James B. Francis, CFA

Chief Research Officer, CRB Monitor

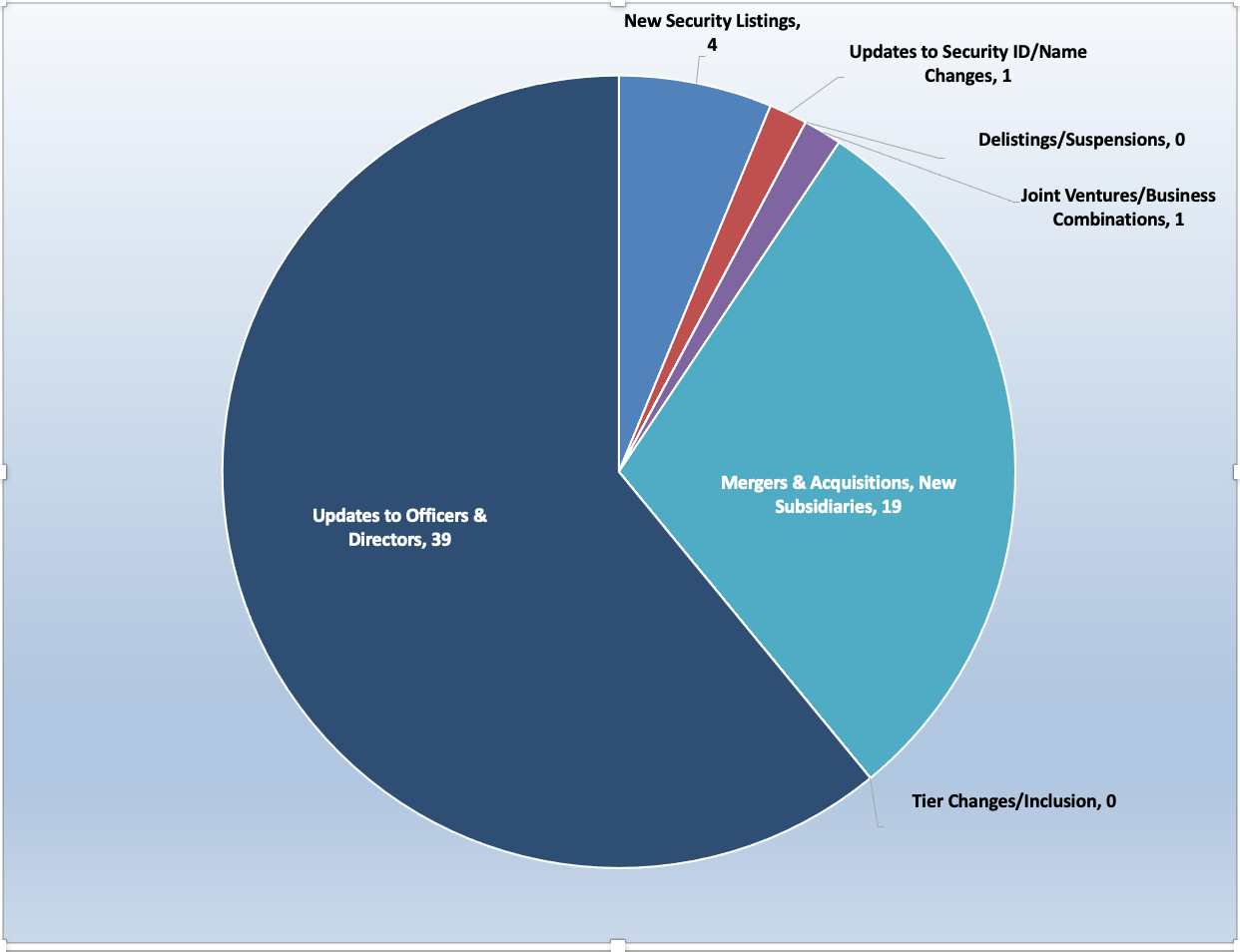

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for February 2022:

Source: CRB Monitor

News Flash: March 2022 Database Enhancements

CRB Monitor is pleased to announce the following securities database enhancements, expected to go into effect prior to *March 31, 2022:

- “Pure Play” tag: Primarily for Tier 1 CRBs, a “Pure Play” CRB earns, or intends to earn more than 50% of its total revenue from its participation in the cannabis industry. [By definition, all Tier 2 CRBs are “Pure Play” and all Tier 3 CRBs are “non-Pure Play”.]

- Dividend tag: For Tier 1 and Tier 2 securities, we are adding a “Y” to the security profile if the issuer currently pays a dividend and an “N” if it does not.

- “Pre-IPO” security status. For Tier 1 and Tier 2 CRBs, we will be adding cannabis-related businesses to the CRB Monitor database prior to their initial public offerings with the status “Pre-IPO”.

*We will send out a notification to all CRB Monitor Securities Database clients with the effective date for these enhancements.

Cannabis News: M&A Activity (JF Update)

We continue our close watch on the cannabis news cycle, and just as we’ve been reporting for many monthly newsletters, February was another busy month for corporate activity. Here are some of the highlights:

Early in the month of February, Tier 1 MSO Verano Holdings Corp. ( CSE: VRNO) announced its proposal to acquire Tier 1A Goodness Growth Holdings, Inc. (CSE: GDNS), which would expand Verano’s operational footprint into New York, Minnesota, and New Mexico. According to the February 1st announcement:

“Upon consummation of the acquisition, Verano’s footprint will span 18 states, with active operations in 15, including 17 cultivation facilities totaling 1.3 million square feet of cultivation capacity and 111 active dispensaries.” The press release goes on to make the prediction that “Between 2022 and 2026, these net new markets are expected to generate combined revenue of more than $13.8B.”

Also in February, Tier 1B Creso Pharma Ltd. (ASX: CPH), an Australia-based company engaged in developing cannabis and hemp-derived, therapeutic-grade Nutraceuticals and Medical Cannabis products, announced that it has entered the US CBD market, with its acquisition of a Colorado based consumer packaged goods company, Sierra Sage Herbs, LLC. According to the press release, “The acquisition provides Creso

Pharma with its maiden entry into the US, an established product suite of plant-based and CBD products generating strong revenues, as well as an existing 90,000 points of sale with major retailers and over 150,000 direct to consumer relationships in one of the world’s largest and fastest growing markets.”

Tier 1A CRB Medicine Man Technologies, Inc. aka Schwazze (OTCQX: SHWZ) announced in February that it has closed the transaction to acquire substantially all the operating assets of Reynold Greenleaf & Associates, LLC, and the equity of Elemental Kitchen & Laboratories, LLC. According to the company’s press release, “Greenleaf is a licensed medical cannabis provider with ten dispensaries, four cultivation facilities – three operating and one in development – and one manufacturing location. The dispensaries are located in Albuquerque, Santa Fe, Roswell, Las Cruces, Grants and Las Vegas, New Mexico. Greenleaf's approximately 70,000 square feet of cultivation as well as 6,000 square feet of manufacturing space are located in Albuquerque.” Medicine Man currently holds 55 active licenses to operate in 5 states.

Ayr Wellness Inc. (CSE: AYR.A), a vertically-integrated Tier 1B U.S. multi-state cannabis operator, announced that it closed the acquisition of Cultivauna, LLC, the owner of Levia-branded cannabis-infused seltzers and water-soluble tinctures. According to the press release, “Levia uses a proprietary technology which provides for rapid onset of the effects of THC, typically 15-20 minutes with lasting effects up to 3 hours, allowing for a more consistent consumption experience compared to many edible products.” Currently Ayr operates in 9 states and through its subsidiaries, holds 69 licenses that are either in active status or are pending approval.

And finally, in February, Billerica, MA Tier 1A Agrify Corporation (NASDAQ: AGFY), announced that it has acquired Lab Society, a leader in distillation and solvent separation solutions for the cannabis extraction industry. Agrify is known as a developer of premium grow solutions for the indoor agriculture marketplace but it also holds a license from the state of Massachusetts for the cultivation and production of industrial hemp. This is what earned Agrify it’s Tier 1A status. According to the press release, “As we continue to learn more about the complex chemical composition of cannabis, the need for distillation solutions is clear. Distillation enables the identification, isolation, and separation of valuable cannabis metabolites. The ability to take cannabis compounds distilled into their pure forms, and then recombine them into specific, purposeful end-products could have significant potential for the pharmaceutical industry in the future.”

Select M&A/New Subsidiary Highlights:

|

Company Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1B |

|||

|

Tier 1A |

|||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1A |

Columbia Care Opens First Cannabist Dispensary in West Virginia |

||

|

Tier 1B |

Lobe Sciences Ltd. Acquires Securities of Ionic Brands Corp. |

||

|

Tier 1A |

|||

|

Tier 1B |

Red White & Bloom Closes Acquisition of PharmaCo with 21 Cannabis Licenses |

||

|

Tier 1B |

Ayr Wellness Closes Acquisition of Levia Cannabis Infused Seltzer |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

New Listing |

|||

|

ID/Name Change |

Canbud Distribution Corp. Announces Name Change to "Steep Hill Inc." |

||

|

New Listing |

|||

|

New Listing |

|||

|

New Listing |

Incannex Completes Listing of American Depositary Shares on Nasdaq; Rings Nasdaq Closing Bell |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Cannabis Sector (CLS) |

|

Tier 3 |

Food, Beverage & Tobacco |

||

|

Tier 2 |

SPAC |

||

|

Tier 3 |

Professional Services |

||

|

Tier 2 |

SPAC |

||

|

Tier 1B |

Owner/Investor |

Cannabis News: Regulatory Updates

Federal Legislators have had their hands full this year, contending with a deep partisan divide that constantly threatens to stall the process of lawmaking. And now they are recently dealing with the implications of Russia’s invasion of Ukraine, as well as the threat of sustained and significant global inflation. With midterm elections closing in and legislators having their plates (and Twitter pages) full of issues, the federal government continues to struggle to get any cannabis legislation across the finish line for the President to sign.

With that said, it was reported in February that Senate Majority Leader Chuck Schumer announced that he’ll formally introduce his bill to legalize cannabis in the Senate this April, saying that marijuana policy reform “is a priority for me.” Schumer, a Democrat and the senior US senator from New York, made his comments at a February 4th event in New York City attended by fellow lawmakers and drug policy reform advocates. Schumer first said last July that he planned to introduce the Cannabis Administration and Opportunity Act (CAOA) to legalize and regulate marijuana at the federal level.

In February, Maryland’s House of Delegates passed bills to put marijuana legalization on the state’s 2022 ballot and set initial rules if voters approve the reform in November. Delegate Luke Clippinger (D), sponsor of two proposed bill amendments, HB1 and HB837, which address minimum age (21) and other rules regarding legalized cannabis should legalization pass in the state of Maryland.

In South Dakota, the State Senate approved bills to 1) legalize and tax marijuana in the state and 2) provide for expungements for low-level cannabis offenses. The bill (SB 3), sponsored by Sen. Michael Rohl (R), passed by a narrow 18-17 margin. It will now advance to the House, the body that had just defeated a separate measure meant to set up a tax model and other regulations for the market. So stay tuned…

In Texas, gubernatorial candidate Beto O’Rourke promised to support legalization of cannabis if he wins election, according to a February article on KCNTV’s website. According to the article, O’Rourke, having clinched the Democratic nomination, asked the question, “…don't you think it's time we legalize marijuana in the state of Texas? I do too. We can get that done". While this might have been a tall order in the past, legalization is far more popular in Texas than it was 10 years ago. According the article, “Back in 2010, there was 60/40 split against legalization. Today, those numbers have flipped to favor legalization.”

Finally, in Kentucky, where cannabis has yet to be legalized, two Kentucky legislators are going back to politicians in an effort to legalize marijuana across the state. Democratic Senators David Yates and Morgan McGarvey filed Senate Bill 186 in early February. According to an article in Wave3, “the ‘LETT’s Grow’ bill, which stands for Legalize, Expunge, Treat and Tax, the legislation ‘would legalize sales of marijuana, expunge past crimes, allow medicinal use and tax sales of cannabis for adults who use it recreationally.’” We will have to wait and see if this effort survives.

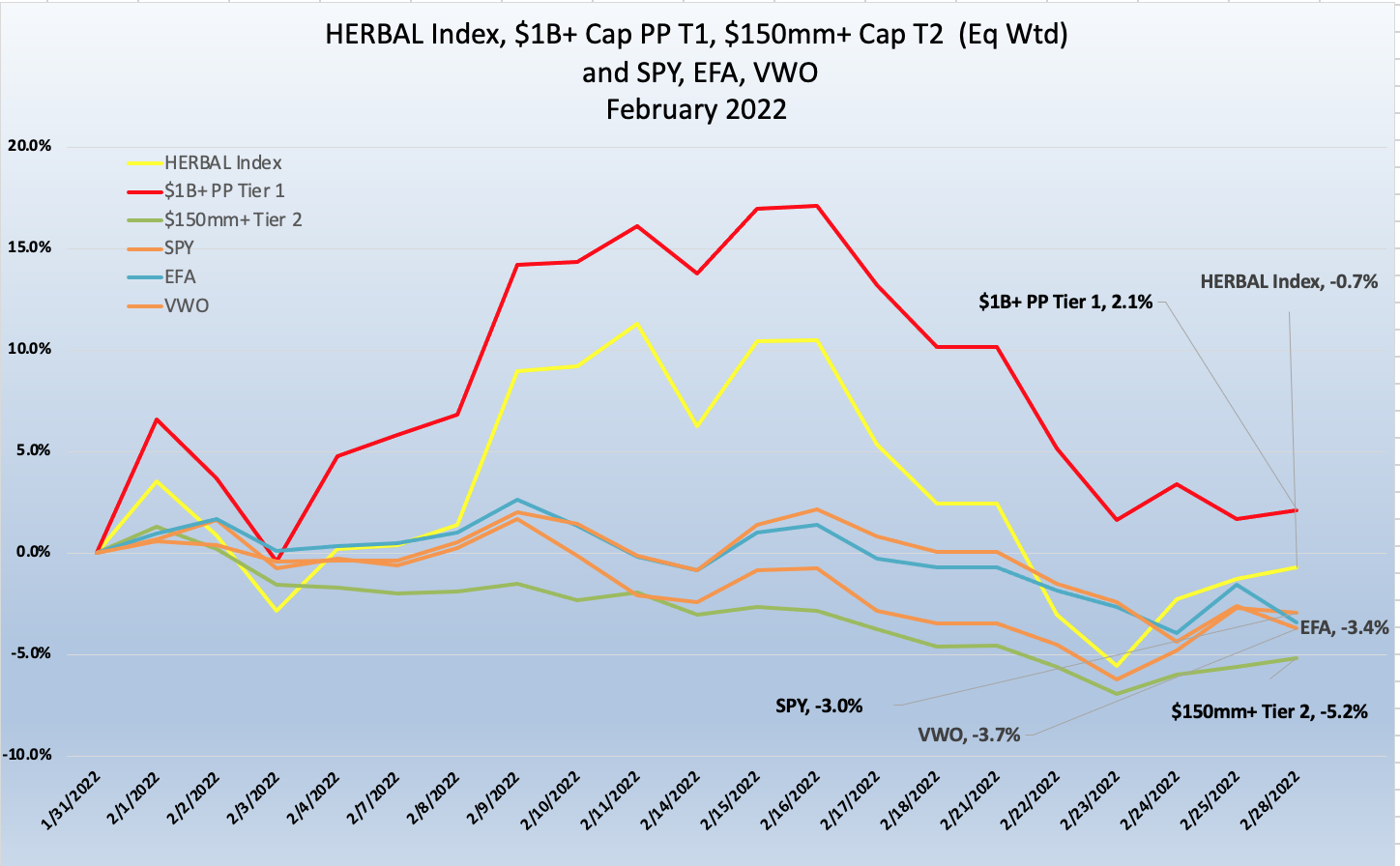

Cannabis-linked Equity Performance

Source: CRB Monitor, Sentieo, Nasdaq

The CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $1b+ market cap was higher by 2.1% in February 2022, as cannabis investors had a brief period to exhale following 11 months of torturous returns. True, February’s positive performance could be described as a “dead cat bounce” and we will stay tuned to see if this is the start of an actual recovery. With that said, we are not seeing too many factors that we would describe as “tailwinds” that might carry these companies deep into 2022. The Federal government is caught up in more pressing issues, primarily Russia’s incomprehensible invasion of Ukraine and the ongoing threat of prolonged inflation here at home. But it was a pleasant surprise to see cannabis equities finally outperform the major indexes (S&P 500, MSCI EAFE, Emerging Markets), which were all in the negative in February.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap fell by 5.2% in February 2022. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term, but often will diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), is a mix of Pure Play Tier 1 and Tier 2 equities, weighted by both investability and strength of theme. HERBAL performed in line with expectations, falling by 0.7% for February.

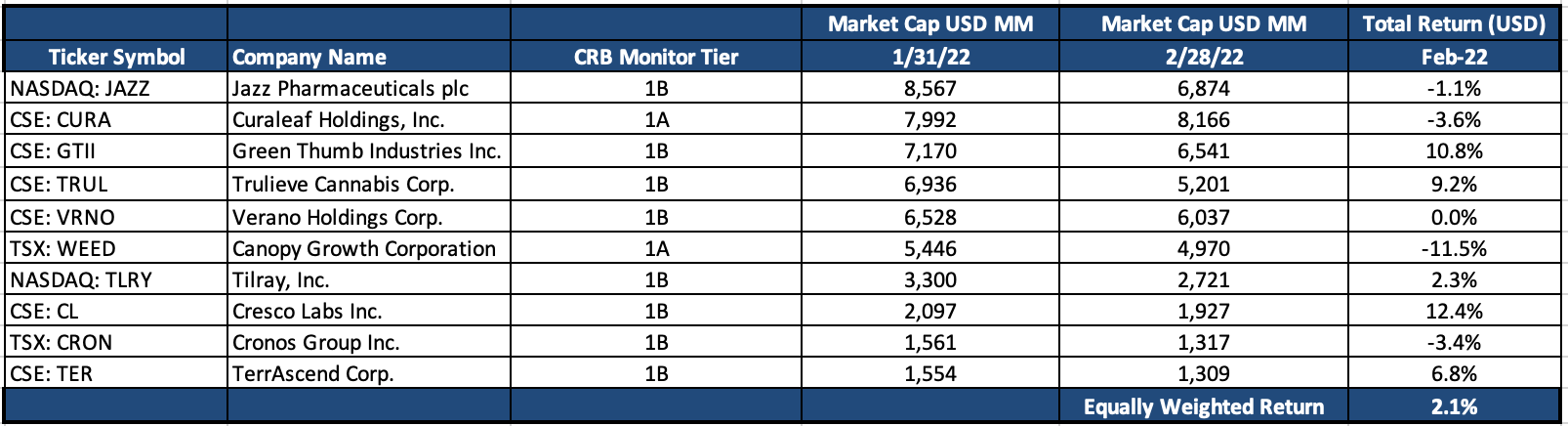

Tier 1 Pure Play CRBs w/Mkt Cap Over $1B – February 2022 Returns

Source: CRB Monitor, Sentieo

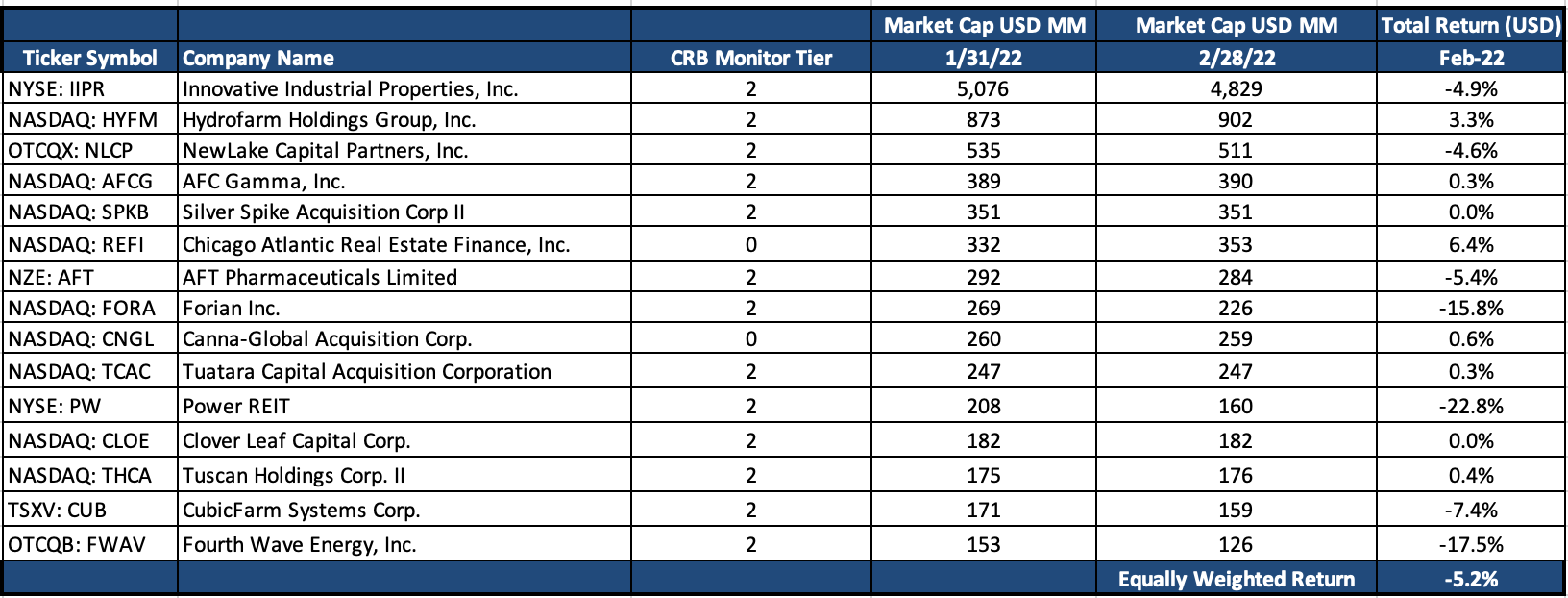

Tier 2 CRBs w/Mkt Cap Over $150mm – February 2022 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

It was nice to see Tier 1 CRBs perform better in February, but we must take this news with a grain of salt. Companies across the industry do not move in lockstep with each other, which is generally a good thing; however, the wide range of returns (see table above) is unsettling.

It was nice to see Tier 1 CRBs perform better in February, but we must take this news with a grain of salt. Companies across the industry do not move in lockstep with each other, which is generally a good thing; however, the wide range of returns (see table above) is unsettling.

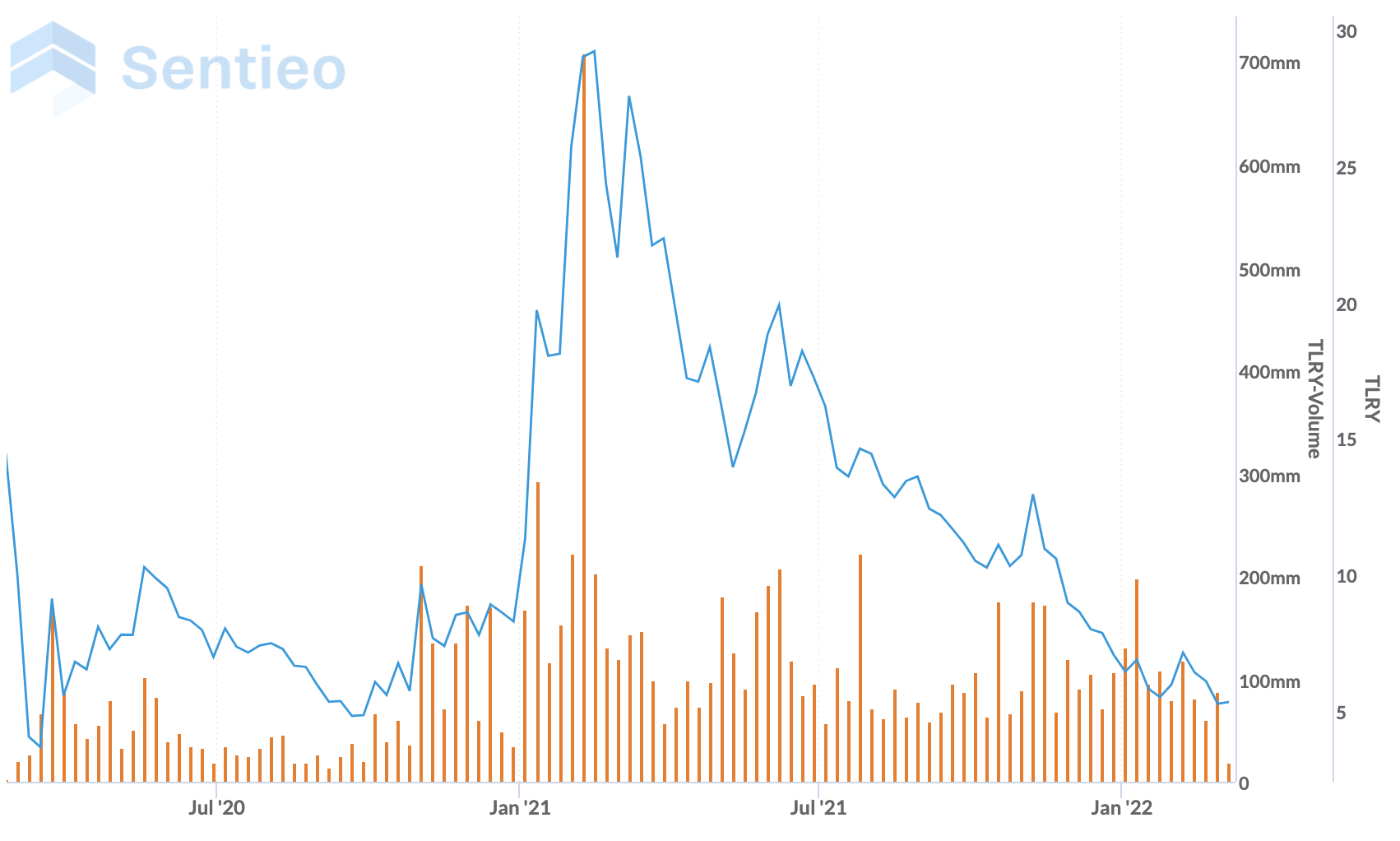

Interestingly, Tilray Brands, Inc. (Nasdaq: TLRY), an infamously volatile stock due largely to securities lending supply and demand issues, closed the month up 2.3%, which would appear to be a sign of stability. But taking a look at the 2-year TLRY share price vs. volume chart, we see that volumes have fallen off from TLRY’s heyday. In early 2021, USD volume for TLRY would frequently top $200 million, while more recently daily volumes struggle to stay above $100 million. A big part of this is undoubtedly the share price, which is now around $5, and what this means is that an investor would need to buy at least 4 times as many shares to purchase a value consistent with a year ago.

Tier 1B multistate operator (MSO) Cresco Labs Inc. (CSE: CL) was the best-performing holding (+12.4%) in the Tier 1 basket for February. Cresco, now operating in 10 states, controls, through its subsidiaries, more than 100 cannabis licenses in either active or pending status. We recall that Cresco terminated its acquisition of Maryland dispensary Blair Wellness in January 2022, due to issues related to filing deadlines. And in spite of weak performance over the prior 10 months, analysts have praised Cresco for its recent acquisitions and aggressive, 5-year plan for growth.

Cresco joins two MSO’s in the Tier 1 basket Trulieve Cannabis Corp. (CSE: TRUL) (+9.2%) and Green Thumb Industries Inc. (CSE: GTII) (+10.8%), the other all-star performers for the month of February. We’ll see if the MSO bet outperforms Canada in 2022, but so far they are looking good.

And what more can be said about Tier 1A perennial disappointment Canopy Growth Corporation (TSX: WEED)? In an optimistic, possibly trend-reversing month for cannabis, WEED delivered a dismal -11.5% return for its shareholders. We believe that non-Pure Play Tier 1B CRB (and WEED’s largest investor) Constellation Brands, Inc. (NYSE: STZ) has to be second-guessing its October 2017 purchase of the so-called “Google of Cannabis”. WEED’s share price is now significantly lower than where it traded 4 ½ years ago (16 CAD vs. 9 CAD on 2/28/22). Nevertheless, Canopy Growth remains one of the household names among cannabis investors, in spite of the fact that earnings are perennially negative. And through its subsidiaries, Canopy continues to control more than 160 licenses to cultivate, process, and dispense cannabis in Canada. So we will wait and see if Constellation Brands holds on this year or gets fed up and finally holds a Canopy fire sale.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies had a -5.2% return for February 2022, which underperformed the equally-weighted Tier 1 basket by 7.3%, and for the second month in a row. When these two portfolios deviate, it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given the direct revenue relationship, but the time it takes to mean revert is not so easy to predict.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.”

IIPR had a difficult February, returning -4.9%; this following a horrific January, when IIPR lost 24.6% of its share value. Trading well off it’s November 2021 highs, IIPR ($188 on Feb. 28th) is still looking pretty pricey compared to its lessees’ (all US CRBs) share prices. With that said, IIPR continues to expand its portfolio, announcing in February that it had acquired a New Jersey property which will be leased by Ascend Wellness Holdings, Inc. (CSE: AAWH.U).

Also in the REIT sector, and also struggling, was Power REIT (NYSE: PW), which was down 22.8% in February. Power REIT’s connection to the cannabis industry is through their leasing of property to medical cannabis cultivators in Colorado, Maine, and California. Power REIT has reported no earnings to date and therefore has not paid any dividends, which would be required by law if there had been any earnings to report.

CRBs In the News

The following is a sampling of highlights from the February 2022 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- Canbud Announces Appointment of Sameet Kanade as Chief Executive Officer and Director and Retirement of Steve Singh (Tier 1A)

- Numinus Appoints New Bioscience Advisors to Advance IP Development (Tier 1B)

- Verano to Enter Coveted New York, Minnesota and New Mexico Markets with Proposed Acquisition of Goodness Growth Holdings (Tier 1B)

- SCHWAZZE ADDS KEY HIRES TO SENIOR LEADERSHIP TEAM (Tier 1A)

- Agrify Acquires Lab Society (Tier 1A)

- Wellness Product Provider Moving Forward on Acquisition of High Value Product Development and Production Company "The Plant": NutraNomics Inc. (Stock Symbol: NNRX) (Tier 2)

- Arcadia Biosciences (RKDA) Names Stan Jacot as CEO (Tier 1A)

- TerrAscend Announces Key Leadership Team Additions (Tier 1B)

- Clever Leaves Appoints George Schultze to Board of Directors (Tier 1B)

- Columbia Care Opens First Cannabist Dispensary in West Virginia (Tier 1A)

- Real Brands Inc. Files to Uplist to OTCQB (Tier 1B)

- BC Craft Announces Appointment of Brett Walker to Board of Directors (Tier 1B)

- Intellipharmaceutics Reports Director Election Results (Tier 1A)

- Leafly and Merida Merger Corp. I Announce Closing of Business Combination (Tier 3)

- Green Thumb Industries Announces Appointment of Dorri C. McWhorter to Board of Directors (Tier 1B)

- Aleafia Health Appoints Tricia Symmes as CEO to Replace Geoffrey Benic (Tier 1B)

- Schwazze Adds President of New Mexico Division Appoints Key Leaders from Former R. Greenleaf Ownership Group (Tier 1A)

- Red White & Bloom Closes Acquisition of PharmaCo with 21 Cannabis Licenses (Tier 1B)

- Village Farms International Appoints Business Leader and Capital Markets Veteran Ann Gillin Lefever as Executive Vice President of Corporate Affairs (Tier 1B)

- Potent Ventures Appoints Seasoned Chief Marketing Officer in Preparation for Launch of the Gummy Project (Tier 1B)

- Potent Ventures Appoints Mr. Bruce Gillies, Former PepsiCo Executive, to Its Advisory Board in Preparation for Launch of The Gummy Project (Tier 1B)

- Cosmos Holdings Announces $6 Million Private Placement of Convertible Preferred Stock and Approval to List on the Nasdaq (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"