James B. Francis, CFA

Chief Research Officer, CRB Monitor

The CRB Monitor Securities Research team covers all aspects of the publicly-traded cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates on officers/directors, and investment performance. With our monthly and quarterly newsletters, we keep our readership informed while we highlight the multi-faceted importance of CRB Monitor’s data to all types of users at financial institutions worldwide.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor January 2023 newsletter, CRB Monitor February 2023 newsletter, and the CRB Monitor March 2023 newsletter.

Database Announcement: CRB Monitor adds CBD-themed Sector Coverage and Cannabis Revenue Ranges

We are pleased to announce that starting in March 2023 CRB Monitor made two additions to our data set.

First, we added five new CBD-themed sectors to our data coverage. These sectors, applied to Tier 2 and Tier 3 CRBs, are as follows:

- CBD - Food, Beverage & Tobacco

- CBD - Online Wholesale and Retail

- CBD - Personal Products

- CBD - Pharma & Biotech

- CBD - Traditional Retail

Second, we have added an additional field to our customer user interface and securities extract file which (for Tier 1 CRBs) estimates the direct cannabis-related revenue as a percentage of total revenue. These ranges are 0-10%, 10%-50%, and 50%-100. The main purpose of these data enhancements is to provide our clients with new flexibility as they use CRB Monitor data to implement their specific, Internal cannabis-related policies.

Cannabis-Related Equity Performance

Source: CRB Monitor, Sentieo, Nasdaq

Source: CRB Monitor, Sentieo, Nasdaq

Cannabis Index Returns - A Brief Respite, Then Back to Reality

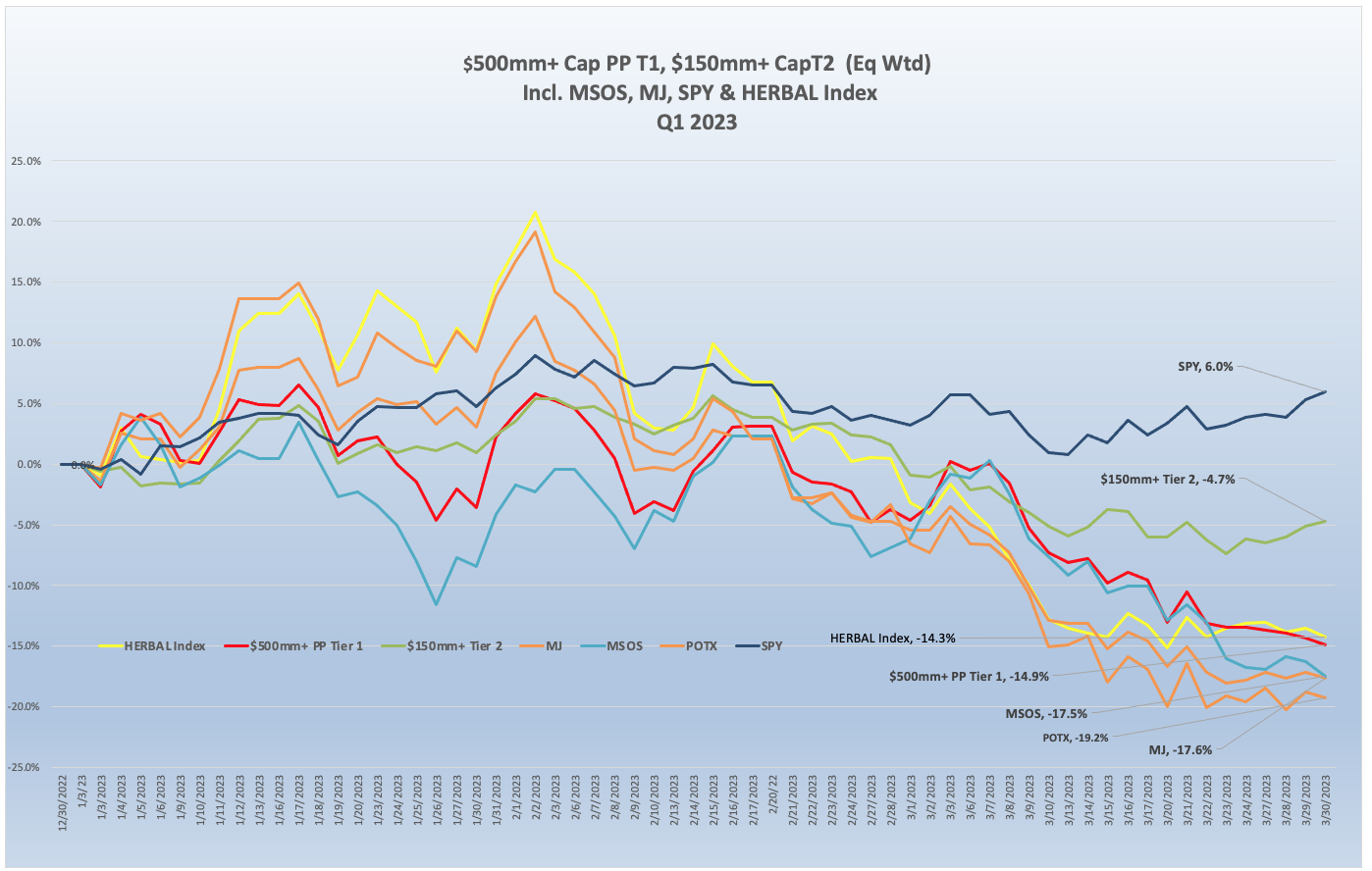

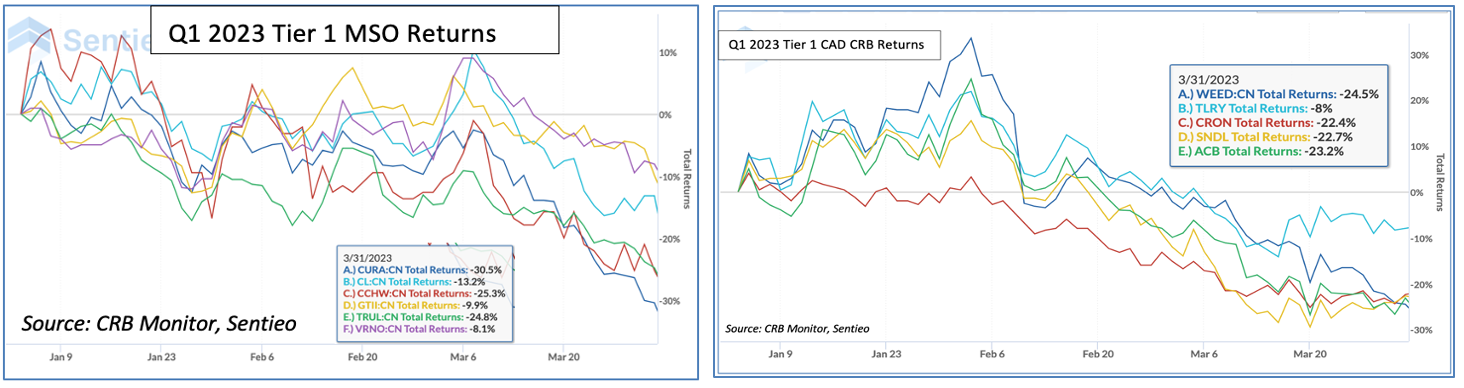

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play cannabis equities, HERBAL was down 14.3% for the 1st quarter of 2023. HERBAL’s performance was ahead of its closest competitor, the Global X Cannabis ETF (Nasdaq: POTX) (-19.2%). The ETFMG Alternative Harvest ETF (NYSE Arca: MJ) struggled (-17.5%) as well. MJ has a ~20% holding in non-pure play CRBs, which tend to have low correlation with Pure Play cannabis, and recently added a 20% US plant-touching component (via return swaps) which will also cause its performance to diverge from the CAD-only cannabis funds. The MSO-heavy Advisorshares Pure Us Cannabis ETF (NYSE: MSOS) lost 17.5% in Q1. MSOS’s performance has a tendency to deviate (but not always) from both HERBAL and POTX largely due to its holdings of CRBs with US Marijuana touch-points, which dominate in that fund. [HERBAL and POTX cannot hold any securities with direct US touch points.] A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $500mm market cap lost 14.9% in Q1 2023. This basket is essentially a hybrid of the companies without US touchpoints and US multistate operators (MSO’s). Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting. We show their comparative performance at the company level on a chart below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap outperformed the Tier 1 basket while falling by 4.7% in Q1. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high (0.8) correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. One lingering reality cannot be avoided, that for better or worse Tier 2 CRBs will eventually inherit the overall success or failure of the Tier 1 universe and there will ultimately be convergence of their return streams.

From the chart above, we can see that cannabis equities were looking somewhat optimistic in January 2023 (following a dismal 2022) then collapsed, unmercifully, in February and again in March. We could speculate that the January bounce was a reflection of the rest of the world, as investors’ fears of protracted inflation and periodic tightening by the Fed were eased by better economic data. Then reality won out, starting in mid-February, as CRBs made an about-face and returned to their languishing, old ways.

And interestingly February 2023 saw significantly different performance by two distinct groups, the Canadian CRBs and the MSOs. The fact of the matter is that nearly all value has gone out of the CRB market, leaving growth, which is also hard to find, and finally sentiment, which is essentially the only factor driving these returns.

March 2023 was more of the same old song, as CRB equities struggled, falling by double digits and continuing their February slide. And while again we saw different performance from Canadian CRBs vs. MSOs, there were no winners in March. Performance differences between the two baskets is understandable given a few factors, the most dominant of which is the anticipated impact of US Federal cannabis reform and the accompanying sentiment. And what we are seeing is sentiment being the only factor that is driving returns, until any concrete legalization (or realistically, any reform at all) passes the US House of Representatives and the Senate and makes it to the President’s desk.

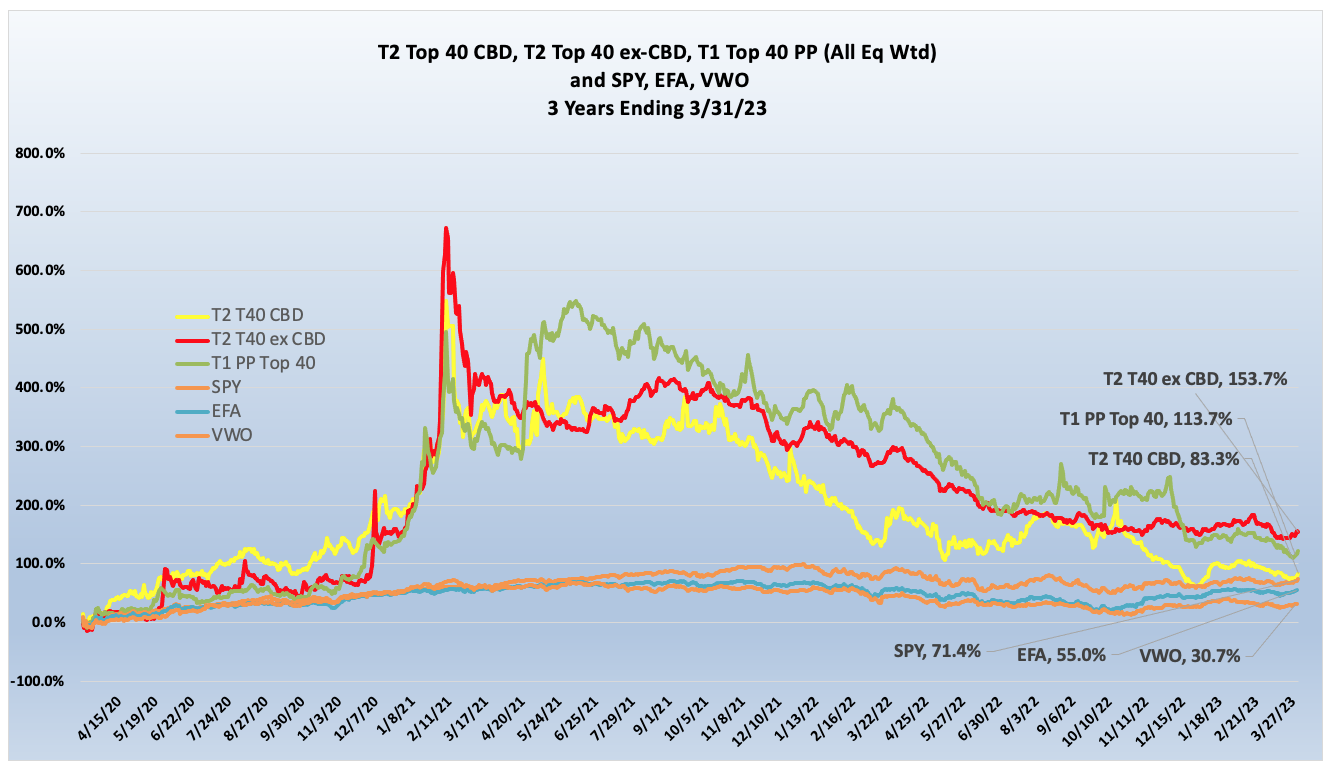

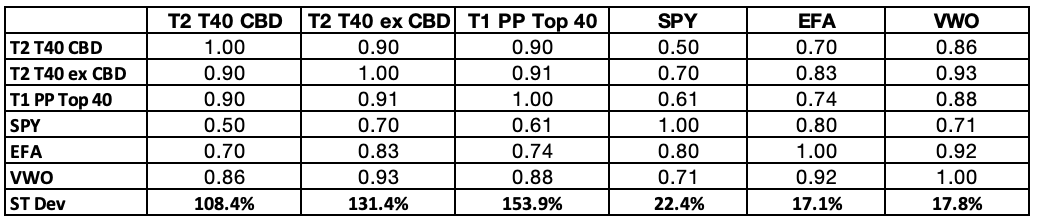

Chart of the Quarter: CBD

During the first quarter we have seen renewed interest in CBD, not so much because of its attractiveness as a cannabis sub-industry but rather due to new concerns from compliance groups. More specifically, the news that CBD has been outlawed in Hong Kong has sent chills throughout the APAC region and as a result, we have created 5 new CBD-themed cannabis sectors that apply to Tier 2 and Tier 3 CRBs.

With this renewed interest came our own curiosity regarding the performance of pure play (aka Tier 2) CBD businesses relative to 1) the rest of the cannabis ecosystem and 2) mainstream equity indexes. [While Tier 3 companies with ties to CBD are covered in CRB Monitor, they were left out of this analysis given their incidental exposure to cannabis.]

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

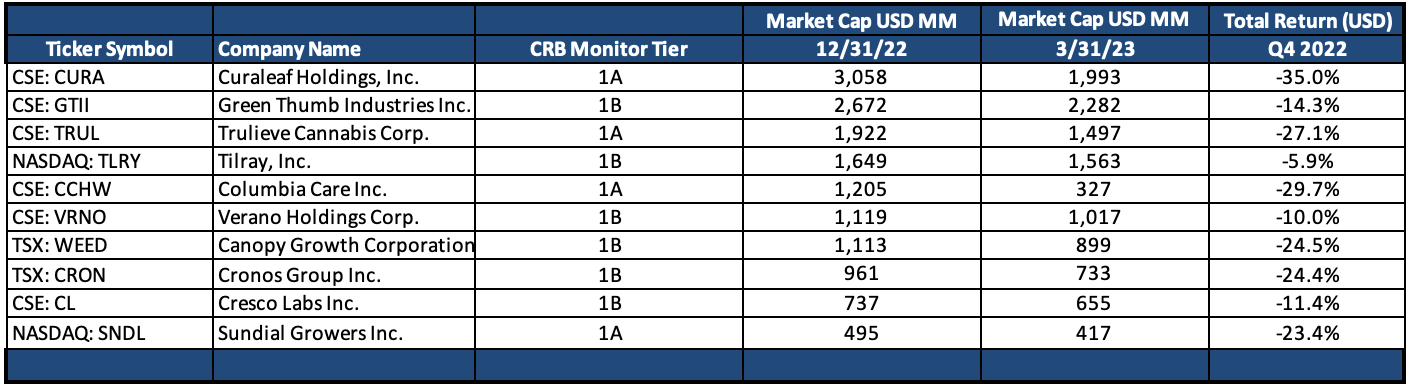

Tier 1 Pure Play CRBs w/Mkt Cap Over $500mm – Q1 2023 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

From the above table, it is clear that there were no bright spots in the publicly-traded Tier 1 CRB space when we talk about Q1 2023 performance. The investors that have hung onto their CRB shares this long are to be commended for their patience as cannabis equities and cannabis-themed funds have largely collapsed. We can only hope that they will be rewarded in the long term, with the hope that cannabis legislative reforms are in the works and will pass in the next couple of years.

Looking at the MSO group, Green Thumb Industries Inc. (CSE: GTII) (-14.3%), Cresco Labs Inc. (CSE: CL) (-11.4%) and its (fingers crossed) subsidiary Columbia Care Inc. (NEO: CCHW) (-29.7%), Curaleaf Holdings, Inc. (CSE: CURA) (-35.0%), and Trulieve Cannabis Corp. (CSE: TRUL) (-27.1%) all hit new lows in spite of a hopeful February.

Tier 2 CRBs w/Mkt Cap Over $150mm – Q1 2023 Returns

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

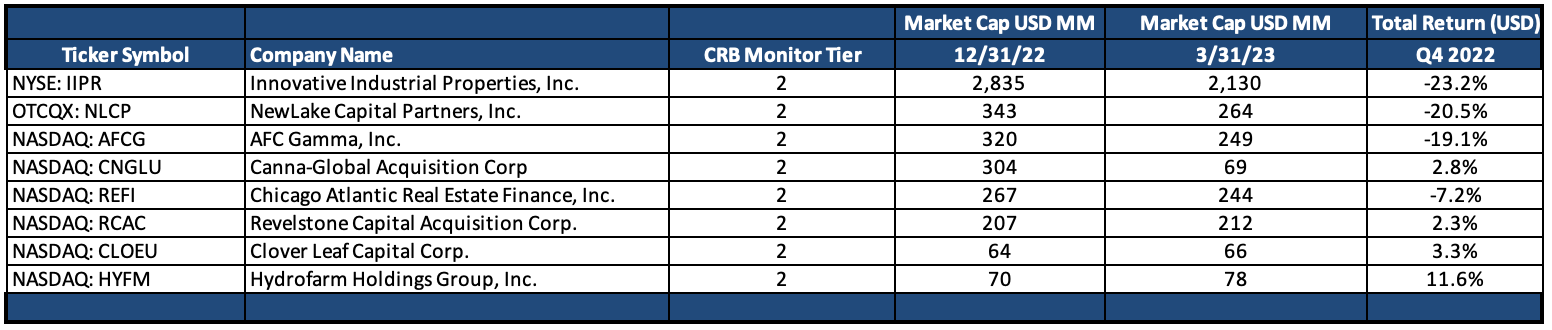

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies lost 4.7% for the first quarter of 2023, which outperformed the equally-weighted Tier 1 basket by more than 10%. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our analysis of CRB correlations in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, as it did in Q1, given the occasional lag from the impact (positive or negative) of market forces.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” We write about IIPR frequently, largely due to the fact that its stock historically (up to January 2022) defied the volatile price patterns of the cannabis space up to 15 months ago consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization. IIPR’s stock price languished in Q1 2023, returning -23.2% and underperforming all other CRBs in the Tier 2 basket. Its dependency on the success of US operators causes investor sentiment to sink or swim based on, among other things, US legalization. This rebound just piles on IIPR’s dismal 2022 return of -59%.

Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM, CLS Sector Agricultural & Farm Machinery) (+11.6%). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR (in fact, much worse), HYFM was in a free fall in 2022, posting a return of -95%. That’s not a typo. As such, any positive monthly or quarterly return should be taken with a grain of salt. In a December 8th article on the website SeekingAlpha.com, author Manuel Paul Dipold describes HYFM’s dire situation as follows:

“From my point of view, Hydrofarm (NASDAQ:HYFM) is in a catastrophic situation, and I think the stock market is about to price in the risk of bankruptcy. The debts are high; interest payments are rising sharply. Cash flow is negative and will remain so for at least another two years. Even the issuance of new shares would flush very little money into the coffers due to the low share price, and they do not even have as much cash left as they burned in the last quarter alone.”

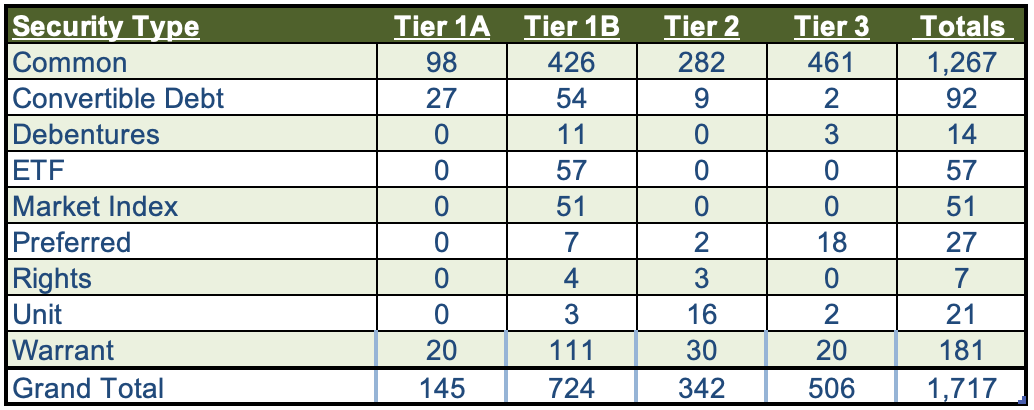

CRB Monitor Securities Database

As of March 31, 2023, the breakdown of publicly-traded, cannabis-linked securities was as follows:  Source: CRB Monitor

Source: CRB Monitor

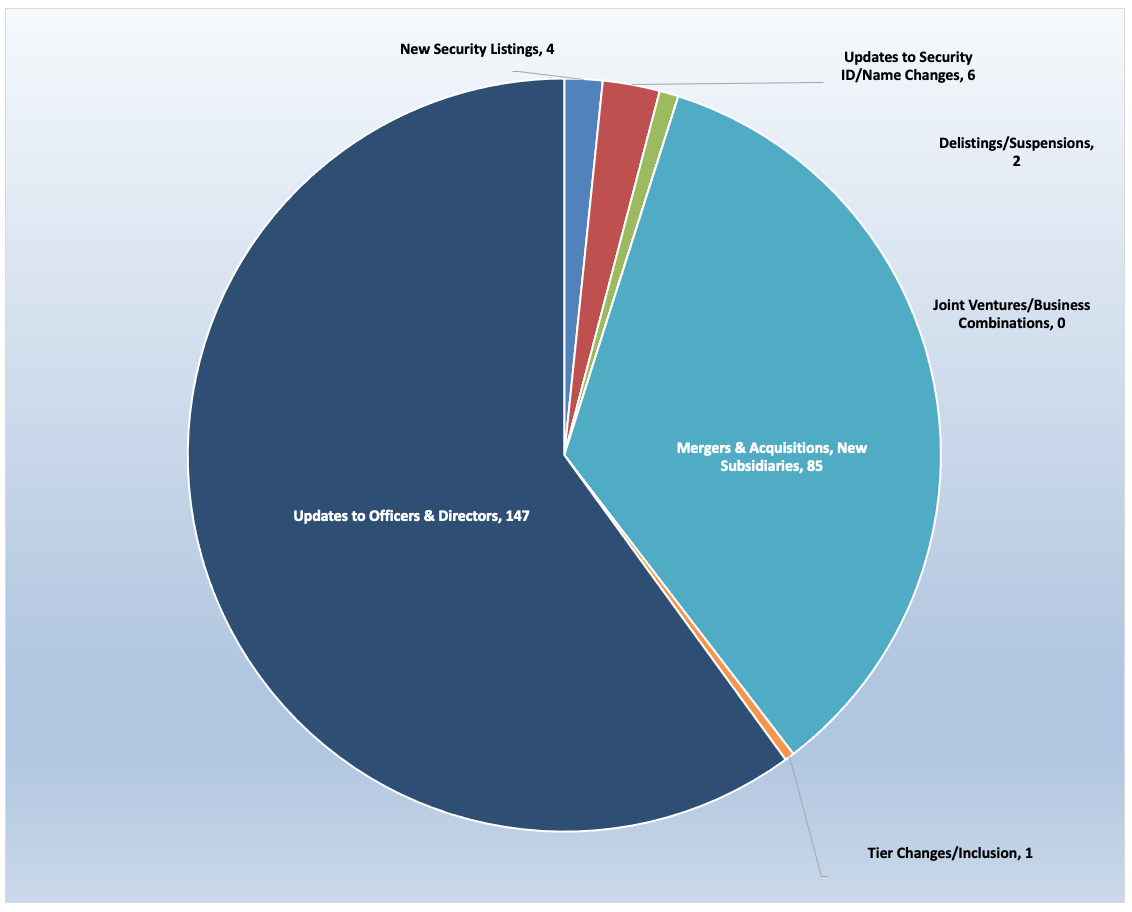

In Spite of the slowdown in M&A activity, Q1 2023 featured plenty of daily updates to the CRB Monitor database. Of the thousands of announcements and filings reviewed during the full year, our daily research resulted in a total of 486 updates to CRB Monitor company profiles (158 updates to issuers’ records, 328 news releases added). The complete list of securities and detailed profiles for more than 1,300 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor January 2023 newsletter, CRB Monitor February 2023 newsletter, and the CRB Monitor March 2023 newsletter.

CRB Monitor Securities Database Updates - Q1 2023

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for March 2023:

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News - Q1 2023

We closely tracked the cannabis news cycle throughout the First Quarter of 2023, making hundreds of updates to the CRB Monitor database related to all types of relevant corporate activity. Cannabis equities were challenged early and late in Q1 2023, and we were there, standing by to capture all the critical information necessary to maintain the world’s best cannabis-linked securities database. The following is a sampling of some of the highlights from the Q1 cannabis news cycle.

On January 20th Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) continued its expansion across the United States, announcing the opening of MÜV Navarre Verano’s 63rd Florida dispensary and 121st nationwide. By their own admission, “Verano Holdings Corp. is a large, vertically-integrated, multi-state cannabis operator in the U.S., devoted to the ongoing improvement of communal wellness by providing responsible access to regulated cannabis products.” According to the press release, “As a demonstration of Verano’s commitment to provide a convenient and reliable experience for Florida patients, MÜV dispensaries feature online menus for effortless browsing of their extensive, award-winning product selection, including the Company’s signature Verano Reserve and Sweet Supply flower, Encore edibles, and Savvy flower and extracts.” With the closing of this acquisition, Verano’s footprint expands to include 68 cannabis licenses in either active status or pending approval. Verano currently operates in 12 United States plus the District of Columbia.

Also during the month of January, Tier 1B Canadian CRB Delta 9 Cannabis Inc. (TSX: DN) issued a press release in which they announced the opening of their eighteenth retail cannabis store in the Province of Manitoba and 40th store overall. In their own words, “Delta 9 Cannabis Inc. is a vertically integrated cannabis company focused on bringing the highest quality cannabis products to market. The Company sells cannabis products through its wholesale and retail sales channels and sells its cannabis grow pods to other businesses.” DN operates in 5 Canadian provinces and holds, through its subsidiaries, 70 cannabis licenses issued by Canadian authorities.

In February a press release from Tier 1B MSO MariMed, Inc. (CSE: MRMD), announced its intention to acquire the operating assets of Ermont, Inc., a medical licensed vertical cannabis operator, located in Quincy, MA. According to the press release, this acquisition “will provide the Company with its third dispensary in Massachusetts, substantially completing its buildout to the maximum allowable by state regulations.” The addition of Ermont expands MariMed’s footprint to 20 active licenses across 5 states.

Also in February, Tier 1B RIV Capital Inc. (CSE: RIV) announced in a press release that that it has entered into a settlement agreement that has resulted in JW Asset Management, LLC consenting to the dismissal of its application related to the Company’s acquisition of Etain, LLC and Etain IP, LLC.

According to the press release:

“Under the terms of the settlement agreement, RIV Capital has repurchased for cancellation all RIV Capital Class A common shares currently owned or controlled by JWAM and its affiliates...amounting to 33,733,334 shares, for an aggregate purchase price of U.S.$19,625,000. RIV Capital has also reimbursed certain legal expenses incurred by JWAM as part of its application and related matters in the amount of U.S.$375,000. RIV Capital funded such amounts with cash on hand. As part of the settlement, JWAM and its affiliated funds have also withdrawn their requisition for a special meeting of the Company’s shareholders currently scheduled for June 6, 2023, which meeting will be cancelled by the Company.”

In March, amidst the tension surrounding the completion of its pending acquisition of Columbia Care, Tier 1A MSO Cresco Labs Inc. (CSE: CL) announced that it opened its fourth Sunnyside dispensary in the greater Orlando, Florida region. Sunnyside South Orlando is located at 2051 Town Center Blvd. The new store is the Company’s 26th dispensary in the state and 61st nationwide. In a March 2nd press release, Charlie Bachtell, Cresco CEO stated, “We’re opening new retail stores in prime locations to sufficiently cover greater Orlando’s four corners and serve the needs of the growing patient population in this Florida region...Orlando is home to over 2.5 million residents and attracts over 75 million visitors annually. In addition to our Fern Park, West Orlando and Winter Park locations, we look forward to serving the patient community out of our newest store in South Orlando.” With this new business the combined Cresco/Columbia Care entity will ultimately have control over 178 licenses across 15 states in the US plus the District of Columbia.

Finally, it was reported in March that Tier 1A Canadian CRB SNDL Inc. (NASDAQ: SNDL) entered into an agreement with Lightbox Enterprises Ltd. to acquire four cannabis retail stores operating under the Dutch Love Cannabis banner. According to the March 28th press release: “Under the Agreement, SNDL will acquire from Lightbox the rights to four Dutch Love stores and the rights to use certain Dutch Love related intellectual property for a total consideration of $7.8 million....As part of the Agreement, SNDL will acquire the rights to three Dutch Love stores in British Columbia and one store in Ontario. The combined assets generated annual revenue of $11.5 million in 2022, with an average gross margin of 36.5%. The completion of the acquisition is expected to further solidify SNDL's position as a multi-banner cannabis retail operator by enhancing the Company's market share and its exposure to a broader consumer base in two key markets.” As a CRB with no US cannabis touch points, SNDL operates legally in Canada with 164 licenses across 7 provinces.

Regulatory Updates

A January article in marijuanamoment.com reported that, according to recently released federal data, marijuana seizures by Customs and Border Protection (CBP) decreased to a historic low in Fiscal Year 2022. According to CBP data, the reasons for this drastic decline is seizures “(include) shifting enforcement priorities, but experts generally view the trend as a reflection of reduced demand for smuggled illicit cannabis as more states have moved to legalize marijuana and provide people with access in a regulated, domestic market.”

The article notes that, “over the previous ten years, CBP marijuana seizures have decreased…from a total of 2,822,478 pounds in Fiscal Year 2012 to just 154,797 pounds in 2022. The annual decline has been substantial and has continued in recent years. The weight of marijuana seized fell by 73 percent between 2020 and 2022, from 319,447 pounds in 2021 to a figure of roughly half in 2022.”

In February, from the great state of Kansas, an article in Marijuana Moment reported that senators have filed a new bill to legalize medical marijuana in the state, “though leadership has tempered expectations about the scope of what might be passable this session.” The legislation is being carried by the Senate Federal and State Affairs Committee. According to the article, an earlier medical cannabis reform measure cleared the House in 2021, but it stalled out in the Senate. In the words of Kevin Caldwell, a legislative manager at the Marijuana Policy Project, “We are excited to see the Kansas legislature introduce legislation that would provide legal access to safe, laboratory tested medical cannabis products for patients suffering from debilitating conditions...The patients of Kansas have been eagerly anticipating the opportunity for a program and to join the 37 other states that have adopted comprehensive medical cannabis programs. Patients have been forced for too long to have to go to the illicit market for products that have not been tested for contaminants as well as face legal repercussions for possessing medicine that can greatly improve the quality of their lives.”

Also in February, it was reported on NPR website WSH.com that Connecticut Attorney General William Tong is cracking down on the illegal sale of THC products. According to the article, “he has sued five retailers for allegedly selling the drug in packaging attractive to children. Tong said the products, called delta-8, are being packaged like snack foods.” The article reminds us that in Connecticut, “a product with more than .3% THC is considered cannabis and requires a license to sell.” Currently there are only 10 retailers that are licensed to sell recreational cannabis, and still only 58 total active retail licenses have been issued there. The article goes on to say, “Only a handful of Connecticut retailers are licensed to sell delta-8 and other cannabis products. The products must comply with strict regulations — including packaging that is not appealing to youth. Tong is also sending warning letters to licensed retailers of electronic vaping products, warning them not to sell cannabis without a license.”

A March article on the website PBS.org attacks the touchy subject: Weed is legal in New York, but the illegal market is still booming. Here’s why. The issue is that while there are quite a few dispensaries in New York City, the vast majority are unlicensed. In the words of the article: “As the first dispensaries have opened across the city in the last several months, and more than 60 licenses have been issued across the state, a sea of unlicensed, illegal shops still dot the streets of all five boroughs, selling marijuana everywhere from small bodegas to large operations that one might confuse for a legal retailer. “Officials have calculated conservatively that there are 1,400 unlicensed shops in the five boroughs. I think that number is probably quite a bit higher,” said Alyson Martin, founder of Cannabis Wire, which covers the marijuana industry in New York and nationwide.” While the article does not offer too many answers to this ongoing problem, it does mention, “To curtail illegal businesses, without sending individuals to jail, the state is turning to civil enforcement...At least something like 400 letters have been sent to landlords and building owners saying, ‘Hey, if you’ve got unregulated activity happening within your building, we’re sort of putting you on notice that if you don’t stop, we’ll intervene.’”

Also in March, Marijuana Moment reported that a bill (HB 639) to legalize marijuana in New Hampshire is going back to the House floor after a second committee passed the legislation with amendments. The proposal, which is being sponsored by Majority Leader Jason Osborne (R) and Minority Leader Matthew Wilhelm (D), cleared the House Ways & Means Committee in a 16-4 vote. According to the article, “Gov. Chris Sununu (R), who was reelected last year, remains opposed to legalization—but his more recent comments on the issue seem to show a softening of his position. He said during a debate last year that reform “could be inevitable,” but he added that states need to “be patient about how you do it.””

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"