CRB Monitor Chart of the Month: Psychedelics-related Businesses (PRBs)

James B. Francis, CFA

Chief Research Officer, CRB Monitor

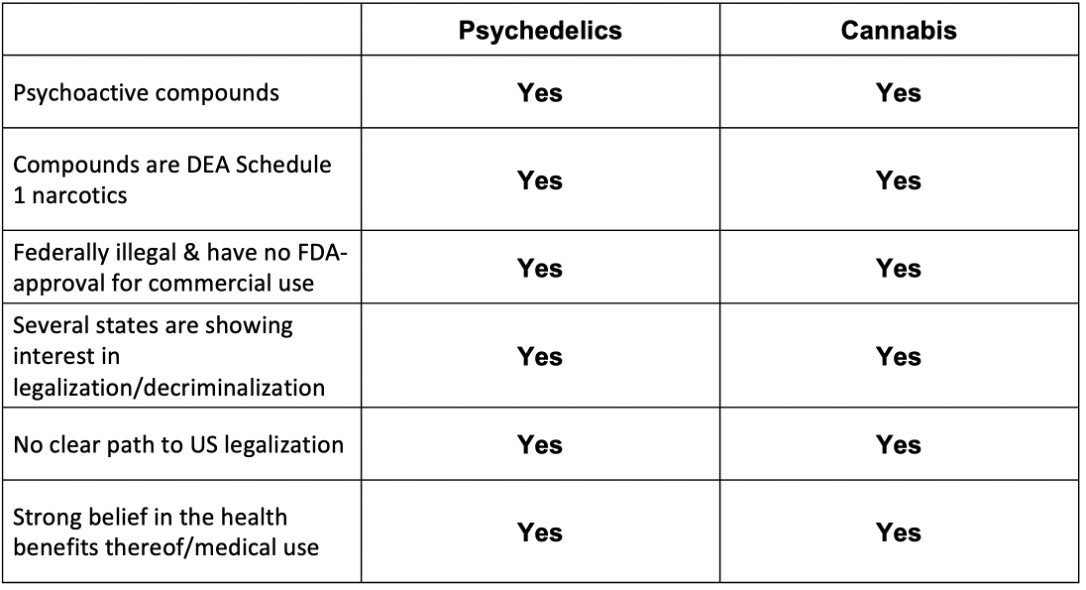

CRB Monitor initiated coverage of psychedelics-related businesses (PRBs) in early 2022. We consider this industry to be early-stage, and it bears a striking resemblance to the beginnings of the cannabis industry. Looking at comparative table below, it is easy to see why PRBs are a natural fit for CRB Monitor’s securities research, and why institutions are starting to pay attention to them:

Source: CRB Monitor, https://www.dea.gov/drug-information/drug-scheduling, https://www.greenstate.com/explained/where-are-psychadelics-legal-in-the-us/

Source: CRB Monitor, https://www.dea.gov/drug-information/drug-scheduling, https://www.greenstate.com/explained/where-are-psychadelics-legal-in-the-us/

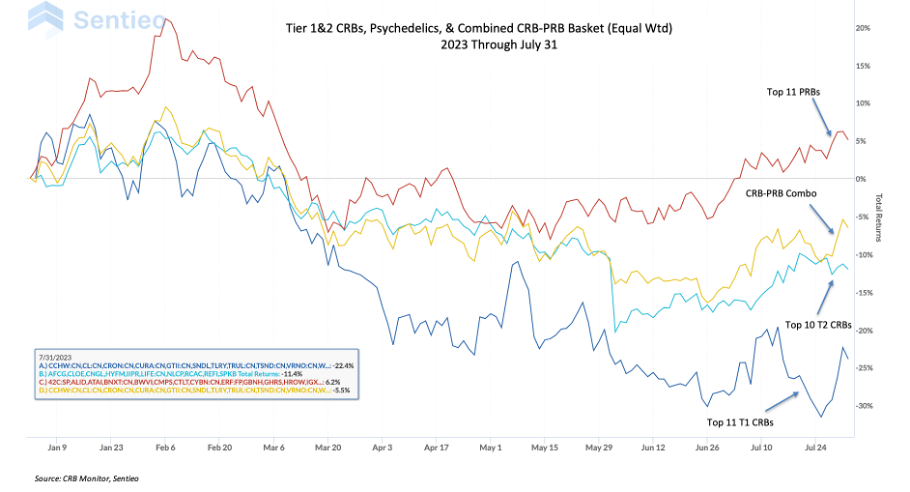

We took a look at year-to-date performance of 4 equity baskets (all pure play, all equally-weighted): 1) Top 11 PRBs, 2) Top 11 Tier 1 CRBs, 3) Top 10 Tier 2 CRBs, 4) PRB/CRB combination.

In terms of equity returns for these two themes, it is important to note that the current supply of investable PRBs is relatively small. While CRB Monitor has identified more than 200 publicly-listed companies in the psychedelics space, there is a significant drop-off in liquidity after the largest handful of companies in the basket. With that said, information can be gleaned from the chart below. What you are looking at is 2023 year-to-date performance for four baskets of equities, all equally-weighted and pure play: 1) the “Top 11 Tier 1 CRBs” and 2) “Top 10 Tier 2 CRBs” from our monthly analysis; plus 3) the Top 11 PRBs by market cap, and 4) a combined CRB/PRB basket, that includes both Tier 1 and Tier 2 CRBS and PRBs:

Not surprisingly, the CRB basket, in spite of the recent July rebound, is under water in 2023 (-22%), as is the Tier 2 basket (albeit to a lesser extent, -11%). The PRB basket (+6%) has been performing well over the last few months which could be a reflection of recent positive news regarding psychedelic therapy as a viable treatment for a range of mental health issues, as presented in this article from the Sacramento Bee.

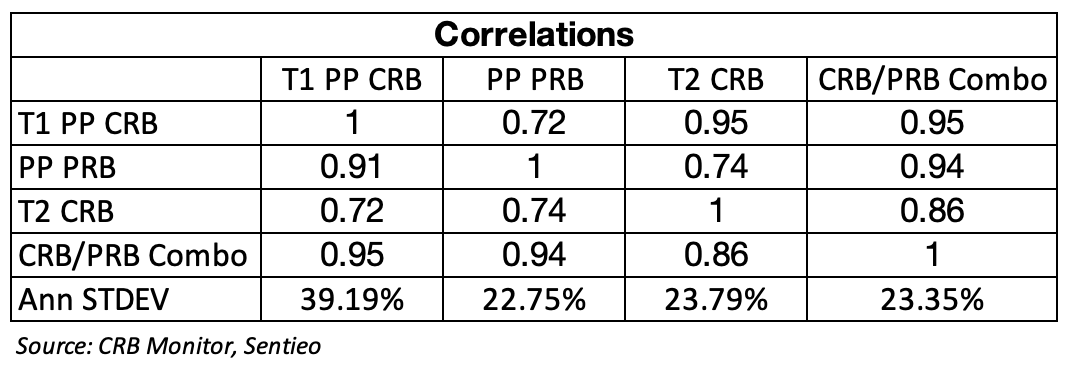

Looking at the table below we see that PRBs are not as highly correlated to CRBs as we might expect, which is a good thing as we are looking for this basket to serve as a diversifier while enhancing returns. PRBs also exhibited a lower standard deviation relative to CRBs for this time period and we will reserve judgement until we view the results over longer periods going forward. With that said, the numbers are encouraging.

Given the short time period of this analysis we will take these results with a grain of salt, but as an investment, psychedelics have held their own (while cannabis has struggled) and the combined portfolio diversifies much of the risk of the CRB component while delivering a return that outperforms both CRB baskets. And we are encouraged by the growth in this nascent industry, which shows us that interest in psychedelics as an investment, as well as an area of risk for compliance officers, are here to stay.

CRB Monitor is a comprehensive, global database of over 1,700 listed cannabis-related securities, 75,000 private cannabis-related businesses, 201,000 cannabis licenses, and 133,000 individuals with connections to the cannabis space. Our goal is to provide our clients with 100% of the private and publicly-traded global cannabis ecosystem and our subscribers include many of the largest financial institutions worldwide.

We have recently added to our coverage more than 200 psychedelics-related securities and more than 1,400 digital asset-related securities.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"