CRB Monitor Expands Cannabis-Related ETF Coverage

James B. Francis, CFA

Managing Director of Publicly Traded Securities Research, CRB Monitor

CRB Monitor is pleased to announce the expansion of our publicly-traded cannabis-linked securities database to include coverage of any exchange traded fund (ETF) that holds at least one "Pure Play" Tier 1A or Tier 1B cannabis-related security.

We define "Pure Play" as a cannabis-related business (CRB) that earns, or intends to earn, at least 50% of its revenue from cannabis-related activities.

These “non-Cannabis-Themed” ETFs generally use a replication approach to track mainstream global indexes; and, interestingly, many of these indexes now include Tier 1 Pure Play CRBs and the ETFs’ construction methodology requires that they hold them.

Why does CRB Monitor include non-Cannabis-Themed ETFs?

CRB Monitor’s subscribers have come to appreciate the diligence and completeness with which we populate our database, and as such we are committed to including 100% of the global cannabis ecosystem. CRB Monitor’s database rules require that we include any publicly-traded company that either owns or invests in the shares of a Tier 1A or Tier 1B cannabis related business.

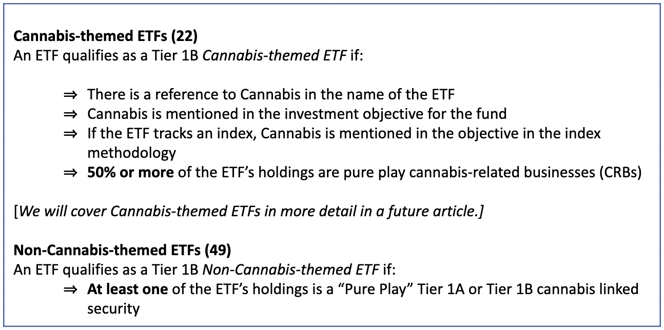

Initially, we added 22 “Cannabis-Themed” ETFs that are predominantly, if not exclusively, composed of CRBs. However, upon further analysis of the entire ETF ecosystem, CRB Monitor has identified and added 49 “Non-Cannabis-Themed” ETFs to our database, thereby increasing our ETF coverage to 71 funds.

This expansion is great news for our institutional partners who need to monitor any and all cannabis-related exposure, with no exceptions, across their investment and custody platforms. Our ETFs are included based on the following rules:

Below is a summary, by issuer, of the Non-Cannabis-Themed ETFs that are covered by CRB Monitor, including their assets under management as of 7/31/2021.

It is interesting to note that several of the largest ETF issuers, including State Street (SPDRs), BlackRock (iShares), and Vanguard, are included on this list, with Vanguard being the largest holder of Tier 1 Pure Play cannabis-related businesses at more than $100 million. BlackRock, JP Morgan, Charles Schwab, and State Street each hold more than $9.5 million in “Pure Play” cannabis-related securities:

|

ETF Issuer |

Sum of ETF AUM w/CRBs (USD) |

Number of ETFs w/CRBs |

Sum of Total CRB Holdings (USD) |

|

Vanguard |

$506,840,000,00 |

8 |

$101,703,436 |

|

iShares |

$108,135,730,000 |

12 |

$25,606,896 |

|

JP Morgan |

$5,540,000,000 |

1 |

$13,850,000 |

|

Charles Schwab |

$30,330,000,000 |

2 |

$10,346,786 |

|

State Street |

$14,801,320,000 |

5 |

$9,561,775 |

|

Fidelity |

$7,477,610,000 |

3 |

$3,931,164 |

|

Nuveen |

$978,550,000 |

1 |

$1,859,245 |

|

First Trust |

$394,140,000 |

2 |

$774,180 |

|

Invesco |

$2,552,460,000 |

5 |

$686,065 |

|

SoFi |

$26,750,000 |

1 |

$556,400 |

|

Goldman Sachs |

$2,610,000,000 |

1 |

$522,000 |

|

FlexShares |

$659,410,000 |

1 |

$353,444 |

|

Dimensional |

$493,000,000 |

1 |

$188,396 |

|

VanEck |

$74,150,000 |

1 |

$163,130 |

|

Xtrackers |

$914,430,000 |

3 |

$106,372 |

|

Franklin |

$27,740,000 |

1 |

$77,672 |

|

PIMCO |

$87,570,000 |

1 |

$52,542 |

|

Grand Total |

$681,942,860,000 |

49 |

$170,339,502 |

Source: ETF Issuer Websites

Why do we include Non-Cannabis-Themed in Tier 1B?

Per CRB Monitor rules, any non-licensed parent company of, or investor in, at least one Tier 1A or Tier 1B CRB is defined as a Tier 1B CRB. Therefore, we now provide coverage for (currently) 49 non-Cannabis-themed ETFs which invest in Tier 1 CRBs.

Examples of Non-Cannabis-themed ETFs Covered by CRB Monitor

Below are a few examples of ETFs that are profiled in the CRB Monitor database, and the current positions that are included in their holdings that define them as cannabis-related businesses (CRBs). Please note that Tier 1A companies (those that directly hold cannabis licenses) are color-coded in red while Tier 1B companies (those that are owner-investors of Tier 1A companies) are color-coded in blue.

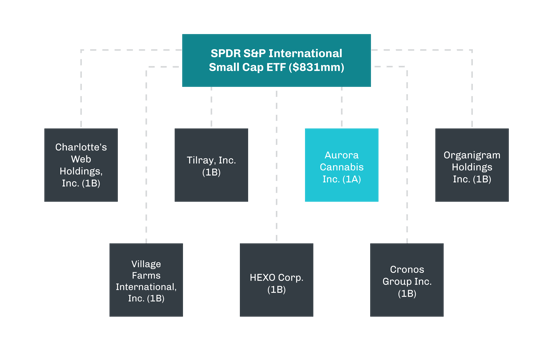

One example of a popular ETF that holds Tier 1 CRBs is the $800 million SPDR S&P International Small Cap ETF (NYSE Arca: GWX). GWX currently has more than 2,500 holdings, seven of which are defined by CRB Monitor as “Pure Play” Tier 1 cannabis companies. Tier 1B CRB Tilray, Inc. (Nasdaq: TLRY), the pure play cannabis company by market cap, is the 29th largest company in GWX. Tier 1A Aurora Cannabis (Nasdaq: ACB) holds marijuana licenses directly and is in the top 350 holdings by market cap.

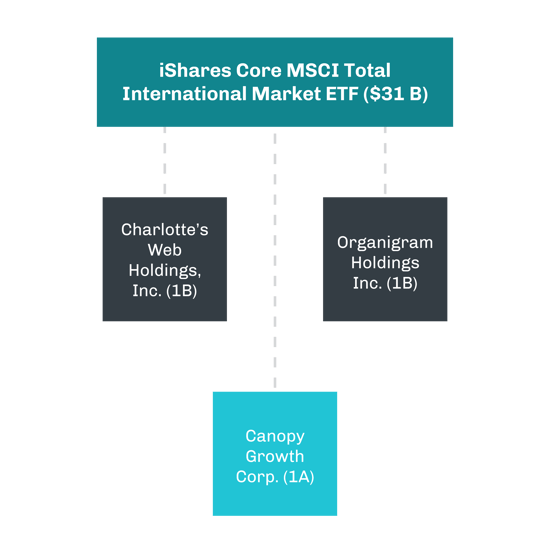

Another notable example of a mainstream ETF that holds pure play Tier 1 CRBs is the iShares Core MSCI Total International Stock ETF (Nasdaq: IXUS). IXUS is currently more than $31 Billion in AUM, and out of its ~4,300 holdings it has positions in three pure play CRBs: Tier 1A Canopy Growth Corp. (TSX: WEED) and Tier 1B’s Charlotte’s Web Holdings, Inc. (TSX: CWEB) and Organigram Holdings (TSX: OGI). While these positions might be considered insignificant, their presence in this standard index & ETF can be a red flag for asset owners who have a “no-cannabis” investment policy.

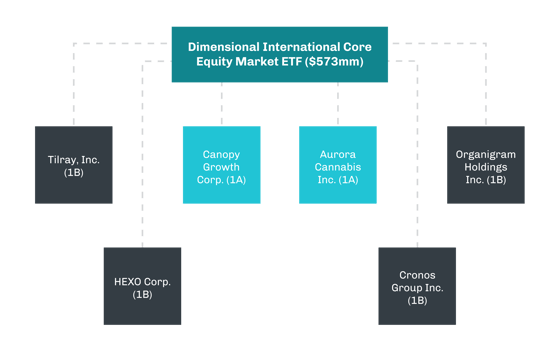

A third non-Cannabis-themed exchange traded fund that holds CRBs is the Dimensional International Core Equity Market ETF (NYSE Arca: DFAI). DFAI has been growing fast and now has an AUM of more than $570 million. Of its more than 2,900 holdings, DFAI currently invests in six of the largest pure play Tier 1 CRBs, including Aurora Cannabis, Canopy Growth, and Tilray. This fund also holds shares of Tier 1B HEXO Corp. (TSX: HEXO). DFAI’s total exposure to the cannabis industry amounts to only a few basis points of its assets under management, but the knowledge of this exposure can be critical for investors who closely monitor cannabis-related risk, regardless of size.

The CRB Monitor database has become the industry standard because of its breadth, depth, and accuracy, as we seek to meet our objective of uncovering every business with a connection, either direct or indirect, to the cannabis industry. The ETFs described above are just 3 out of the 49 funds that we recognize as “Non-Cannabis-Themed” but still could pose a potential compliance issue for institutions that prohibit investment, trading, or custody of cannabis-related securities in clients’ accounts. [The complete list of 71 ETFs can be found with underlying details and supporting documentation in the CRB Monitor Database.]

CRB Monitor tracks ~ 1,400 publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have ~1,600 traded securities, including more than 70 exchange-traded funds (ETFs). We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-linked (CLS) sectors. In addition, CRB Monitor unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"