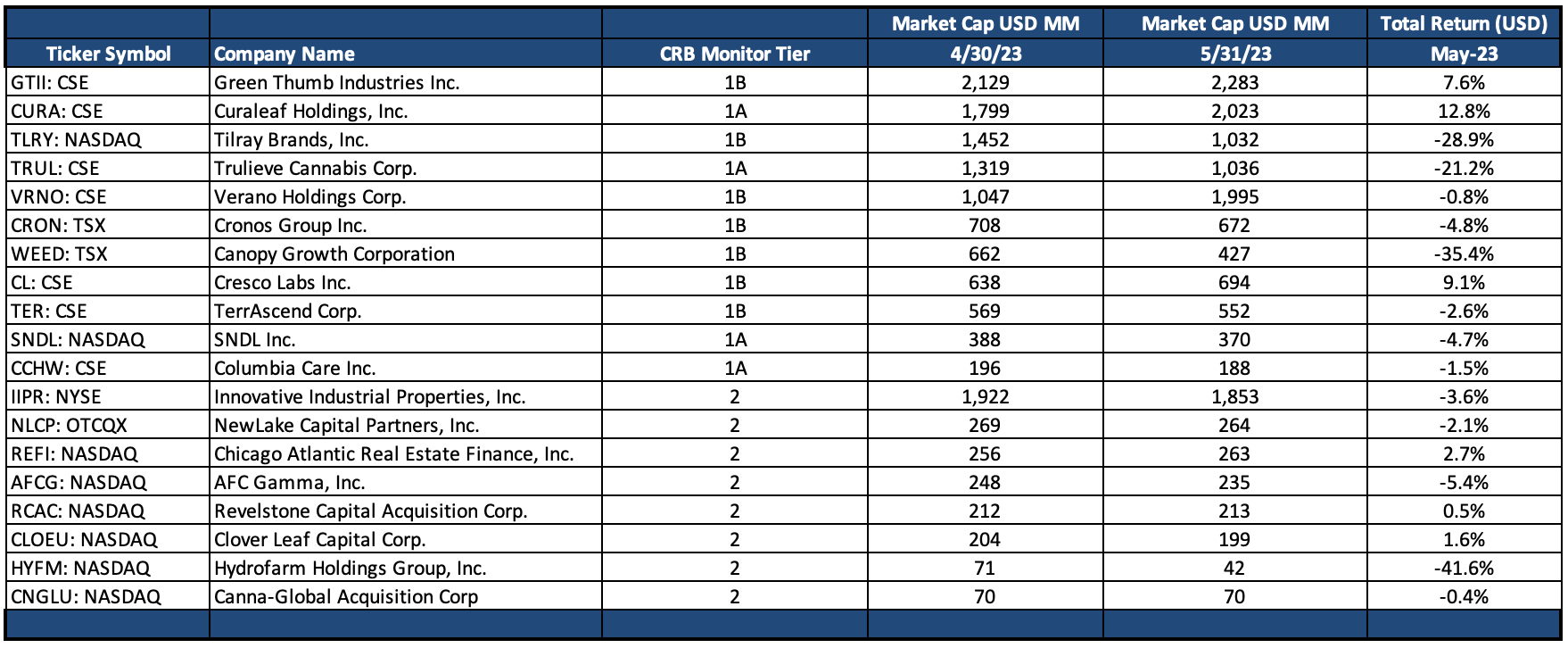

The performance of the CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $500mm+ market was -5.9% in May 2023, with the basket being more negatively affected by the Canadian (non-MSO) component than the MSO basket, with the MSOs having a better month in May. Looking at the table below, we see how the CRBs without US touchpoints provided the drag on the basket for the month. A more detailed analysis of Tier 1 CRB performance can be found below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap finished the month slightly behind the Tier 1 CRB basket, posting a negative -6.1% return. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term (as they did in May 2023), their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. We’ll take a closer look at these later in this newsletter.

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – May 2023 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities returned -5.9% for May 2023.

CRB equities were generally lower in May, although there were some rays of sunshine among the storm clouds, particularly with the multistate operator group (MSO’s). We often see the Canadian (non-US plant-touching) group deviate from the MSO group, given their exposure to various factors, but the most profound of these factors is the progress toward US federal legalization.

Performance differences between the two groups is understandable given their respective sensitivity to, above all other things, the anticipated impact of US Federal cannabis reform and the accompanying sentiment. And given that sentiment has been the dominant factor driving cannabis equity returns, until any concrete legalization (or realistically, any reform at all) passes the US House of Representatives and the Senate and makes it to the President’s desk, this negative sentiment is likely to persist.

The MSO basket - Curaleaf Holdings, Inc. (CSE: CURA) (+12.8%), Green Thumb Industries Inc. (CSE: GTII) (+7.6%) and the pending combination and Cresco Labs Inc. (CSE: CL) (+9.1%) and Columbia Care Inc. (CSE: CCHW) (-1.5%) all looked better in month of May. Curaleaf reported Q1 earnings in mid-May, sporting a 14% YoY growth in revenue and $160mm in gross profit. According to the 5/17 press release, “The Company's year-over-year revenue growth primarily reflects continued organic growth driven by new retail store openings and the significant focus on research and development, resulting in the introduction of 171 products in 2022, three new brand launches, and the contributions from Tryke and Four 20 Pharma.” While CURA’s share price popped following this report, let’s not forget that CURA’s current share price ($4) is down 66% YTD. CURA operates in 18 states plus the District of Columbia as well as in Portugal, Spain, and Germany. In all CURA controls 145 cannabis licenses either directly or through its subsidiaries.

Trulieve Cannabis Corp. (CSE: TRUL) (-21.2%) and TerrAscend Corp. (CSE: TER) (-2.1%) brought up the rear of the MSO basket in May. Trulieve reported Q1 earnings in May as well, however they were not as rosy as Curaleaf’s. TRUL reported a net loss of $64mm for the quarter, amid lower expenses and $195mm in cash on their balance sheet. Investors apparently were not impressed and scurried for the exits, forcing TRUL’s share price through the floor, if there ever was a floor to begin with. TRUL has the majority of its operations in Florida, with 32% of their retail operations in 11 states outside the sunshine state. TRUL controls either directly or through its subsidiaries, 133 cannabis licenses.

The “legal” Canadian CRB basket languished for another month given the regulatory fits and starts that we write about far too often. Tilray Brands, Inc. (Nasdaq: TLRY) (-28.9%), Canopy Growth Corporation (TSX: WEED) (-35.4%), Cronos Group Inc. (TSX: CRON) (-4.8%) and SNDL, Inc.(Nasdaq: SNDL) (-4.7%) were all down, but TLRY and WEED got crushed in May. What is to come of these two former titans of the cannabis industry? Time will tell, but the thought of Canopy’s largest shareholder, Constellation Brands, Inc. (NYSE: STZ) looking to unwind their position in WEED is not entirely out of the question. As we reported last month, back in February, WEED’s collapse was foreseen by Alan Brochstein of New Cannabis Ventures. In his editorial entitled This Popular Cannabis Company Moves Closer to Financial Trouble, Brochstein highlights several “red flags” related to WEED’s financial condition for investors to consider, including this: “We aren’t entirely surprised by the deterioration of Canopy Growth’s debt financing. The debt has been rising, and the cash has been falling. The company continues to burn a lot of cash in its operations. Canopy Growth’s move from a fixed-price convertible to a variable one could weigh on the stock.”

Once again US equities were up in May, as we remain cautiously optimistic that the economy is cooling off while unemployment remains low (the signs that a recession was likely avoided). The S&P 500 posted a +1% for the month, outperforming the cannabis indexes once again.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a -6.1% return for May 2023, which underperformed the equally-weighted Tier 1 basket by 0.2%. While they are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically, but we also feel that there is no need to try to game them as a strategy. We have always said that when these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict.

Performance across the Tier 2 basket was mixed in May, with most of the Tier 2 CRBs challenged for the month. Investors are showing zero compassion for Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (-41.2%) which spiraled further in May. HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day, as it did in May. With its price now oscillating around $1, HYFM's Q1 2023 earnings report came out on May 10th, and there were few silver linings for investors. With net sales off $62mm and a net loss of $16.8 mm, HYFM is now in the midst of consolidation and restructuring, and investors are apparently not waiting around to see the credits of this tearjerker.

A perennial favorite discussion topic of ours, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (-3.6%), was negative for the third month in a row. By their own admission, IIPR is “an internally-managed real estate investment trust ("REIT") focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” On May 8th IIPR reported Q1 2023 earnings, which looked reasonable given the struggles across the cannabis industry. According to the report, IIPR generated total revenues of approximately $76.1 million in the quarter, representing an 18% increase from the prior year’s quarter. In addition, the company recorded net income attributable to common stockholders of approximately $40.8 million for the quarter, or $1.43 per diluted share. Investors seemed content with this modestly good news and the stock price was largely unaffected through the end of May.

IIPR bears significant risk relative to the cannabis industry, given that their business depends on US cannabis cultivators paying their rent. Nevertheless, IIPR paid its 10.1% dividend in May, and it remains one of the only Tier 1 or Tier 2 CRBs with a dividend yield.

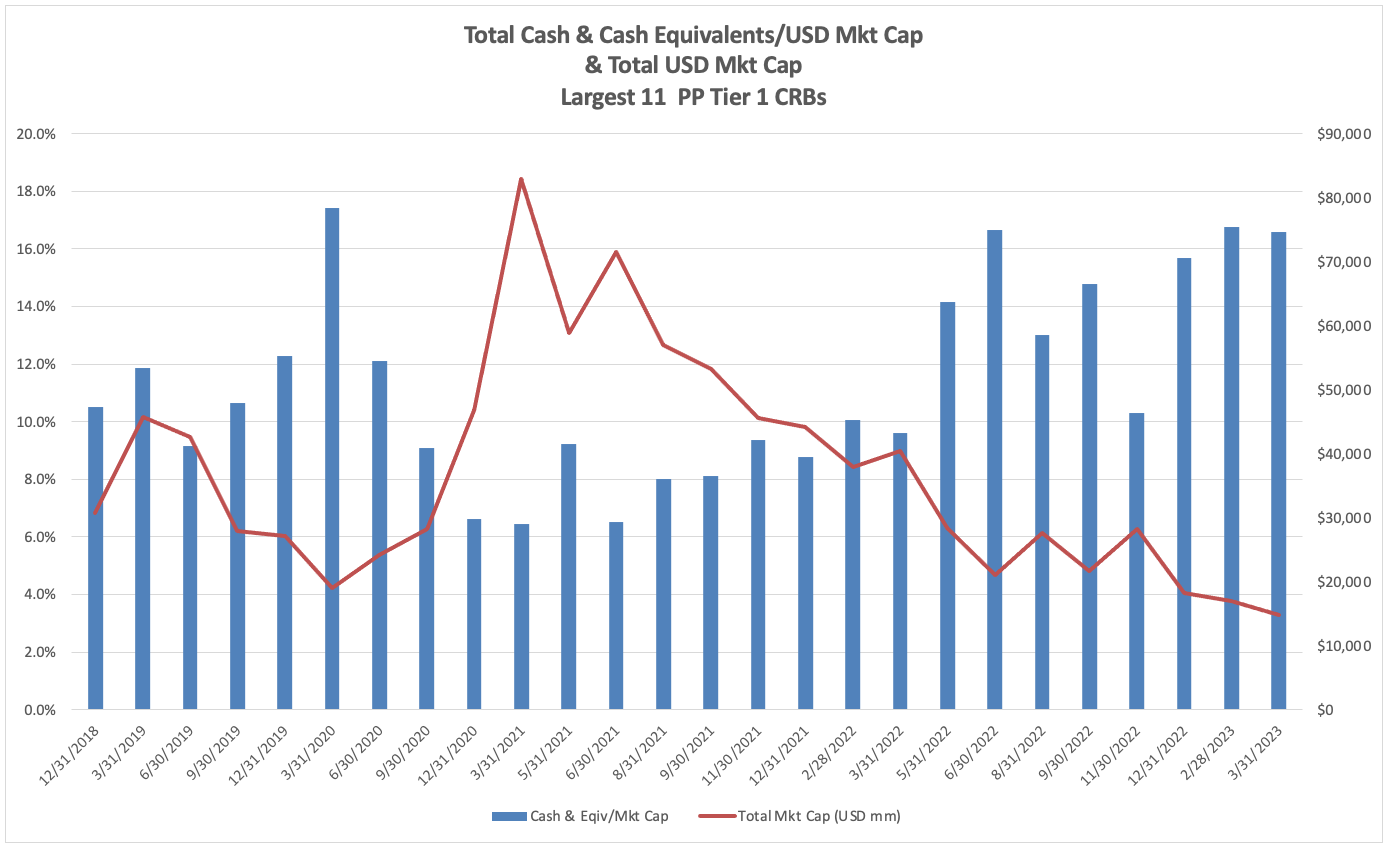

Chart of the Month: Cash & Cash Equivalents

After a brief respite last month where we served up some interesting returns of digital asset-related businesses (DARBs), we return to cannabis and an interesting analysis of the balance sheet item Cash and Cash Equivalents, which is well-defined as follows by Investopedia.com:

- Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a company's assets that are cash or can be converted into cash immediately.

- Cash equivalents include bank accounts and marketable securities such as commercial paper and short-term government bonds.

- Cash equivalents should have maturities of three months or less.

- Cash equivalents must also be able to be liquidated to cash; for this reason, cash equivalents often have active markets.

- A company carries cash and cash equivalents to pay its short-term bills but to also preserve capital for long-term capital deployment.

The chart below highlights the precipitous decline over the recent 4+ year period in the total market cap of the largest publicly-traded cannabis-related companies (as indicated by the red line); and the trend in Cash & Cash Equivalents over total market cap over the same period (the blue bars). The February 2021 spike is related to the “Gamestop” effect that was pervasive at that time. As the chart shows, as the total market cap went into its downward spiral, companies’ percentage in cash were rising and staying high. [As a comparison Tier 3 CRB Amazon.com, Inc. (Nasdaq: AMZN)’s average quarterly percentage Cash & Cash Equivalents of Total Market Cap since 2001 is 4.3%[1]. Microsoft Corp (Nasdaq: MSFT)’s average since 2001 is 2.3%.] [2]

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

Is such a high ratio of C&CE/MCAP a good thing? Given that this is, in essence, a measure of liquidity, it should give investors some level of comfort when a CRB maintains this percentage above 15% of market cap. It shows that these companies are, by and large, risk averse as they hunker down waiting for legalization. On the other hand, companies that maintain this level of liquidity/risk aversion might be hamstrung as they attempt to carry out a growth strategy. We will wait and see, but the scary red line will have difficulty turning around without meaningful progress toward US legalization.

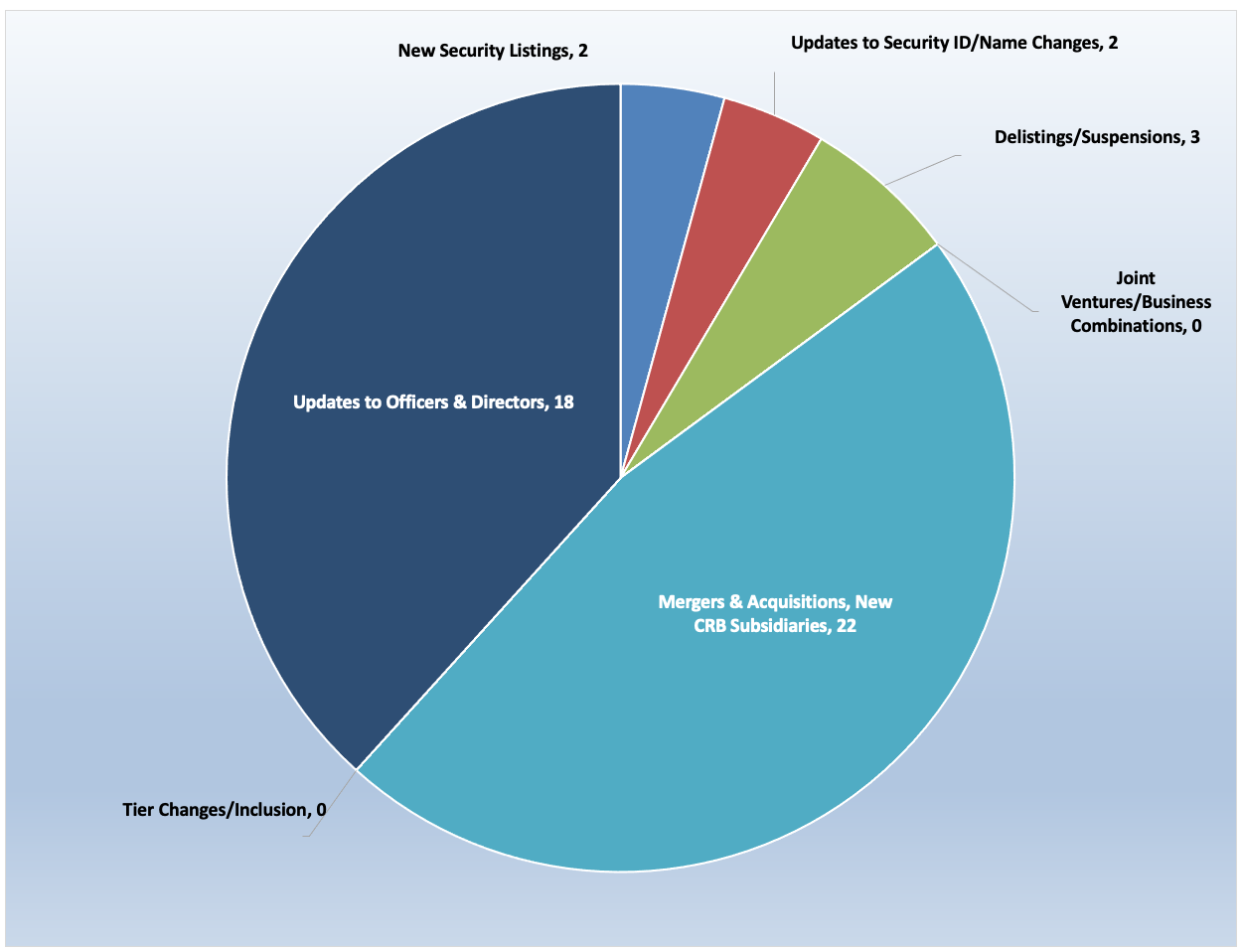

CRB Monitor Securities Database Updates - May 2023

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for May 2023:

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News - May 2023

Since the announcement of the complicated, yet-to-be-closed Cresco Labs/Columbia Care acquisition more than a year ago, M&A activity has effectively ground to a halt except for a few smaller, single-digit $million deals. With that said, operational expansion, particularly across the US, marches on. And lest we forget that there is still cautious optimism due to the latest version of cannabis reform on the Hill, the SAFE Banking Act 2023 (S.1323). But even if SAFE Banking passes, we reiterate our view that CRBs (both in the US and Canada) are facing the reality that the US federal government has not gotten materially closer to federal legalization or decriminalization, and this is having a profound (negative) impact on the profits and earnings forecasts of many, if not all, cannabis-related businesses. And as we have stated in previous newsletters, we are seeing signs of consolidation in the cannabis industry and expect an increase in acquisitions in the months to come.

Here are some of the May highlights:

As mentioned above, we are following the progress of Tier 1B MSO Cresco labs, Inc. (CSE: CL) proposed acquisition of Tier 1A MSO Columbia Care, Inc. (CSE: CCHW). The largest cannabis-related M&A deal in the last 2 years, the deadline for closure of the CL/CCHW acquisition has been extended to June 2023 due to complexities related to divestiture of respective businesses. In a May 25th Green Market Report article, Adam Jackson quotes Charlie Bachtell, Cresco CEO: “The divestitures and the resulting proceeds from those are a big component of our ability to get the combined debt leverage ratio in the right spot...It really does come back to whether or not we can make the deal make sense. We’ll continue to update the public as we have more definitive information on those divestitures.” Please check out our 2022 interview with Mr. Bachtell here.

Late in the month of May, Tier 1B Canadian CRB Organigram Holdings Inc. (NASDAQ: OGI) issued a press release announcing that it has reached an agreement with Phylos Bioscience Inc., “a U.S. cannabis genetics company and provider of production ready seeds, based in Portland, Oregon.” In the words of the press release, the purpose of this acquisition is “to initiate a wide-ranging technical and commercial relationship in Canada. This innovation relationship is expected to further support Organigram’s industry leading cultivation efforts in Canada with patent-pending foundational technologies and genetics. In the future, subject to receipt of any required approvals and permits, Organigram intends to export THCV products to select legal international markets.” CRB Monitor classifies Phylos Biosciences as private Tier 2 CRB.

Also in May, Tier 1B MSO Acreage Holdings, Inc. (CSE: ACRG.A.U) issued a press release announcing their launch of adult-use cannabis operations at The Botanist dispensary in Danbury, Connecticut. In the words of Acreage CEO Peter Caldini, “Following the successful launch of adult-use sales at The Botanist in Montville in January, we’re thrilled to welcome adult-use guests to The Botanist in Danbury...The Botanist team has taken its quality service to the next level, smoothly transitioning to adult-use sales while maintaining top-tier care for our medical patients. We look forward to contributing to the expansion of adult-use operations in Connecticut.” The Botanist represents the latest in Connecticut’s slow rollout of recreational licenses over the last year. Acreage currently holds, through its subsidiary businesses,118 licenses in the US, Canada, and Australia.

Always in growth mode, Florida’s largest CRB and Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) issued a press release that it has expanded its operations in Pennsylvania with the opening of a new Trulieve-affiliated medical marijuana dispensary in Limerick, PA. In the words of Trulieve’s CEO, Kim Rivers, “Pennsylvania is one of the strongest medical markets in America...We are proud to serve customers by offering quality products, first-class service and convenient locations throughout Pennsylvania.” This new dispensary will expand Trulieve’s footprint in Pennsylvania, as (according to the press release) are currently operating in “Camp Hill, Coatesville, Cranberry Township, Devon, Harrisburg, Johnstown, King of Prussia, Philadelphia, Philadelphia Charter City, Philadelphia Washington Square, Pittsburgh, Pittsburgh North Shore, Reading (on Lancaster), Reading (on 5th St. Hwy), Scranton, Washington, Whitehall, York and Zelienople.” By CRB Monitor’s count, this new dispensary increases the number of TRUL’s (active or pending approval) license total to 133.

Tier 1B MSO TerrAscend Corp. (CSE: TER) issued a press release announcing that its subsidiary, Gage Cannabis Co. recently launched sales at its new flagship cannabis provisioning center in Oxford, Michigan. According to the announcement, “Cookies Oxford is operated by Gage through a partnership with Cookies, the leading lifestyle and cannabis brand in North America. This is TerrAscend's fifth licensed Cookies dispensary in Michigan joining locations in Detroit, Ann Arbor, Kalamazoo and Jackson. Cookies, a globally recognized cannabis company, offers a collection of over 70 proprietary cannabis cultivars and more than 2,000 products. Based in the Bay Area, Cookies' Co-Founder and CEO Berner is a prolific rapper and entrepreneur along with his partner, Jai, a highly respected cannabis cultivator and breeder. Cookies values the power of the plant and focuses on creating game-changing genetics.” With this acquisition, TerrAscend’s cannabis license count expands to 95 that are either in active status or pending approval.

Finally, the premier name in cannabis, Tier 1B Canadian CRB Canopy Growth Corporation (TSX: WEED) announced in a press release with its subsidiary, Indiva Inc., that they “have entered into a license assignment and assumption agreement providing Canopy Growth exclusive rights and interests to manufacture, distribute, and sell Wana™ branded products in Canada which accelerates Canopy Growth's ability to leverage the Wana brand. Simultaneously, to support continuity of quality supply and aligned to Canopy Growth's asset light strategy for sourcing of cannabis 2.0 formats, Canopy Growth and Indiva also entered into a contract manufacturing agreement, under which Canopy Growth will grant Indiva the exclusive right to manufacture and supply Wana™ branded products in Canada for a period of five years, with the ability to renew for an additional five-year term upon mutual agreement of the parties.” This represents an interesting shift for Canopy Growth, which started divesting itself of all its Canadian retail dispensary businesses in 2022. Canopy’s share price has taken a nose dive over the last three years and their divestiture of retail is a defensive move while they await (as we all do) US legalization. With that said, Canopy holds via it’s subsidiaries 75 active or pending licenses in Canada, Colombia, and Denmark. This number will shrink once the sales of the retail businesses close.

Select CRB Business Transaction Highlights:

|

Company Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1B |

|||

|

Tier 1A |

|||

|

Tier 1B |

High Tide Opens Canna Cabana Location in Grande Prairie, Alberta |

||

|

Tier 1B |

Acreage Further Expands Adult-Use Retail Operations in Connecticut |

||

|

Tier 1B |

ACT Laboratories, Inc. Extends Multi-State Expansion Strategy into Florida |

||

|

Tier 1B |

TerrAscend Celebrates the Opening of its Fifth Cookies Dispensary in Michigan |

||

|

Tier 1A |

Trulieve Announces Opening of Affiliated Medical Marijuana Dispensary in Limerick, PA |

||

|

Tier 1B |

|||

|

Tier 1B |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

Name and Symbol Change |

CSE Bulletin: Name and Symbol Change - High Fusion Inc. (FUZN) |

||

|

Stock Suspensions/Delistings |

|||

|

New Listings |

|||

|

New Listings |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Sector |

|

Tilray Brands 5.20% Convertible Senior Notes Due 2027 |

N/A |

1B |

Owner/Investor |

|

Incannex Healthcare Ltd. Convertible Bonds April 2026 |

N/A |

1A |

Licensed CRB |

|

Incannex Healthcare Ltd. Convertible Bonds May 2028 |

N/A |

1A |

Licensed CRB |

Cannabis Regulatory Updates - May 2023

Here are some of the cannabis-related regulatory highlights from May 2023:

Update on the SAFE Banking Act: One positive statement we can make about the latest version of the SAFE Banking Act (S.1323) is that it is still alive, as of the end of May 2023. As reported on May 11th on Reuters.com, the mood surrounding this iteration of the bill is generally positive and even optimistic. Reuters quotes several cannabis industry titans, and here are a few of the highlights:

"In this challenging economic environment, swift passage (of the bill) is crucial for the tens of thousands of state-licensed and ancillary cannabis businesses. This legislation will also help address the public safety risks that have been created by forcing a $30 billion industry to operate largely in cash." - Troy Datcher, CEO of TPCO Holdings Corp. (NEO: GRAM.U)

"Instead of squandering another opportunity, Congress has a chance to pass the SAFE Banking Act. Cannabis businesses have continued to pay more than their fair share of state, federal, Social Security and Medicare taxes, and it's time we stop discriminating against the industry." - Jim Cacioppo - CEO, Chairman and Founder, Jushi Holdings Inc. (CSE: JUSH)

"This is the first of several steps for the Senate to proceed forward to a vote so this was very welcome to say the least. The American Bankers Association is pleading for fast tracking to a vote in the Senate and we support their plea." - Morgan Paxhia, Managing Partner and Manager of AdvisorShares Poseidon Dynamic Cannabis ETF (NYSE Arca: PSDN)

We will get ourselves some extra popcorn and watch as this one plays out over the summer.

Legalization in Minnesota: According to a number of articles published in May on the website Marijuana Moment, the governor of Minnesota “has reaffirmed that he will sign a marijuana legalization bill that lawmakers sent to his desk...and the state has already launched a website providing information about the new law before it’s even been formally enacted.” According to a May 22nd article on Marijuana Moment, Gov. Tim Walz (D) “made clear that he intended to sign the legislation prior to its passage in the legislature. After the final votes were taken, he discussed the reform in several interviews over the weekend—and signaled that he plans to sign it at a “big” ceremony just after next week’s Memorial Day holiday.”

On May 25th an article on the website MPR.com reported that Minnesota state agencies are setting a target to begin issuing retail licenses for legal marijuana sales, which will not be in effect until January 2025. According the article, “A request for vendors offers the timeline for a program buildout after the Legislature approved a bill allowing adults at least 21 years old to possess and buy cannabis. Gov. Tim Walz has said he plans to sign the bill into law, making Minnesota the 23rd state to legalize marijuana for recreational use. The state is seeking a software vendor to manage applications and information around retail licenses. The bid package says the project would start in July and license applications would start in May 2024. The estimated start of marijuana sales from dispensaries is listed as January of 2025, although that could shift.” In the meantime, citizens of Minnesota will be able to grow marijuana legally, within limits.

Less happy news out of New Hampshire: On May 11th it was reported in the New Hampshire Bulletin that the New Hampshire State Senate voted down a bill to legalize cannabis, “closing off legalization supporters’ hopes for success this year.” According to the report, “In a 14-10 vote, the chamber voted to kill House Bill 639, which would have legalized cannabis for adults 21 and older and created an opportunity for the state to regulate and tax retail sales.” It is somewhat shocking that New Hampshire continues to be a holdout on legalization given the popularity not only nationwide, but locally. “Democrats argued that the chamber should legalize to respond to New Hampshire residents; a February University of New Hampshire poll found that 71 percent of respondents in the state supported legalization of marijuana, including 56 percent who “strongly” support it. That’s slightly down from 2021, when support hit a 10-year high of 75 percent, according to an earlier UNH poll.” New Hampshire will have to try again next year as they see millions in revenue escape across the border to surrounding New England states.

Finally, an article in MJ Biz Daily reported that Connecticut legislators took the first step toward outlawing synthetic marijuana while seeking to place “THC caps” on sleep aids and other consumable products sold in convenience and CBD stores which reside outside the state’s regulated medical and recreational cannabis markets. According to the article, the state’s House of Representatives voted 148-1 for a bipartisan bill that “represents the first of what is likely to be annual regulatory updates to the state’s adult-use marijuana market, which launched in July.” Consensus is that Connecticut’s Senate also is expected to approve House Bill 6699 which will then make it to Gov. Ned Lamont’s desk for his signature. In short, this legislation would ban the unregulated sale of synthetic marijuana including products containing chemically induced offshoots of delta-8 and delta-9. The bill also “would place limits on the amount of THC in products sold outside the regulated market.”

CRBs in the News

The following is a sampling of highlights from the May 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

-

- Indoor Harvest Corp. Announces Completion of Acquisition of 369Hemp(r) (Tier 2)

- GREEN CURES & BOTANICAL DISTRIBUTION INC announces the acquisition of MARVEL VISION CENTER (Tier 1A)

- Atlas Announces Closing of Acquisition of GreenSeal, Increasing Export Capacity and Strengthening its Integrated Value Chain (Tier 1B)

- Bhang Completes Acquisition of Innovative Patents and IP (Tier 1B)

- GABY Announces Leave of Absence for Current CEO and Appointment of Interim CEO (Tier 1B)

- Neptune Wellness Announces Agreement on Price of Option to Acquire Remaining Ownership Interest of Organic Baby Food Brand, Sprout Organics (Tier 1A)

- West Island Corporate Update and Change of Board (Tier 1B)

- High Tide Opens Canna Cabana Location in Grande Prairie, Alberta (Tier 1B)

- Vertical Peak Announces Corporate Updates and Annual Meeting Results (Tier 1A)

- Acreage Further Expands Adult-Use Retail Operations in Connecticut (Tier 1B)

- Doseology Announces New Director and Corporate Secretary (Tier 1B)

- CSE Bulletin: Name and Symbol Change - High Fusion Inc. (FUZN) (Tier 1A)

- CSE Bulletin: Delist - Alliance Growers Corp. (ACG) (Tier 1B)

- Kanabo Group Appoints Ian Mattioli as Chair of the Board and Secures a PS2.5M Minimum Investment Round (Tier 1B)

- Acreage Announces Update to Senior Management Team (Tier 1B)

- CANADA HOUSE CANNABIS GROUP ANNOUNCES DEPARTURE OF CEO (Tier 1B)

- Shiny Health & Wellness Announces Leadership Transition (Tier 1B)

- FLUENT Opens 34th Nationwide and 31st Medical Cannabis Dispensary in Pensacola, Florida (Tier 1B)

- ACT Laboratories, Inc. Extends Multi-State Expansion Strategy into Florida (Tier 1B)

- Green Scientific Labs Announces the Sale of Florida Assets (Tier 1B)

- High Tide Opens Canna Cabana Location in Grande Prairie, Alberta (Tier 1B)

- Delota Corp. Announces CSE Listing and TSXV Delisting (Tier 1B)

- AWH Announces Leadership Transition (Tier 1B)

- Devonian Health Group Announces the Appointment of New Board Members and Grant of Stock Options (Tier 1A)

- Completion of Health House International Acquisition (Tier 1B)

- TerrAscend Celebrates the Opening of its Fifth Cookies Dispensary in Michigan (Tier 1B)

- CSE Bulletin: Delist - Fiore Cannabis Ltd. (FIOR) (Tier 1B)

- MULTI-STATE CANNABIS OPERATOR, SCHWAZZE, ACQUIRES TWO RETAIL DISPENSARIES FROM SMOKEY’S CANNABIS COMPANY (Tier 1A)

- MedMen Expands Chicago-Area Footprint, Opens Newest Dispensary in Morton Grove (Tier 1B)

- Radient Technologies Announces Board Changes (Tier 1A)

- Atlas Signs Definitive Agreement to Acquire an Additional Pharmacy and Provides Update on Expanding its Global Cannabis Footprint and Progressing Its International Value Chain Strategy (Tier 1B)

- Trulieve Announces Opening of Affiliated Medical Marijuana Dispensary in Limerick, PA (Tier 1B)

- 4Front Ventures Announces Change to Board of Directors (Tier 1B)

- TILT Holdings Announces Leadership Change, Departure of Chief Financial Officer (Tier 1B)

- Item 9 Labs Corp. Executes Major Restructuring to Pave the Way to Profitability (Tier 1B)

- Atlas Signs Definitive Agreement to Acquire a Controlling Interest in Three Pharmacies Expanding its Cannabis Network in Israel (Tier 1B)

- Body and Mind Markham Illinois Dispensary Grand Opening (Tier 1B)

- Agrify Announces Changes to Executive Leadership Team (Tier 1A)

- Green Cures & Botanical Distribution, Inc. Announces Name Change and Share Reductions (Tier 1A)

- Organigram Makes First Strategic U.S. Investment in Phylos Bioscience to Commercialize THCV and Scale Seed Based Production (Tier 1B)

- Tilray Brands Prices $150 Million Convertible Notes (Tier 1B)

- Shoppers Drug Mart and Avicanna Execute Definitive Asset Purchase Agreement for Avicanna's Acquisition of the Medical Cannabis by Shoppers Business (Tier 1B)

- Blackhawk Growth Announces the Acquisition of Hardenbrook and Board Changes (Tier 1B)

- IIROC Trading Halt - AH.WT.A (Tier 1B)

- CANOPY GROWTH AND INDIVA ANNOUNCE AGREEMENT TO POSITION WANA GUMMIES FOR CONTINUED NORTH AMERICAN BRAND LEADERSHIP (Tier 1B)

- Branded Legacy, Inc. Welcomes New Management Team and Announces Strategic Transformation Into Biotech Industry (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"