CRB Monitor Chart of the Month: MSO Business Trends

James B. Francis, CFA, Chief Research Officer, CRB Monitor

Kyle Buckley, Senior Analyst, CRB Monitor

Multistate operators (MSOs) are CRBs that spread their revenue-generating, licensed cannabis operations (cultivation, manufacturing, distribution, etc.) across two or more states in the US. This model for doing business can be complicated and painful, but CRBs’ hands are tied while cannabis is still federally illegal and operating on a state-by-state basis (and internal to each state) is the only way to grow revenues within the US.

As such, MSOs face obstacles that can limit their ability to operate profitably in every state where they are licensed. Some notable hurdles include:

- Licensing requirements that seek to establish or restore social equity to CRB ownership

- Varying levels of state taxation

- Barriers to using mainstream banking services, such as payments, lending, and deposit accounts

- Varying degrees of participation by the illicit market which undermine the legal market

And so given these (and other) headwinds, several large, publicly-traded multistate operators have closed their operations in one or more states. And we thought it might be interesting to take a look at this trend in the cannabis industry as it could be a reflection of companies’ need to survive while the politicians figure things out.

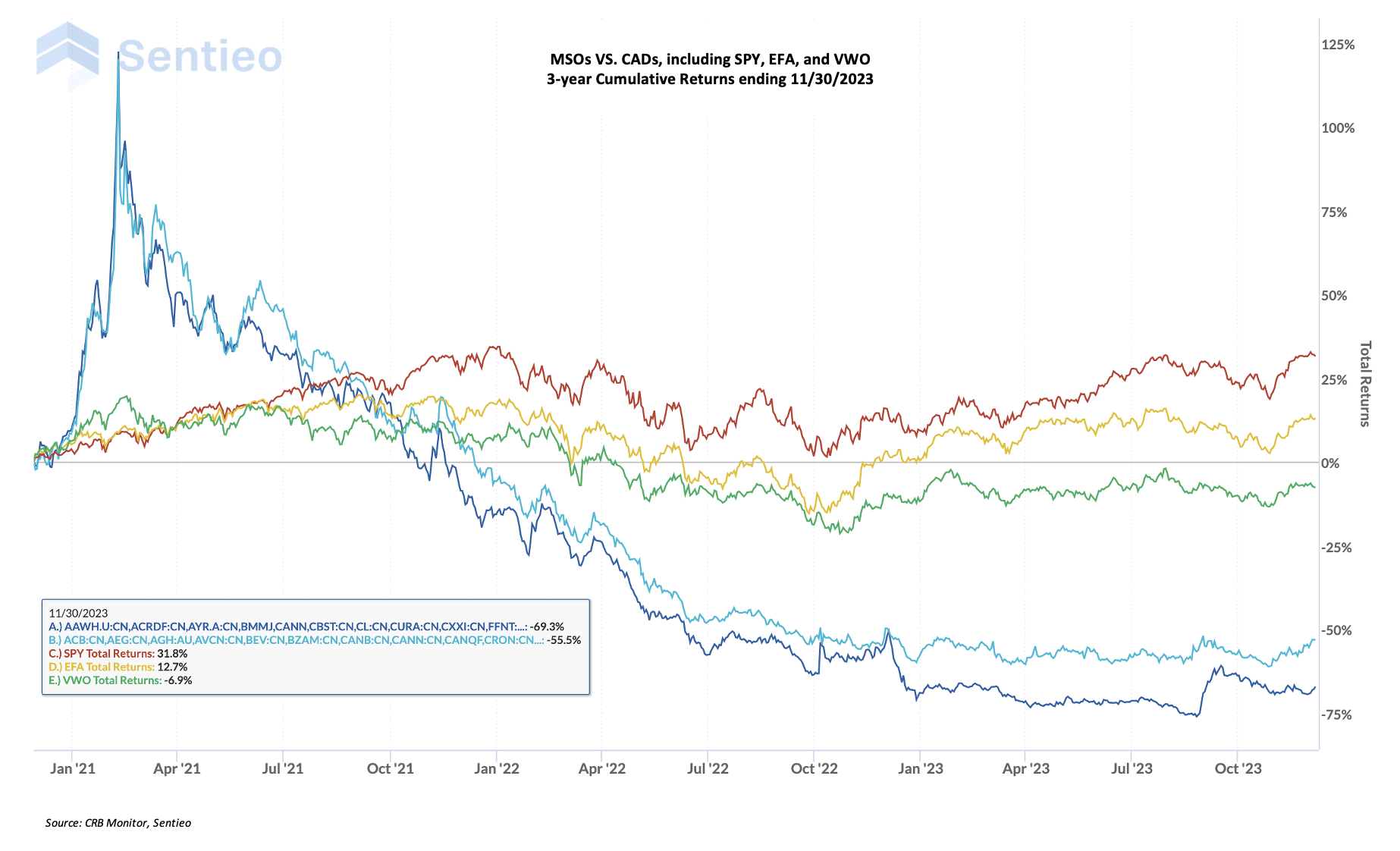

But first, and to provide some context, let’s take a look at market performance. It is an understatement to say that cannabis-related equities have been in a free fall for the better part of the last 3 years (see chart below).

The two lines at the bottom of this chart represent the performance of a basket of the largest 30 MSOs (dark blue) and the largest 30 Canadian-based CRBs (light blue). The remaining three series represent the performance of SPY (S&P 500 ETF), EFA (MSCI International ETF), and VWO (Vanguard Emerging Markets ETF). Not only have the cannabis baskets spent most of the last 3 years in a downward spiral, they are largely uncorrelated with the other broad market equity indexes.

Interestingly, the two equally-weighted CRB baskets were largely in lock-step until Q4 2022, when they started to diverge, with MSOs underperforming the CADs. Why the bottom fell out for MSOs can be traced to the progress, or lack thereof, of cannabis reforms by our leaders in the US Congress. It could be inferred from the data that the MSO group has taken a significant hit (following a major bubble) as our congressional leaders have dragged their feet; and whether or not the damage is reversable is anyone’s guess.

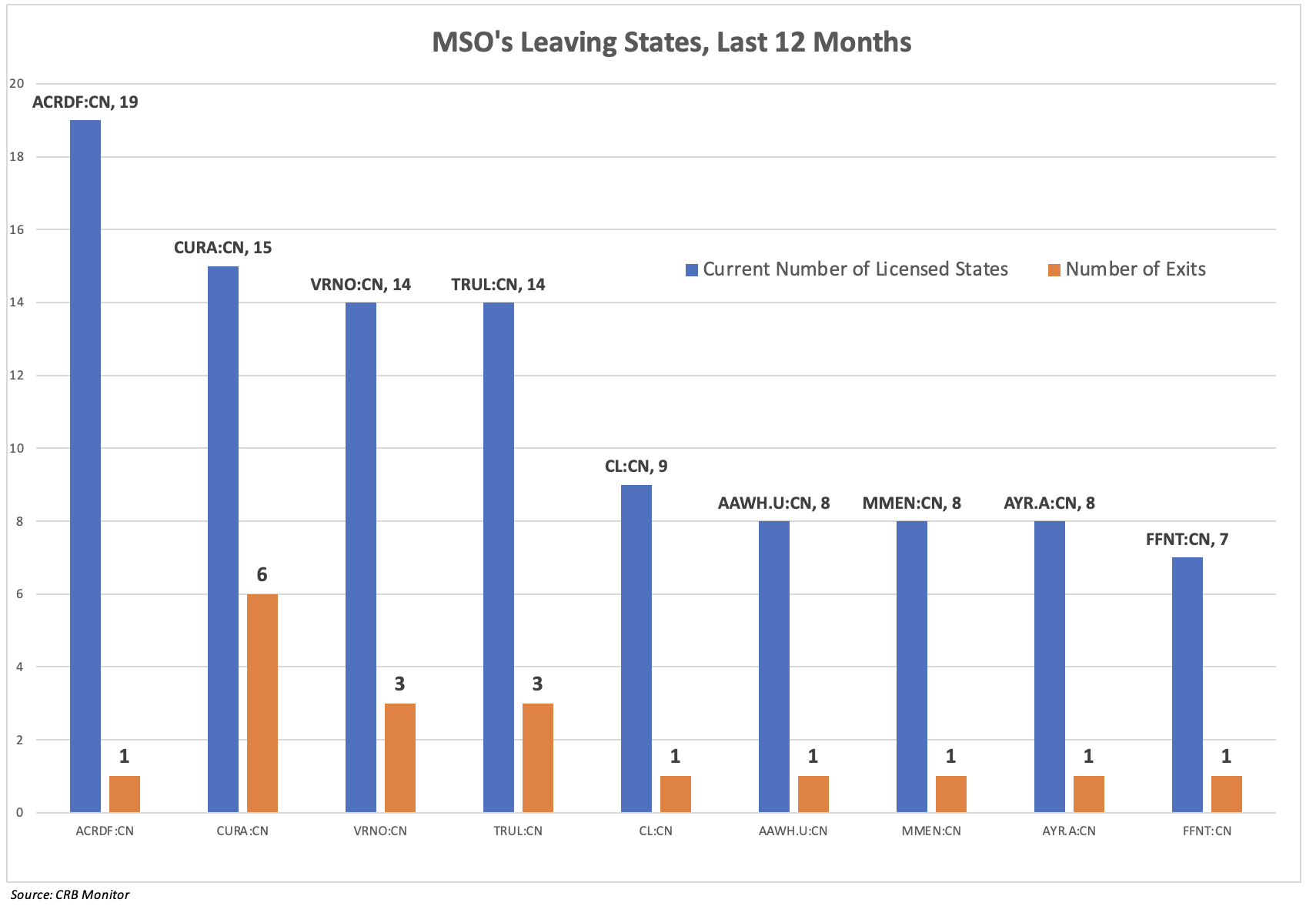

On that note, over the last year the MSO group has been forced into playing defense, and that is where CRB monitor’s research kicks in. What has interested us is the trend of the largest MSOs packing up and moving operations out of a number of states over the last 12 months and the data is eye-opening.

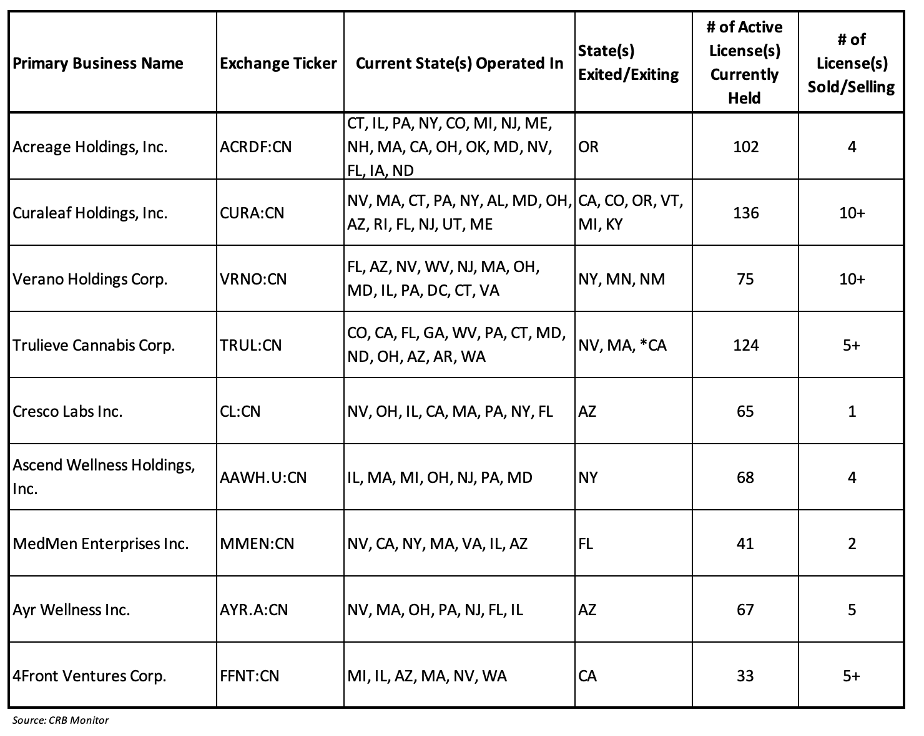

The above chart represents an interesting trend for nine of the largest CRBs which recently “picked up their ball and went home,” selling licensed operations in states where they had moved in not long ago. [We have provided more detail at the company level in the table below]. The process of moving into a state is complex and expensive, as an operator must secure one or more licenses from a state authority while navigating the twists and turns of doing business in local municipalities that have mixed levels of acceptance among residents.

*Trulieve closed three dispensary locations in California; however, one still remains active.

*Trulieve closed three dispensary locations in California; however, one still remains active.

One significant example of this phenomenon is Tier 1A Curaleaf Holdings, Inc. (CSE: CURA), an MSO that has unwound operations in 6 states in the last 12 months. During 2023, Curaleaf Holdings, Inc. concluded its operations in multiple states including California, Colorado, Oregon, Vermont and Michigan. The company exited production and cultivation facilities in California, Colorado and Oregon and sold two dispensary locations and a cultivation/manufacturing facility in Vermont. Additionally, the Curaleaf announced it has exited operations in Michigan and Kentucky. Per Curaleaf's Chairman: "Throughout 2023, the company’s been focused on improving efficiency metrics and dialing in operations to maximize its existing base."

Another Tier 1 MSO that has made its exit from multiple states is perennial acquirer and Tier 1B CRB Verano Holdings Corp. (CSE: VRNO). In Q1 2022, Verano Holdings Corp. entered into an agreement to acquire publicly-traded Tier 1B CRB "Goodness Growth Holdings Inc." Through this acquisition, Verano would have entered the states of New York, Minnesota and New Mexico. Goodness Growth, a Tier 1A private CRB, operates multiple cultivation facilities and dispensary locations across these three states. Goodness Growth also operates a manufacturing and processing facility in New York. However, in Q4 2022 Verano terminated this agreement. Per Verano's CEO: "We believe the decision to terminate this arrangement agreement was in the best interest of Verano and our shareholders."

A third Tier 1 MSO that has backed out of several states is Trulieve Cannabis Corp. (CSE: TRUL). In late Q2 2023, Trulieve announced its plans to wind down cannabis operations in Massachusetts and Nevada. At that time, Trulieve also announced the consolidation (not a total exit) of its California operations with the closure of select retail assets in Palm Springs and Venice.* Trulieve exited the Nevada wholesale market and expects to cease Massachusetts operations by the end of 2023. Per Trulieve's CEO: "These difficult but necessary measures are part of ongoing efforts to bolster business resilience and our commitment to cash preservation as we continue to focus on our business strategy of going deep in our core markets and jettisoning non-contributive assets."

The last 12 months have been a challenge for both the cannabis industry and its investors. With DEA re-scheduling, SAFER Banking, and legalization all in a holding pattern of sorts, CRBs have had to make difficult choices as they look to the future. And although this analysis might look a bit tame, we identified nine cannabis-related businesses that are effectively moving operations out of 14 different states. We will continue to report on this as the story unfolds.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"