James B. Francis, CFA

Chief Research Officer, CRB Monitor

By now the cannabis industry and its investors have had a little time to digest the breaking news of the blockbuster acquisition of Columbia Care Inc. (CSE: CCHW) by Cresco Labs Inc. (CSE: CL). Once it closes, the combination of these two leading multi-state operators (MSOs) will produce a combined entity that will likely be the largest Pure Play publicly-traded cannabis-related business (CRB).

According to a March 23, 2022 press release:

“Cresco Labs (CSE:CL) (OTCQX:CRLBF) (“Cresco Labs” or the “Company”) and Columbia Care Inc. (NEO:CCHW) (CSE:CCHW) (OTCQX:CCHWF) (“Columbia Care”) announced today they have entered into a definitive arrangement agreement (the “Arrangement Agreement”) pursuant to which Cresco Labs will acquire all of the issued and outstanding shares (the “Columbia Care Shares”) of Columbia Care (the “Transaction”). Subject to customary closing conditions and necessary regulatory approvals, the Transaction is expected to close in the fourth quarter of 2022.”

The press release goes on to announce that shareholders of Columbia Care “…will receive 0.5579 of a subordinate voting share of Cresco Labs for each Columbia Care common share (or equivalent) held based on the closing price of CL on March 22, 2022. Furthermore, the Transaction provides Columbia Care Shareholders with “premiums per Columbia Care Share of approximately 16% based on the closing prices of the Columbia Care Shares and the Cresco Labs Shares, and 19%, based on the 20-day volume weighted average prices (“VWAP”) of the Columbia Care Shares and the Cresco Labs Shares, each on the CSE as of March 22, 2022.”

Once this deal is completed, Columbia Care shareholders will own, on a fully-diluted basis, approximately 35% of pro forma Cresco Labs shares.

This acquisition is just the latest in a string of cannabis-related M&A deals by MSOs: Terrascend Corp.’s (CSE: TER) purchase of Gage Growth, Trulieve Cannabis Corp.’s (CSE: TRUL) purchase of Harvest Health, and Verano Holdings Corp.’s (CSE: VRNO) purchase of Goodness Growth. We also had last year’s mega deals, Jazz Pharmaceuticals plc (Nasdaq: JAZZ)/GWPH and Tilray Brands, Inc. (Nasdaq: TLRY)/Aphria.

Analysis of the Deal

According to its CRB Monitor profile, and by its own admission, “Cresco Labs is one of the largest vertically-integrated multi-state cannabis operators in the United States. Cresco Labs is built to become the most important company in the cannabis industry by combining the most strategic geographic footprint with one of the leading distribution platforms in North America.” Similarly, Columbia Care describes itself as “one of the largest and most experienced cultivators, manufacturers and providers of medical and adult use cannabis products and related services with licenses in 18 US jurisdictions and the EU.”

Given the above, it would seem that the synergies are in line for this acquisition. The combined entity is expected to be the #2 cannabis retailer in the United States, with an estimated $1.3 billion in projected sales and a market capitalization of $3.2 billion.

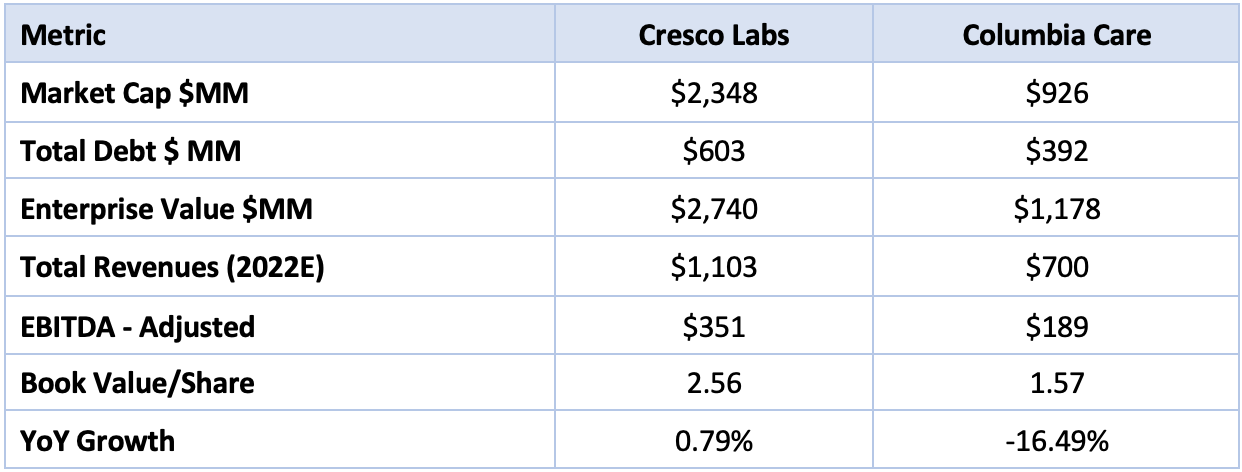

Source: Sentieo

Expansion of Operations

Looking at the impact on geographic diversification, the CCHW acquisition adds just two additional states, Michigan and Nevada, to Cresco’s operations. The post-acquisition roster expands to 17 states, plus DC and Puerto Rico. With that said, Cresco’s number of cannabis licenses will effectively double, as they will hold more than 220 cannabis licenses in either active or pending-approval status. Once this business combination is complete at year end, Cresco Labs will hold licenses across essentially all cannabis-related categories, including cultivation, retail, manufacturing/processing, delivery/transportation, and vertical integration. An in-depth analysis of the productivity of each of these Tier 1A licensed businesses would be essential to assess the viability of this transaction, and we trust that Cresco has done its homework. With that said, we will plan to take a deeper dive into this deal in a follow-up blog post.

Historical Performance

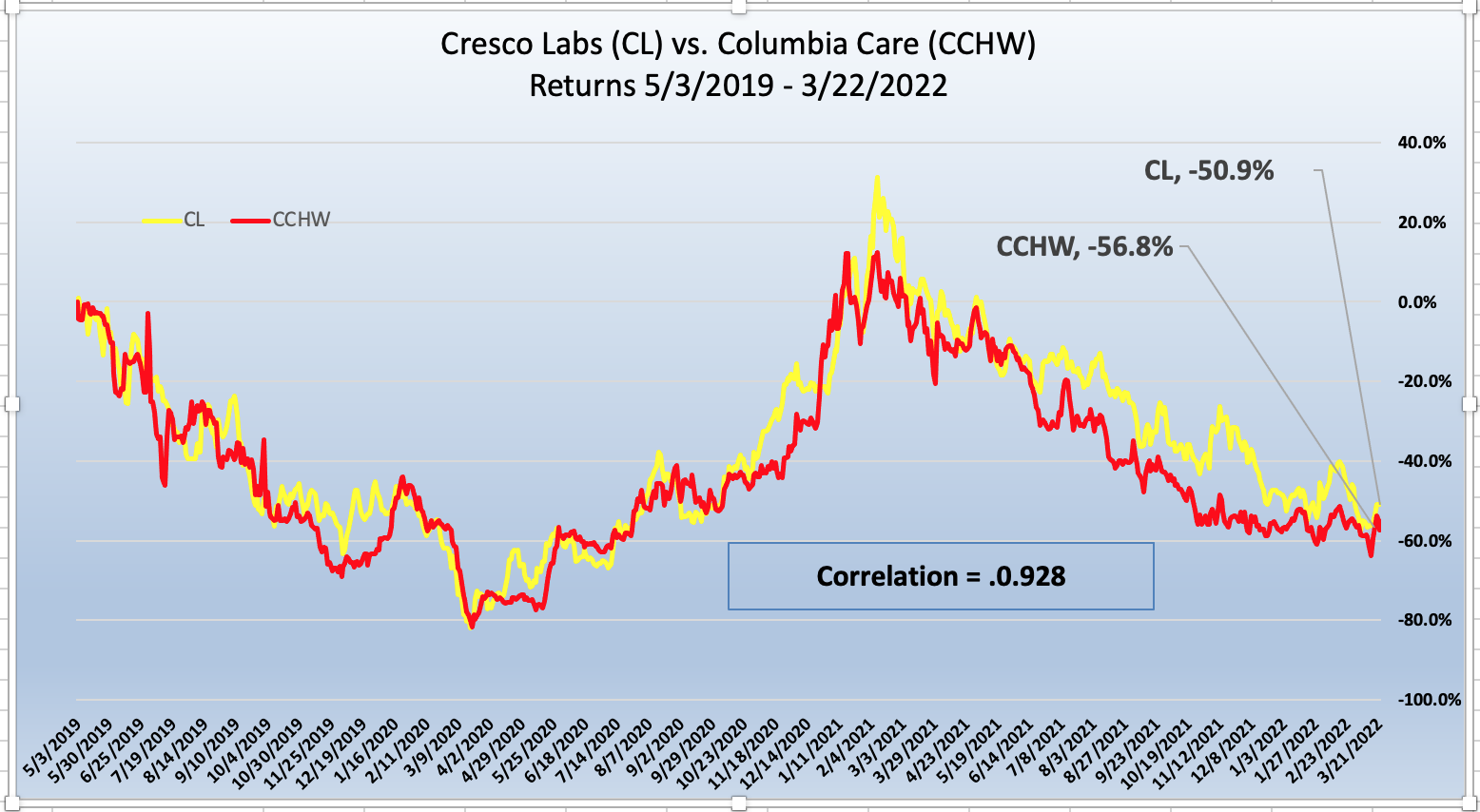

We see from the following chart that the returns of CL and CCHW are nearly identical to each other leading up to the announcement. Their performance is largely in lock step, with a correlation of 0.93. This is no surprise, as the financials (see the table above) make Columbia Care look like a “mini-me” version of Cresco Labs. What does this say about the prospects of this acquisition? Time will tell, but the cannabis industry has not been kind to its investors for much of the last 3 years and this deal does not appear to provide a significant hedge for the uncertainty caused by unknown market forces.

Source: Sentieo, CRB Monitor

Impact on Portfolios & Thematic Indexes

What does this event, and others like it, mean for cannabis-themed funds? For one thing, this acquisition removes one more company from the Pure Play, Tier 1 CRB universe.

Take as an example the Tilray/Aphria merger. When this deal was originally announced, we wrote that fund managers would feel the impact of having one less large (5-10% index weight) CRB to invest in. This is particularly important in the thematic ETF space, where fund issuers must guarantee diversification to their shareholders and, more importantly, to the regulators. Losing even one top-tier holding due to an M&A deal can be a major blow to a cannabis-themed index, as the index weight that is removed must be redistributed among the rest of the portfolio.

The Cresco/Columbia Care acquisition will have a similar impact on managers of ETFs (such as MJUS and MSOS) that include MSOs in their holdings. And any further consolidation in the cannabis industry will place ETF managers in an even more inconvenient position as they are forced to do more with less. As an example, the Advisorshares Pure Us Cannabis ETF (NYSE: MSOS), currently holds more than 12% in the two CRBs (8.1% in CL, 4.2% in CCHW). Merging the two companies would result in one, highly-concentrated position, potentially placing the ETF’s diversification at risk and forcing a rebalance. Similarly, the ETFMG U.S. Alternative Harvest ETF (NYSE Arca: MJUS) holds a total of 8.4% in CL and CCHW, split almost evenly between the two holdings. When the acquisition is complete, the index weight would be concentrated in one holding and would likely need to be re-allocated into the remaining basket, which would be reduced to 21 holdings from 22.

Publicly-traded cannabis equities, due to their small size and investability issues, have historically been volatile. This has largely been due to factors beyond the CRBs’ control, such as the ongoing federal legalization stalemate, the global economic crisis, the impact of a two-year pandemic, and an omnipresent black market for cannabis. Unless one or more of these headwinds subside, it is unclear that large M&A deals like this will be effective in the long run. And with the historical performance of CL/CCHW in mind (<-50% over the last 3 years), we might be seeing more of this consolidation in the coming months as CRBs attempt to play defense while they wait for the storms to clear.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"