James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Linked Equity Performance

Source: CRB Monitor, Nasdaq, Sentieo

Source: CRB Monitor, Nasdaq, Sentieo

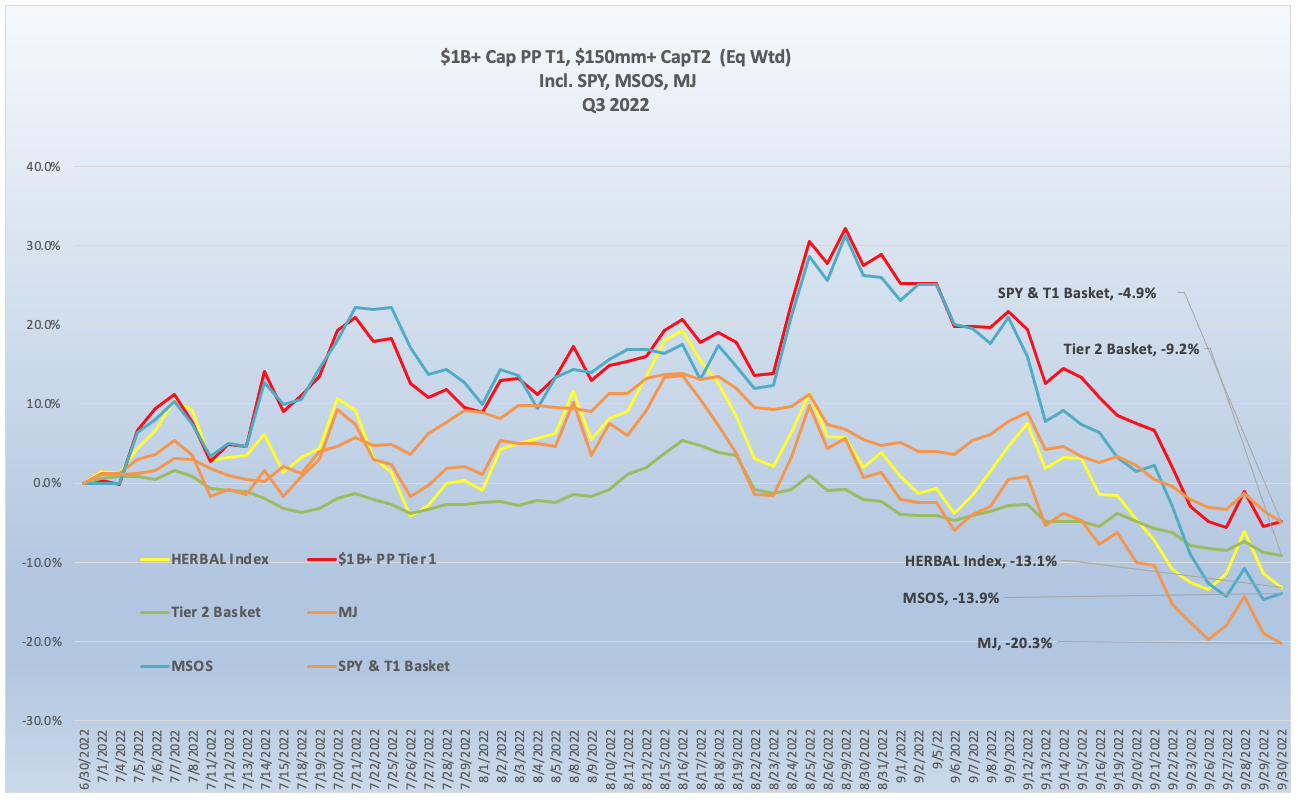

Cannabis Index Returns

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play cannabis equities, HERBAL was down 13.2% for the 3rd quarter of 2022. HERBAL’s performance was consistent with other cannabis-themed vehicles, like the ETFMG Alternative Harvest ETF (NYSE Arca: MJ). MJ’s underperformance (-20.3%) relative to HERBAL was due in some part to the fund’s ~20% holding in non-pure play CRBs, which tend to have low correlation with Pure Play cannabis. The MSO-heavy Advisorshares Pure Us Cannabis ETF (NYSE: MSOS) lost 13.9% in Q3. The MSOS performance tends to deviate from both HERBAL and MJ largely due to its holdings of CRBs with US Marijuana touch-points, which dominate in that fund. [MJ and HERBAL cannot hold any securities with direct US touch points.] A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $500mm market cap lost 4.9% in Q3 2022. This basket is essentially a hybrid of the companies without US touchpoints and US multistate operators (MSO’s). Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap underperformed the Tier 1 basket, falling by 9.2% for Q3. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. One lingering reality cannot be avoided, that for better or worse Tier 2 CRBs will eventually inherit the overall success or failure of the Tier 1 universe.

From the chart above, we can see that aside for a few isolated spikes cannabis investors were by-and-large disappointed in Q3 2022. Inflation has not subsided since the end of the second quarter, and it looks like a majority of economists are predicting a recession for the US. And while unemployment remains at historically low levels, the US Federal Reserve Bank has been raising interest rates at a feverish pace which appears to have slowed that trend for now. None of this makes for a bullish cannabis market, which is vulnerable not only to prices here at home but also abroad. As we have written recently, the economy was eventually going to overheat, given pandemic-related residual shocks to the supply chain, pent-up demand from bulging savings accounts, and two Covid-related relief packages plus one historic infrastructure package which some economists believe inflamed consumer demand even further.

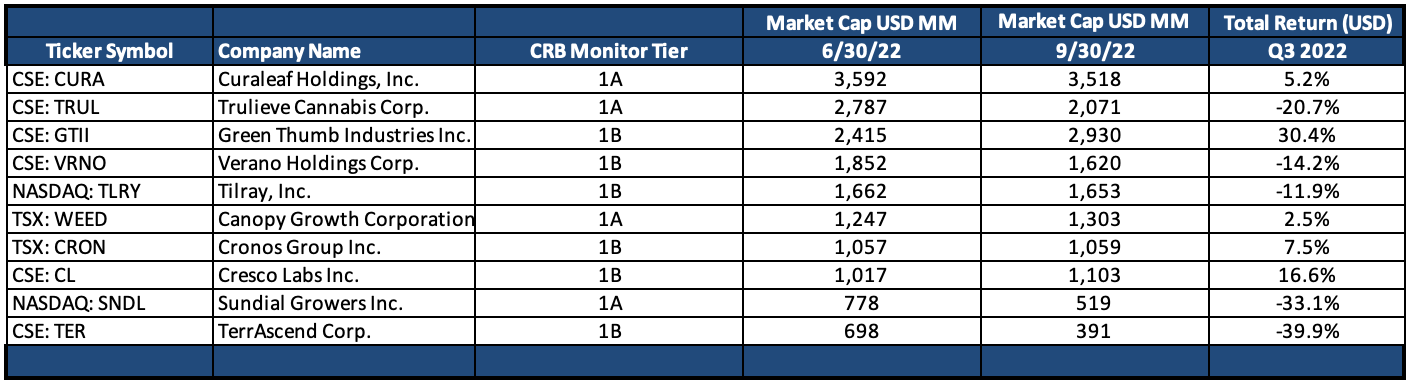

Tier 1 Pure Play CRBs w/Mkt Cap Over $500mm – Returns 3rd Quarter 2022

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

As we have been seeing for 6+ quarters, there was little to be happy about in Tier 1 CRB space during Q3 2022. Investors that have hung on this long deserve shiny medals along with some strong antacid for their persistent optimism. With that said, there were a few individual bright spots during the quarter that provided a ray hope for those that still choose to pay attention.

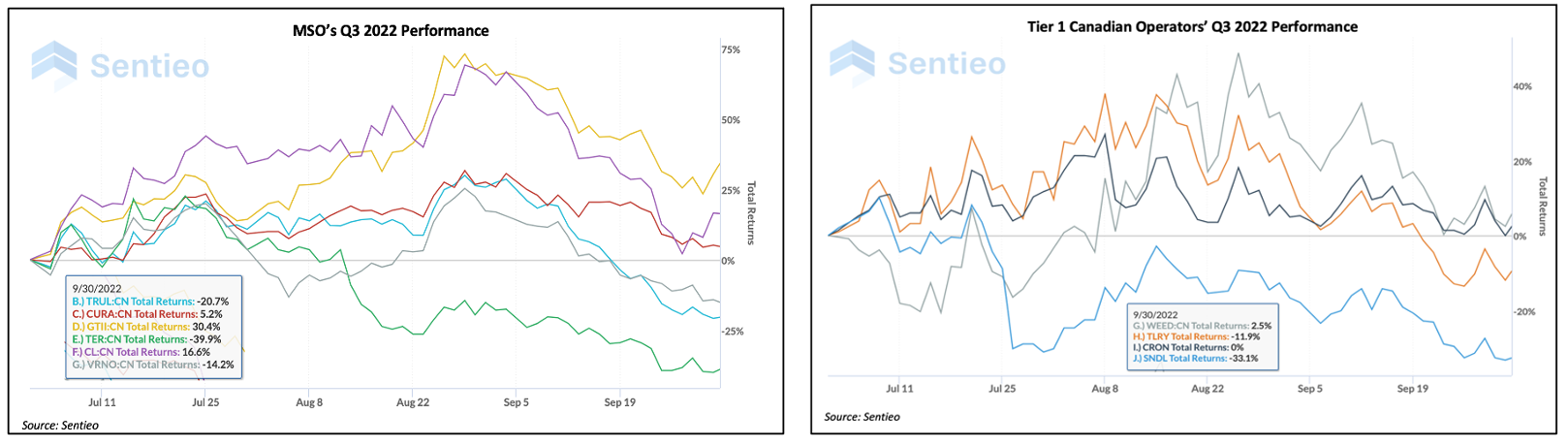

Looking at the MSO group, Green Thumb Industries Inc. (CSE: GTII) (+30.4%) was the big winner in the Tier 1 basket, clawing back nearly half of its 53% collapse in the second quarter. There isn’t a whole lot to say about GTII except that over the prior 18 months it had lost 78% of its value and perhaps it was looking a bit oversold. As for the rest of the MSO group, Cresco Labs Inc. (CSE: CL), following their 3/23/22 announcement of their acquisition of Columbia Care Inc. (NEO: CCHW), also experienced a “dead cat bounce” of sorts, returning +16.6% in Q3. The brightest moment of the quarter for Cresco Labs was CEO Charlie Bachtell’s interview with CRB Monitor’s Chief Research Officer, James Francis. Mr. Bachtell and James had a stimulating conversation that is loaded with his insights into several topics, all of which could have a profound impact on the cannabis industry, in the near term and in going forward.

As for the rest of the multi-state operators (MSOs), they were generally unimpressive in Q3. Curaleaf Holdings, Inc. (CSE: CURA) (+5.2%), Verano Holdings Corp. (CSE: VRNO) (-14.2%), Trulieve Cannabis Corp. (CSE: TRUL) (-20.7%) and TerrAscend Corp. (CSE: TER) (-39.9%) did little to stem the tide that had started in early 2021 (see chart below).

The Canadian operators were providing little hope as well, with Tier 1 CRBs Tilray Brands, Inc. (Nasdaq: TLRY) (-11.9%), Cronos Group Inc. (TSX: CRON) (+7.5%), Canopy Growth Corporation (TSX: WEED) (+2.5%), and Sundial Growers, now called SNDL, Inc., (Nasdaq: SNDL) (-33.1%) either making up very little value or continuing their 18-month swoon. As we have written, Canadian CRBs generally tread water in advance of US federal legislation as it would most likely result in their selling cannabis to US operators.

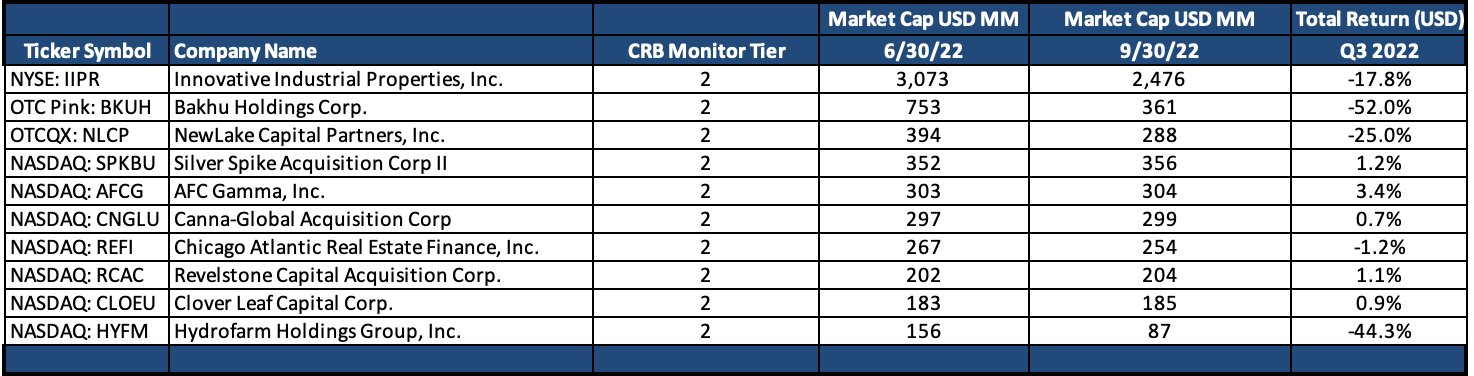

Tier 2 CRBs w/Mkt Cap Over $150mm – Returns 3rd Quarter 2022

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies returned -9.2% for the second quarter of 2022, which underperformed the equally-weighted Tier 1 basket by about 5% and matched the performance of the S&P 500 index. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” We write about IIPR frequently, largely due to the fact that its stock has historically defied the volatile price patterns of the cannabis space as it has, until recently, consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization. With that said, IIPR’s stock price has generally been in free fall since it reached its high in November of 2021. Its dependency on the success of US operators causes IIPR to either live or die based on, among other things, US legalization. Not to mention so many other little hidden gems that we have referenced in past newsletters, many of them highlighted in this April 2022 research report by Blue Orca Capital.

At the risk of driving a number of Tier 2 investors to the edge of the cliff, we mention the breathtaking downturn of Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM, CLS Sector Agricultural & Farm Machinery). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR (actually worse), HYFM has been in a free fall in 2022, posting a 3rd quarter return of -44.3%.

As we wrote in our September Newsletter, HYFM is clearly in trouble, having announced its second quarter 2022 results, which revealed a decrease in Net Sales to $97.5 million compared to $133.8 million while Gross Profit decreased to $7.3 million compared to $29.6 million. To add insult to injury, A September article on Benzinga.com reported that HYFM’s Return on Capital Employed (a measure of yearly pre-tax profit relative to capital employed by a business) was a negative 0.5%. In the words of the Benzinga report, “A higher ROCE is generally representative of successful growth of a company and is a sign of higher earnings per share in the future. A low or negative ROCE suggests the opposite. In Q2, Hydrofarm Holdings Group posted an ROCE of -0.5%.”

CRB Monitor Securities Database

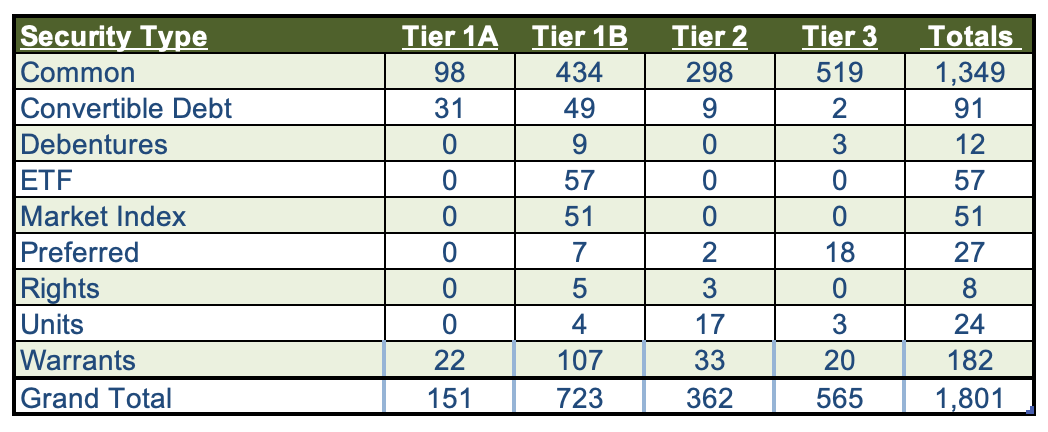

As of September 30, 2022, the breakdown of publicly-traded, cannabis-linked securities was as follows:

Source: CRB Monitor

Source: CRB Monitor

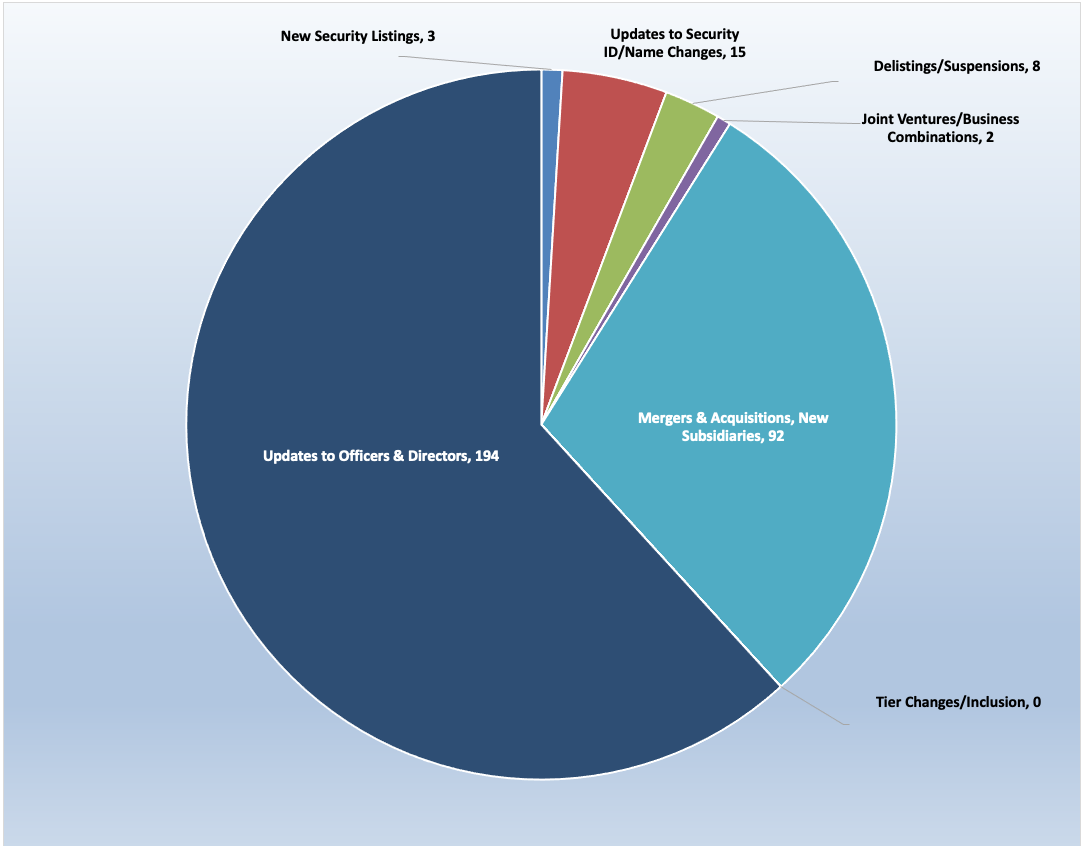

Of the thousands of announcements and filings reviewed during Q3 2022, our daily research resulted in a total of 608 updates to the CRB Monitor database (190 updates to issuers’ records, 418 news releases added). The complete list of securities and detailed profiles for more than 1,400 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor July 2022 newsletter, CRB Monitor August 2022 newsletter, and the CRB Monitor September 2022 newsletter.

CRB Monitor Securities Database Updates – Q3 2022

Source: Sentieo

CRBs In the News

We closely tracked the cannabis news cycle throughout the third quarter of 2022, making hundreds of updates to the CRB Monitor database related to all types of relevant corporate activity. Cannabis equities were challenged throughout Q3 2022, and we were there, standing by to capture all the critical information necessary to maintain the world’s best cannabis-linked securities database. The following is a sampling of some of the highlights from the Q3 cannabis news cycle.

In July, Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) announced in a press release the opening of MÜV Tamarac, Verano’s 49th Florida dispensary and 102nd nationwide. According to the announcement, “MÜV Tamarac’s close proximity to Fort Lauderdale and Boca Raton will allow us to reach even more patients in Florida’s growing medical marijuana program,” said John Tipton, President of Verano. “Tamarac marks our second location in Broward county, the second most populous county in Florida, and we are excited and ready to expand access to our premium cannabis products to more patients in the state.” With this acquisition Verano continues its expansion in the United States which has resulted in operations in 16 states plus Puerto Rico, and controls over 88 cannabis licenses in either active status or pending approval.

Also in July, Tilray, Inc. (NASDAQ: TLRY) announced in a press release that it closed its previously-disclosed acquisition from HT Investments MA LLC of the secured convertible note issued by HEXO Corp. (TSXV: HIP). Tilray Brands acquired the HEXO Note from HTI, which has a current principal balance of $173.7 million outstanding. The purchase price paid to HTI for the HEXO Note was $155 million, reflecting a 10.8% discount on the outstanding principal balance.

What this means: The conversion price of the HEXO Note of CAD$0.40 per share, implies that, as of July 11, 2022, Tilray Brands would have the right to convert into approximately 48% of the outstanding common stock of HEXO (on a non-diluted basis). By CRB Monitor’s count, assuming the exercise Tilray would, through all of its subsidiaries, hold 273 cannabis licenses in either active or pending approval status.

In August, Tier 1B TerrAscend Corp. (CSE: TER) announced in an August 24 press release that it “completed its acquisition of KISA Enterprises MI, LLC (aka "Pinnacle"), a dispensary chain operator in Michigan, and related real estate assets from KISA Holdings, LLC, for total consideration of US$28.5 million. The acquisition is immediately accretive to TerrAscend on both a Sales and EBITDA basis. The acquisition includes six dispensary licenses, five of which are currently operational and located in the cities of Addison, Buchanan, Camden, Edmore, and Morenci. The addition of Pinnacle expands TerrAscend's retail footprint to 17 in Michigan and 32 nationwide.” Now that this deal is closed, TerrAscend’s subsidiaries operate in seven states in the US and two Canadian provinces. Through their subsidiaries, TerrAscend holds a total of 94 cannabis licenses that are either active or pending approval.

In September, Tier 1A CRB Canopy Growth Corporation (TSX: WEED) issued a press release announcing that they had entered into agreements to divest its retail business across Canada which includes the stores operating under the Tweed and Tokyo Smoke retail banners. In the words of the press release, “the announcement reinforces the Company's focus on advancing its path to profitability as a premium brand-focused cannabis and consumer packaged goods (CPG) company.”

The press release goes on to state that Canopy “has reached an agreement with OEG Retail Cannabis, an existing Canopy Growth licensee partner that currently owns and operates the Company's franchised Tokyo Smoke stores in Ontario. As part of this agreement, OEGRC has agreed to acquire all of Canopy Growth's corporate stores outside of Alberta as well as all Tokyo Smoke-related intellectual property. The Company has also reached an agreement with 420 Investments Ltd. pursuant to which FOUR20 has agreed to acquire the ownership of five retail locations in Alberta.”

David Klein, Canopy Growth’s CEO, put a positive spin on the sale: "By realizing these agreements with organizations that possess proven cannabis retail expertise, we are providing continuity for consumers and team members. Through the best-in-class retail leadership that OEGRC and FOUR20 have demonstrated, they will continue to serve Canadian consumers with the high-quality in-store experiences that are essential for success in a new industry.''

With this transaction, which is pending approval by Canadian Authorities, Canopy Growth’s footprint covers six Canadian provinces and two ex-North American countries. Canopy holds 80 licenses through its subsidiaries that are either in active status or are pending approval.

Regulatory Updates

In July, A July 14th article on the website Truthout.com reported the results of a poll that suggests that nearly 6 in 10 Americans “want marijuana legalized.” The July Poll, conducted by The Economist/YouGov, surveyed 1,500 adults and found that “most Americans would welcome the legalization of marijuana. Just 28 percent of Americans want to keep the drug illegal at the federal level…while nearly 6 in 10 Americans (58 percent) say THAT it should be legal to use recreationally.” Not surprisingly, more of those who support legalization identified as Democrats (68%) as opposed to Republicans (43%).

Also in July it was reported that Switzerland has legalized medical cannabis. Switzerland is to join other European countries that have legalized cannabis for medical purposes. According to a July 27th article in Forbes, patients will be able to purchase cannabis with a medical prescription, beginning on August 1st.

The new regulations also allows for “the export of medical cannabis for commercial purposes through the authorization companies need to request from Swissmedic, the Swiss surveillance authority for medicines and medical devices.”

Furthermore, the law only allows for cannabis products that contain CBD, with less than 1% THC content. With that said, the article states that “Switzerland is to start a trial program for adult-use cannabis, aiming to provide information to regulate cannabis in the whole country by selling adult-use cannabis products in Basel to around 400 volunteers.”

According to cannabis informational website The Cannigma, 27 countries in Europe now allow cannabis (in some form) to be used for medical purposes only. Germany appears to be the only European country, at this time, that is anywhere close to legalizing recreational marijuana.

In August, a recent article on the website Reason.com cites a new poll that finds that 55 percent of Texas voters favor legalizing marijuana for recreational use. While the article concedes that the numbers are down a bit from the 60-percent support measured last spring, “it is still a pretty striking result in a state where Republicans outnumber Democrats, control the state legislature, and occupy all statewide elected offices.”

The story goes on to say, “the survey…found that 65 percent of Democrats wanted to legalize recreational marijuana, compared to 63 percent of independents and 43 percent of Republicans. Forty-eight percent of Republicans opposed legalization, while 9 percent offered no opinion.”

The most compelling point about this article is that, in addition to Texas, legalization is looking rather popular in several red states, in spite of resistance from their legislators. The authors site similar polls that show strong support in Iowa (54%), Louisiana (58%), and North Carolina (60%).

Finally, in September it was reported by Marijuana Moment that while US Senate leadership took steps to pass a House-approved marijuana research bill, at least one GOP senator objected to the process, and threatened to delay the vote. The bill, called the “Medical Marijuana and Cannabidiol Research Expansion Act (H.R.8454)” was expected to pass under unanimous consent; however, Sen. John Cornyn (R-TX) threw a wet blanket on the proceedings by objecting to passing the bill via unanimous consent.

A few words about this legislation: Once signed into law, “the U.S. attorney general would be given a 60-day deadline to either approve a given application or request supplemental information from the marijuana research applicant. It would also create a more efficient pathway for researchers who request larger quantities of cannabis.”

Second, and what we would consider the most significant measure of the bill, it would encourage the Food and Drug Administration (FDA) to develop cannabis-derived medicines. According to the article: “One way it proposed doing so is by allowing accredited medical and osteopathic schools, practitioners, research institutions, and manufacturers with a Schedule I registration to cultivate their own cannabis for research purposes.” This could be a possible game-changer for the cannabis industry in the long run.

A couple of additional highlights of this bill:

- The Drug Enforcement Administration (DEA) would get a mandate to approve applications to be manufacturers of marijuana-derived, FDA-approved drugs under the bill. Manufacturers would also be allowed to import cannabis materials to facilitate research into the plant’s therapeutic potential.

- The Department of Health and Human Services (HHS) to look at the health benefits and risks of marijuana as well as policies that are inhibiting research into cannabis that’s grown in legal states and provide recommendations on overcoming those barriers.

- Statement that it “shall not be a violation of the Controlled Substances Act (CSA) for a State-licensed physician to discuss” the risk and benefits of marijuana and cannabis-derived products with patients.

The article goes on to say that this legislation “would mark the first time in history that a standalone cannabis reform measure would be enacted into law.” It also states that Cornyn’s office did not provide a reason for his objection. We will be watching this one as it looks like it has a good chance to pass once Cornyn’s concerns are addressed.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"