James B. Francis, CFA

Chief Research Officer, CRB Monitor

The CRB Monitor Securities Research team covers all aspects of the publicly-traded cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates on officers/directors, and investment performance. With our monthly and quarterly newsletters, we keep our readership informed while we highlight the multi-faceted importance of CRB Monitor’s data to all types of users at financial institutions worldwide.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor October 2022 newsletter, CRB Monitor November 2022 newsletter, and the CRB Monitor December 2022 newsletter.

Cannabis-Related Equity Performance

Cannabis Index Returns - Into the Woods

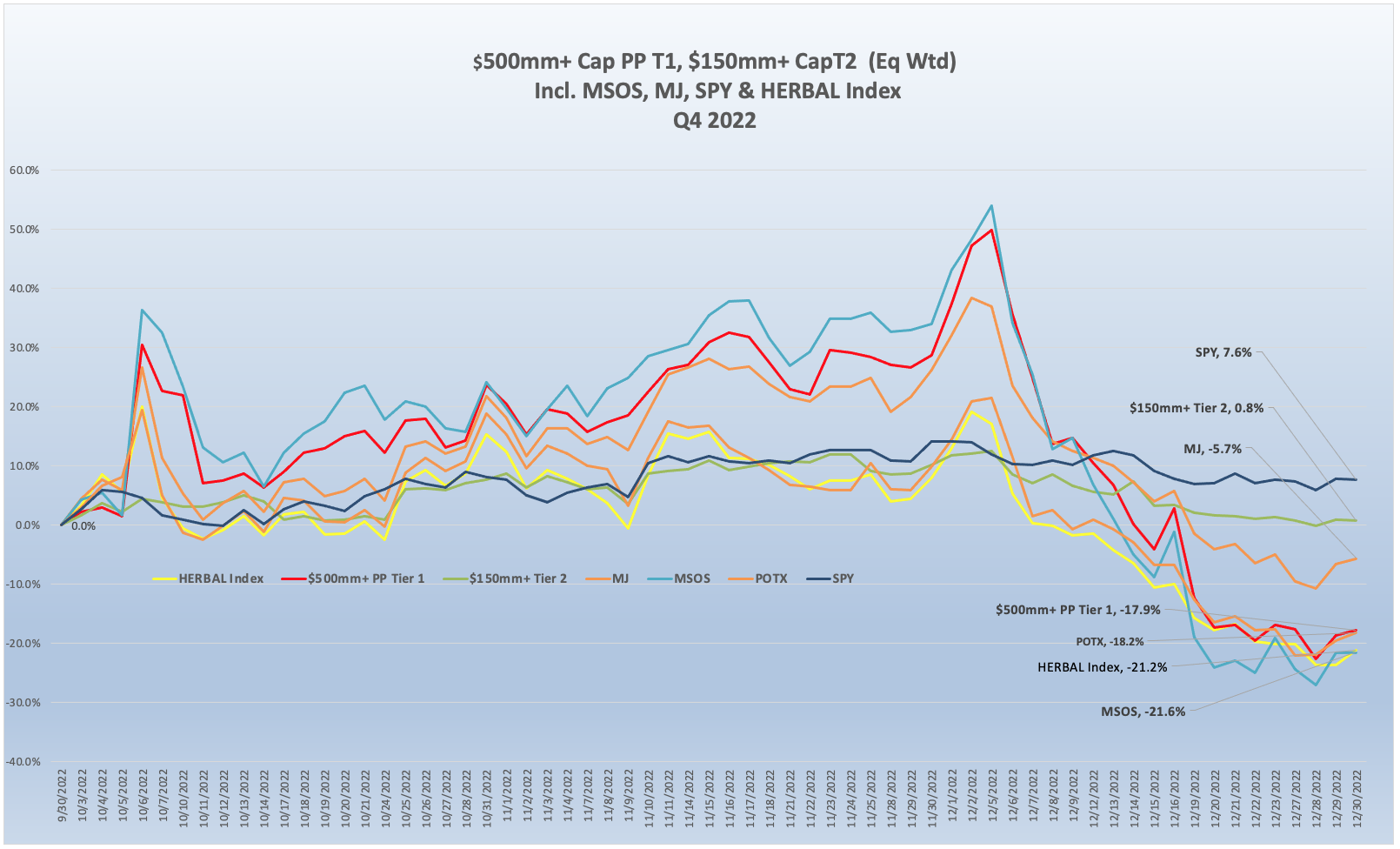

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play cannabis equities, HERBAL was down 21.2% for the 4th quarter of 2022. HERBAL’s performance was consistent with its closest competitor, the Global X Cannabis ETF (Nasdaq: POTX) (-18.2%). The ETFMG Alternative Harvest ETF (NYSE Arca: MJ) fared better (-5.7%) due in large part to the fund’s ~20% holding in non-pure play CRBs, which tend to have low correlation with Pure Play cannabis. The MSO-heavy Advisorshares Pure Us Cannabis ETF (NYSE: MSOS) lost 21.6% in Q4. The MSOS’s performance has a tendency to deviate (but not always) from both HERBAL and POTX largely due to its holdings of CRBs with US Marijuana touch-points, which dominate in that fund. [HERBAL and POTX cannot hold any securities with direct US touch points.] A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $500mm market cap lost 17.9% in Q4 2022. This basket is essentially a hybrid of the companies without US touchpoints and US multistate operators (MSO’s). Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap outperformed the Tier 1 basket, rising 0.2% for Q4. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high (0.8) correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. One lingering reality cannot be avoided, that for better or worse Tier 2 CRBs will eventually inherit the overall success or failure of the Tier 1 universe and there will ultimately be convergence of their return streams.

From the chart above, we can see that cannabis equities had a reasonably good run early in Q4, and why not? Right at the beginning of October, investors were treated to the best piece of news that they had gotten in a few years: that the President of the United States was finally weighing in on reforms. Investors and cannabis consumers took a collective exhale on October 6th, when President Joe Biden finally delivered the message that they all wanted to hear:

“As I often said during my campaign for President, no one should be in jail just for using or possessing marijuana. Sending people to prison for possessing marijuana has upended too many lives and incarcerated people for conduct that many states no longer prohibit. Criminal records for marijuana possession have also imposed needless barriers to employment, housing, and educational opportunities. And while white and Black and brown people use marijuana at similar rates, Black and brown people have been arrested, prosecuted, and convicted at disproportionate rates.” - President Joe Biden, October 6, 2022

We will recall that decriminalization of cannabis was a plank in the Biden/Harris platform back in 2019 when the democratic presidential campaign was launched. And we wrote about the impact on cannabis equities in more detail in our October 12th article, Biden’s Cannabis Pardons: What does it mean for Cannabis Equities?.

And as the results of the midterm elections played out, with the House of Representatives flipping to a narrow Republican majority, we watched as the President’s words wilted and eventually fell off the vine, as the last possibility for cannabis reform, the SAFE Banking Act, was unceremoniously removed from the omnibus spending package in December. Not coincidentally, that is when you see all the oxygen flow out of the cannabis market. With little optimism left for investors, cannabis equities went back into free-fall and finished the year with most of them having lost 60-70% of their value.

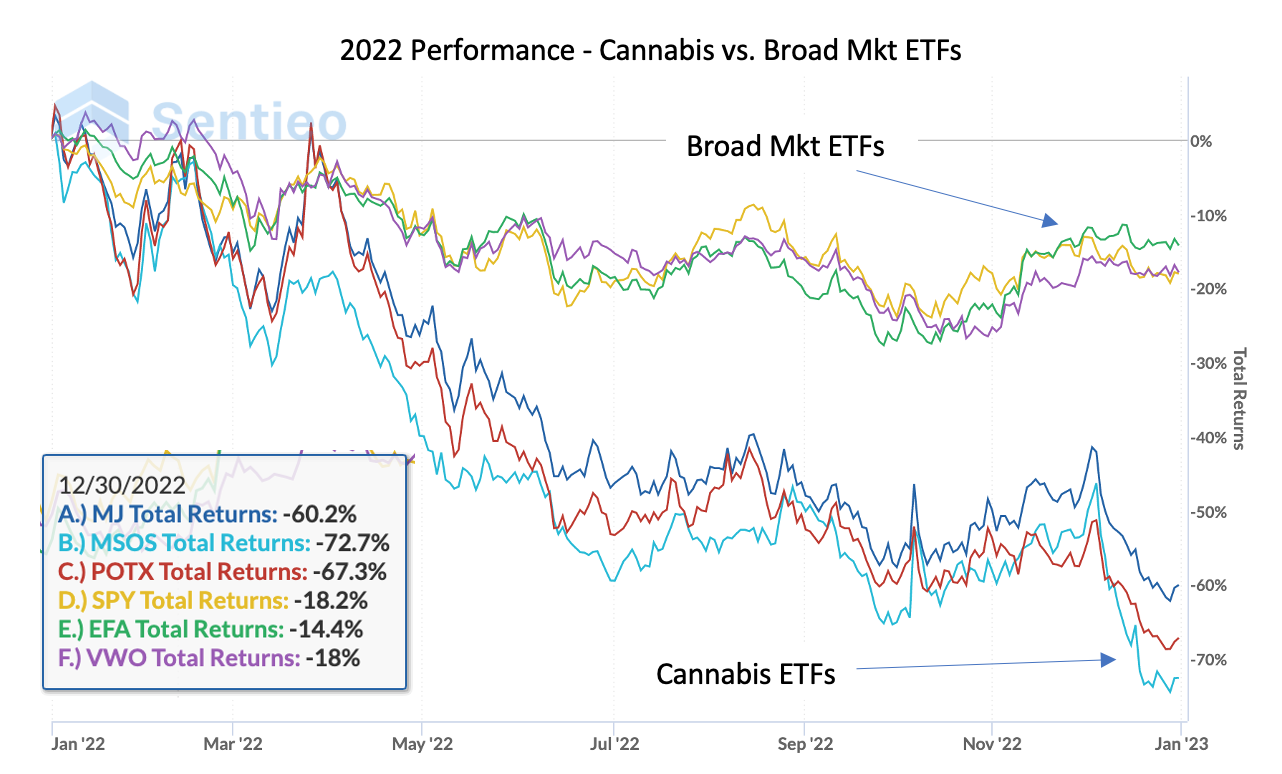

And because we would not feel like we were doing our duty unless we included a chart showing just how dramatic 2022 was for cannabis equities, here is what it looks like. And while 2022 was a challenge for all equities, cannabis faced something much more severe. In fact, the spread between broad equities and cannabis equities in 2022 was in excess of 50%. Should we call this the “legalization risk premium”? This chart also reminds us that the slow, painful crawl toward (and sometimes away from) legalization affects US plant-touching and non-US plant touching CRBs similarly.

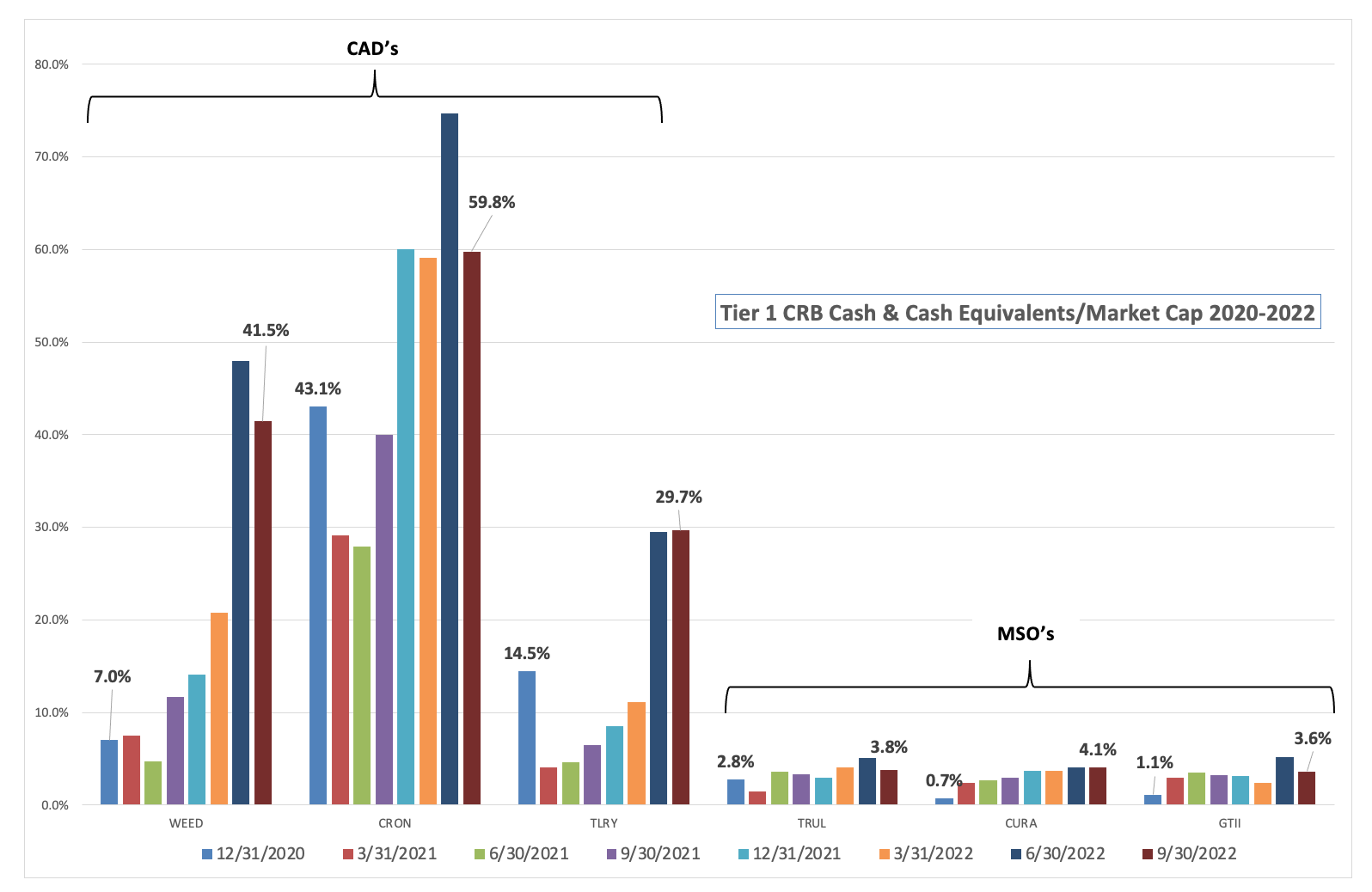

Chart of the Quarter: Cash & Cash Equivalents /Market Cap

The balance sheet item Cash & Cash Equivalents is a critical measure of a company’s health, given that these assets are an indication of security and sustainability. Cash also allows for the flexibility to acquire new subsidiary businesses as a cannabis company seeks to expand operations into new territories. Conversely, low cash and cash equivalents indicate a vulnerability to a downturn in business and the global economy, not to mention a stalling of federal cannabis legalization which we have seen. Looking at the trend of Cash & Cash Equivalents/Market Capitalization is an easy way for analysts to know when a company is in rough shape and possibly a target for acquisition, or possible bankruptcy.

The 2-year chart below shows this ratio over time for two groups of Tier 1 CRBs - the Canadian businesses (non US plant-touching) and the MSOs. It’s interesting to see the more defensive position (from 30% to 60%) of the larger Canadian CRBs, which is a reflection of the steep drop in share prices while cash positions on the balance sheets remained reasonably high.

Conversely, the MSO group has taken a leaner approach, carrying a more modest cash position relative to market cap over this period.

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

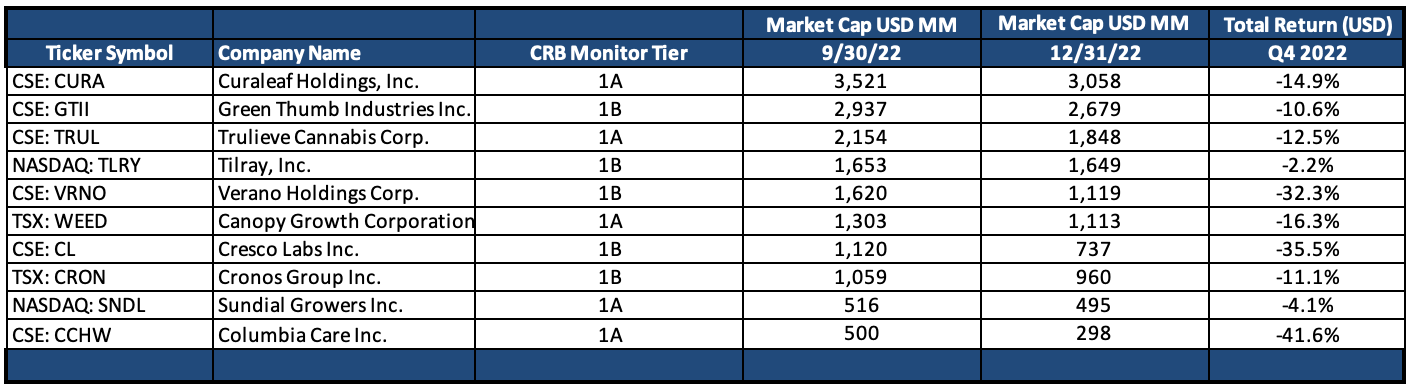

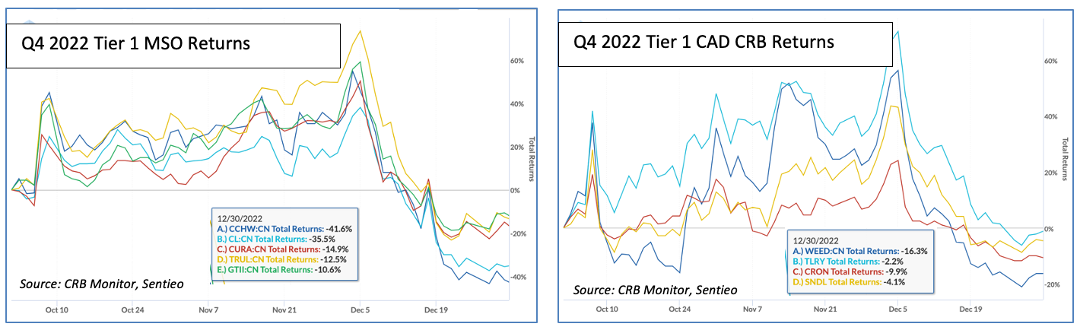

Tier 1 Pure Play CRBs w/Mkt Cap Over $500mm – Returns 4th Quarter 2022

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

There were essentially no bright spots in the publicly-traded Tier 1 CRB space when we talk about Q4 2022 performance. We are impressed with the investors that have hung on this long as cannabis equities and cannabis-themed funds have largely collapsed. With that said, we continue to cover this industry in earnest, and believe that those with strong stomachs are likely to get paid in the long term.

Looking at the MSO group, Green Thumb Industries Inc. (CSE: GTII) (-10.6%), Cresco Labs Inc. (CSE: CL) (-35.5%) and its pending subsidiary Columbia Care Inc. (NEO: CCHW) (-41.6%), Curaleaf Holdings, Inc. (CSE: CURA) (-14.9%), and Trulieve Cannabis Corp. (CSE: TRUL) (-12.5%) were all double-digit losers following a hopeful October and November.

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

The Canadian (non US plant-touching) operators struggled largely in similar fashion, with Tier 1 CRBs Tilray Brands, Inc. (Nasdaq: TLRY) (-2.2%), Cronos Group Inc. (TSX: CRON) (-11.1%), Canopy Growth Corporation (TSX: WEED) (-16.3%), and Sundial Growers, now called SNDL, Inc., (Nasdaq: SNDL) (-4.1%) finishing out a miserable year. As we have written, Canadian CRBs are also sensitive to the progress of US federal legislation as legalization would most likely result in their ability to sell cannabis to US operators.

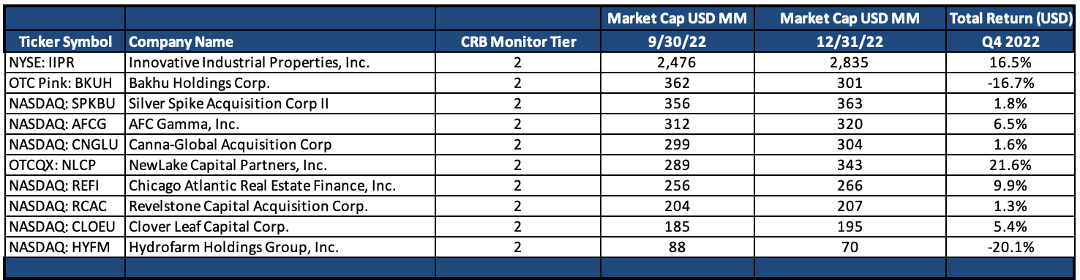

Tier 2 CRBs w/Mkt Cap Over $150mm – Returns 4th Quarter 2022

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies was largely flat for the second quarter of 2022, which outperformed the equally-weighted Tier 1 basket by about 17%. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” We write about IIPR frequently, largely due to the fact that its stock has historically defied the volatile price patterns of the cannabis space as it has, until recently, consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization. IIPR’s stock price rebounded in Q4 2022, returning 16.5% and outperforming all non-SPAC CRBs in the basket. Its dependency on the success of US operators causes IIPR to either live or die based on, among other things, US legalization. This rebound could be considered a “dead cat bounce” given its 2022 return of -55.8%.

Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM, CLS Sector Agricultural & Farm Machinery) (-20.1%). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR (in fact, much worse), HYFM has been in a free fall in 2022, posting a return of -94%. That’s not a typo. In a December 8th article on the website SeekingAlpha.com, author Manuel Paul Dipold describes HYFM’s dire situation as follows:

“From my point of view, Hydrofarm (NASDAQ:HYFM) is in a catastrophic situation, and I think the stock market is about to price in the risk of bankruptcy. The debts are high; interest payments are rising sharply. Cash flow is negative and will remain so for at least another two years. Even the issuance of new shares would flush very little money into the coffers due to the low share price, and they do not even have as much cash left as they burned in the last quarter alone.”

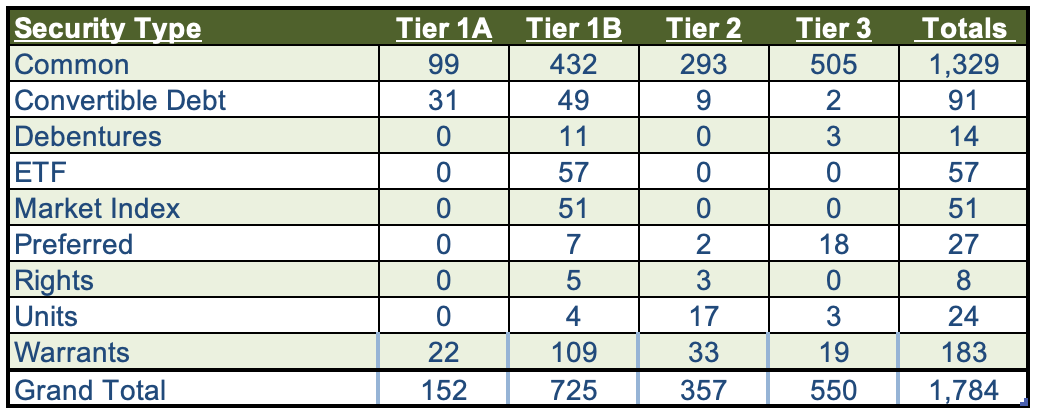

CRB Monitor Securities Database

As of December 31, 2022, the breakdown of publicly-traded, cannabis-linked securities was as follows:

Source: CRB Monitor

Source: CRB Monitor

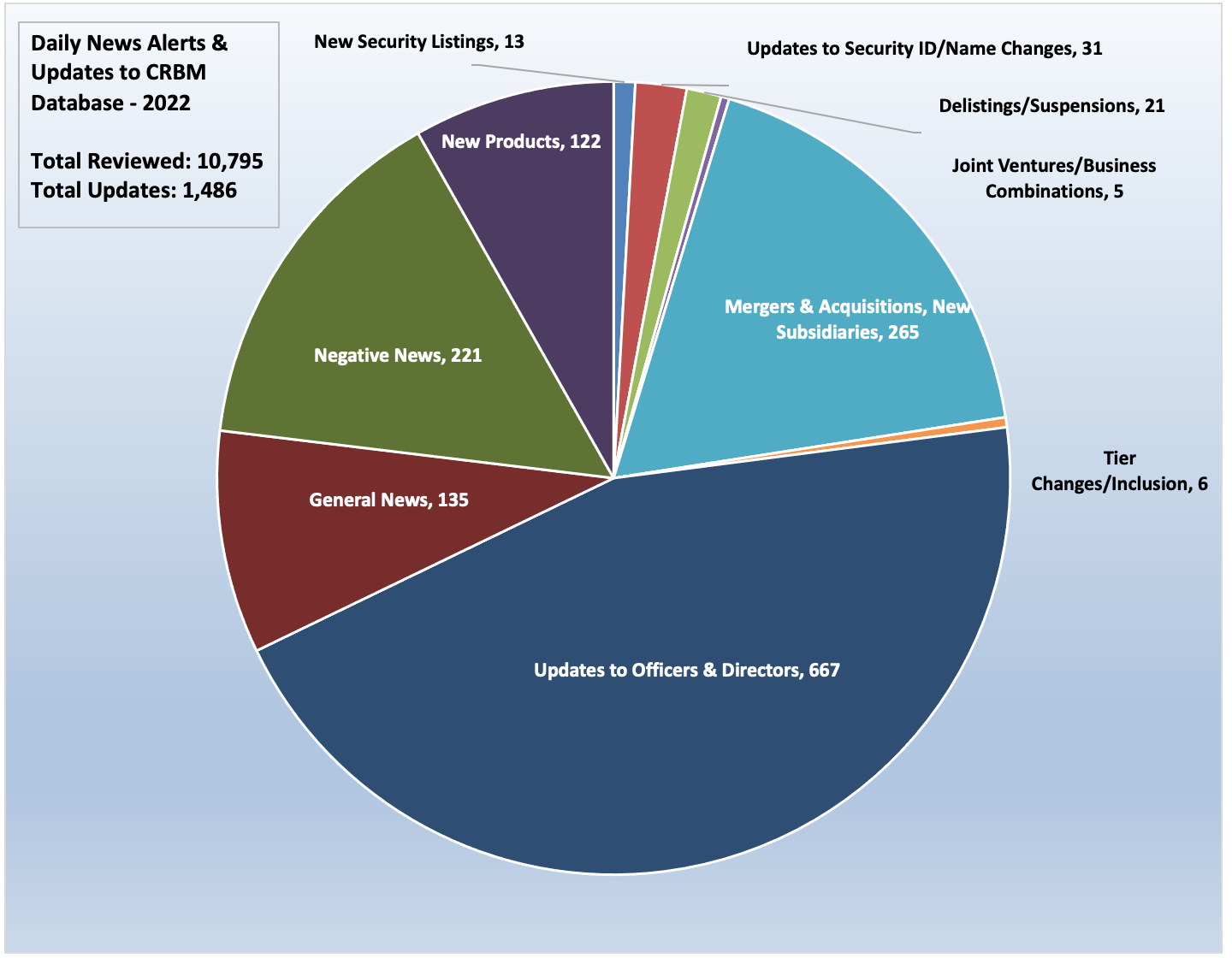

2022 was a busy year for daily updates to CRB Monitor. Of the thousands of announcements and filings reviewed during the full year, our daily research resulted in a total of 2,494 updates to the CRB Monitor database (1,008 updates to issuers’ records, 1,486 news releases added). The complete list of securities and detailed profiles for more than 1,350 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor October 2022 newsletter, CRB Monitor November 2022 newsletter, and the CRB Monitor December 2022 newsletter.

CRB Monitor Securities Database Updates – Q3 2022

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News

We closely tracked the cannabis news cycle throughout the Fourth Quarter of 2022, making hundreds of updates to the CRB Monitor database related to all types of relevant corporate activity. Cannabis equities were challenged throughout Q4 2022, and we were there, standing by to capture all the critical information necessary to maintain the world’s best cannabis-linked securities database. The following is a sampling of some of the highlights from the Q4 cannabis news cycle.

In October, Tier 1A CRB Canopy Growth Corporation (TSX: WEED) made the news once again following their blockbuster announcement in September that they had entered into agreements to divest its retail business across Canada, which includes the stores operating under the Tweed and Tokyo Smoke retail banners. Then in October, Canopy Growth turned heads once again with its announcement that it has entered into an arrangement with Acreage Holdings, Inc. (OTCQX: ACRDF) whereby Canopy USA will acquire all of the issued and outstanding Floating Shares by way of a court-approved plan of arrangement for consideration of 0.4500 of a common share of Canopy in exchange for each Floating Share. Here’s the key part of the deal:

“Upon exercise of the Fixed Option and completion of the Floating Share Arrangement, Canopy USA will own 100% of all outstanding Fixed Shares and Floating Shares. Pursuant to a press release issued today, Canopy announced that, on exercising of the Fixed Option and closing of the Floating Share Arrangement, options to acquire 100% of the membership interests of Mountain High Products, LLC, Wana Wellness, LLC, and The Cima Group, LLC (together, “Wana”) and 100% of the shares of Lemurian, Inc. (“Jetty”), which are or will be held directly or indirectly by Canopy USA, will be exercised, and Canopy USA is expected to retain its conditional ownership position in TerrAscend Corp. (CSE: TER, OTCQX: TRSSF).”

Also in October, Canadian Tier 1B CRB The Green Organic Dutchman Holdings Ltd. (TSX: TGOD) announced its merger with Tier 1A private business BZAM Cannabis. In an October press release, TGOD outlined the highlights of the deal:

- Creates sixth largest Canadian Licensed Producer(1) with right sized facilities in the largest provinces and a complete portfolio of popular products and brands(2)(3)(5)

- TGOD's market strength in Quebec and Ontario complements BZAM's strength in western Canada markets, with opportunities to expand distribution

- Combined entity forecasts net revenue of at least $100 million for calendar year 2023 and adjusted EBITDA positive by mid 2023(2)(3)(4)

- Expected annualized savings of at least $10 million in COGS and SG&A through rationalization and economies of scale(2)(3)(4)

- Addition of BZAM materially strengthens TGOD's financial position including improved debt ratios

- Combined entity will be led by experienced leadership team with track record in execution and disciplined cost management

TGOD’s share price had been falling over its entire history and was trading at just $0.07 on 10/31/22, suggesting that this merger was not only timely, but essential for their survival going forward.

In November, Tier 1B MSO and cannabis superpower Cresco Labs Inc. (CSE: CL) and its future subsidiary business Columbia Care Inc. (CSE: CCHW) announced the signing of definitive agreements to divest certain New York, Illinois, and Massachusetts assets to an entity owned and controlled by Sean “Diddy” Combs. According to the November 9th press release, “The divestiture of the Assets is required for Cresco to close its previously announced acquisition of Columbia Care. The Transaction is expected to close concurrently with the closing of the Columbia Care Acquisition. Total consideration for the Transaction is an amount up to US$185,000,000.”

The press release goes on to say, “The Transaction is Combs’ first investment in cannabis, the fastest growing industry in the U.S., and upon closing, will create the country’s first minority-owned and operated, vertically integrated multi-state operator. This industry-changing transaction is rooted in Cresco’s vision to develop the most responsible, respectable and robust industry possible, and advances Combs’ mission to open new doors in emerging industries for Black entrepreneurs and other diverse founders who are underrepresented and underserved.”

And in December, in an M&A deal that was one of only a few in the last 18 months, Tier 1 CRB MediPharm Labs Corp. (TSX: LABS) announced in December that MediPharm and Tier 1B VIVO Cannabis Inc. (TSX: VIVO) have entered into a definitive arrangement agreement (the "Arrangement Agreement") whereby MediPharm has agreed to acquire VIVO in an all-equity business combination transaction (the "Transaction"). The Transaction is expected to combine two highly complementary businesses, creating a unique and market differentiating international medical cannabis leader. Upon the completion of the Transaction, existing MediPharm shareholders are expected to own between 65% and 79% of the combined company resulting from the Transaction (the "Combined Company") and VIVO shareholders are expected to own between 35% and 21% of the Combined Company.

Cannabis-Related Regulatory Updates

In October, As we reported in early October on CRBMonitor.com, President Joe Biden announced his intention to pardon thousands of people who have been convicted by the federal government of marijuana possession. This represented the first concrete announcement from the Biden administration regarding cannabis legalization and it was well-received by the market. As we wrote earlier in this newsletter, cannabis equities rallied on the news, which hit the tape on October 6th and continued to perform well for the rest of the month. Biden’s announcement not only called for the expulsion of federal cannabis-related convictions but also the de-scheduling of THC on the DEA’s schedule 1 narcotics list.

Additionally, Biden called for governors in states who have not yet decriminalized marijuana possession to do so. “Just as no one should be in a Federal prison solely due to the possession of marijuana, no one should be in a local jail or state prison for that reason, either.”

In November, Kyle Jaeger published a story in Marijuana Moment about a federal agency that is proposing to replace a series of job application forms for prospective workers in a way that would treat past marijuana use much more leniently than under current policy. According to the article, “The Office of Personnel Management (OPM) first announced in a Federal Register notice last week that it was proposing the changes, which are currently open to public comment for a two-month period, partly because of “changing societal norms” amid the state-level legalization movement and to widen the applicant pool for qualified federal workers.”

The article goes on to say: “The draft Personnel Vetting Questionnaire (PVQ) would replace the current SF85, SF85P, SF 85P-S and SF86 forms, which each cover positions of varying levels of sensitivity and security. Those forms require applicants to disclose use of illicit drugs by checking them off on a list.”

Also in November, MJ Biz Daily reported in mid-November that Missouri (yes, Missouri) could begin recreational marijuana sales in early February or even sooner, according to a spokesperson for the state. Under Missouri’s new constitutional amendment legalizing recreational cannabis – approved by the voters on November 8th, existing medical marijuana companies can apply on Dec. 8 to switch their business to adult use.

According to the report, “Under the law, the state must take action on the applications within 60 days, which would be Feb. 6. However, Lisa Cox, spokesperson for Missouri’s health department, told the Post-Dispatch that the state expects to convert licenses before that deadline – as soon as the agency has rules in place.”

Finally, in December it was reported in High Times and other sources that local lawmakers in Washington, D.C. approved a bill to expand medical marijuana sales, giving the city’s unlicensed cannabis “gifting shops” a path to the regulated market. According to the article, the bill, which was approved by the D.C. district council on December 20, comes after Congress included an existing prohibition on regulated adult-use cannabis sales in the nation’s capital as part of the National Defense Authorization Act (NDAA).

The bill, called B24-0113 - Medical Cannabis Amendment Act of 2021, “would allow qualifying patients to obtain their medical cannabis and medical cannabis products from any dispensary registered in the District. Dispensaries would operate safe use treatment facilities as well as offer tastings and demonstrations and/or classes with the proper endorsements. It would allow delivery and curbside pickup services by dispensaries. It eliminates the count on the number of plants that a cultivation center can grow and increases the number of permitted dispensaries in the District. Among other things it removes certain prohibitions against returning citizens ability to take part in the medical marijuana industry.”

In the words of the High Times article, “Half of the new licenses will be reserved for social equity applicants, which are defined as D.C. residents who have a low income, have spent time in prison, or are related to someone who was incarcerated for a cannabis or drug-related offense.”

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"