James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Related Equity Performance

Cannabis Equity Index Returns - Reality Bites

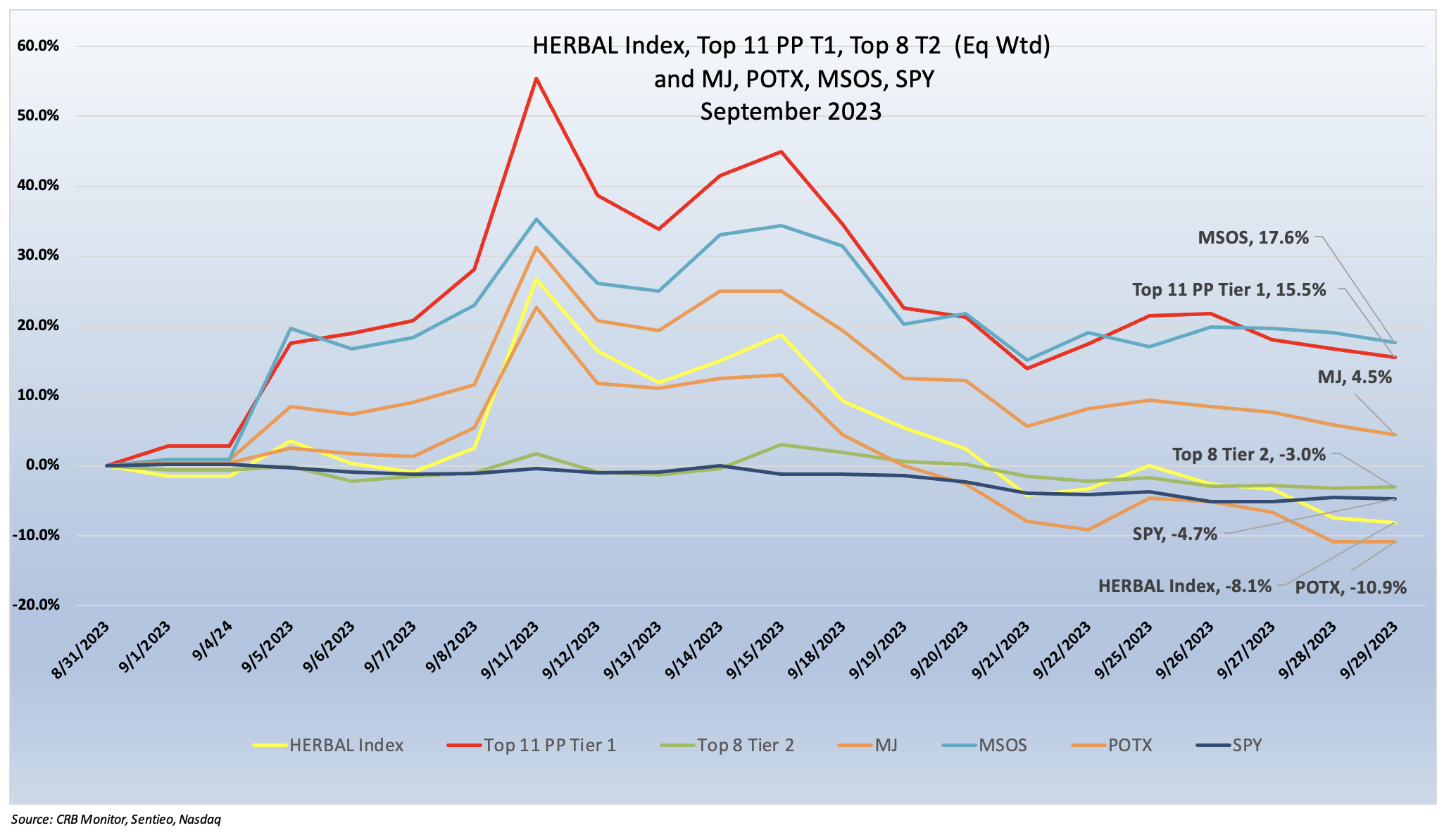

With the hysteria over The announcement that the US Department of Health and Human Services recommended rescheduling cannabis to Schedule III from Schedule I now in the rear view mirror, investors in cannabis equities (and others) are left with largely the same uncertainty that they had prior to the announcement. Truth be told, this is a positive development, but unlike death and taxes, it is not guaranteed. What we have seen over the last month is that rescheduling, the latest aspect of cannabis reform is not without its opponents and therefore it will necessarily sail smoothly to its ultimate. In fact, in mid-September two Republican senators filed legislation, called the Deferring Executive Authority (DEA) Act, which does exactly what one would expect. The bill, filed by Cynthia Lummis (R-WY) and Steve Daines (R-MT), would “make it so any administrative proposal to transfer marijuana “between schedules” of the Controlled Substances Act (CSA)—as the U.S. Department of Health and Human Services (HHS) recently recommended to the Drug Enforcement Administration (DEA) as part of a review directed by President Joe Biden—must first be submitted to Congress for review.” Whether or not this bill goes the distance, it is clear from the above performance chart that returns started heading south in the middle of the month, as this was an indication that (as we suspected) the opposition to cannabis legalization will not go down without a fight.

Also in the works in September was the latest iteration of the SAFE Banking Act, now named the SAFER Banking Act. While SAFER has bipartisan support, the margins are razor thin and it is unclear if there are enough congresspeople from both chambers to get it through particularly in these contentious times. And this uncertainty is directly reflected by the sentiment in the stock market, which will simply not support announcements that go nowhere. [For an excellent summary of SAFER Banking, please check out CRB Monitor’s article “With Bipartisan Support, Cannabis Banking Bill Heads to Senate Floor” on crbmonitor.com.]

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), rode the roller coaster that was brought on by the aforementioned announcements and finished in the middle of the pack. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a negative 8.1% return in September 2023 and finished ahead of its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (-10.9%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al) as well as rules for inclusion, particularly thresholds for minimum price and market capitalization.

HERBAL trailed the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+4.5%) and finished significantly behind the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which closed out September with a return of +17.6%.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its unusual composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases non-CRB) holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. Additionally, In 2022 MJ added and maintains close to a 50% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure. MJ also carries a large balance (10%) in a cash vehicle, which will serve as a persistent performance drag if maintained at that level.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can deviate materially from HERBAL’s as well (as it did in September), largely due to its holdings of CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap steamrolled into month end, +15.5% for September 2023, was hit hard by the uncertainty but managed to stay afloat and buoyed by the abovementioned revelations from HHS and SAFER Banking. Returns were mostly strong across the board with very few exceptions (see the table below).

The CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month lagging far behind the Tier 1 CRB basket, posting a negative 3.0% return in September. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. With that said, the breadth of the Tier 2 basket has shrunk over time and the spreads have widened, which will likely contribute to short term performance differences as well.

US equities were down again in September as fears of a government shutdown and higher gas prices turned up the tension in the markets. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a negative 4.7% for the month, which bore little resemblance to the performance of cannabis equities.

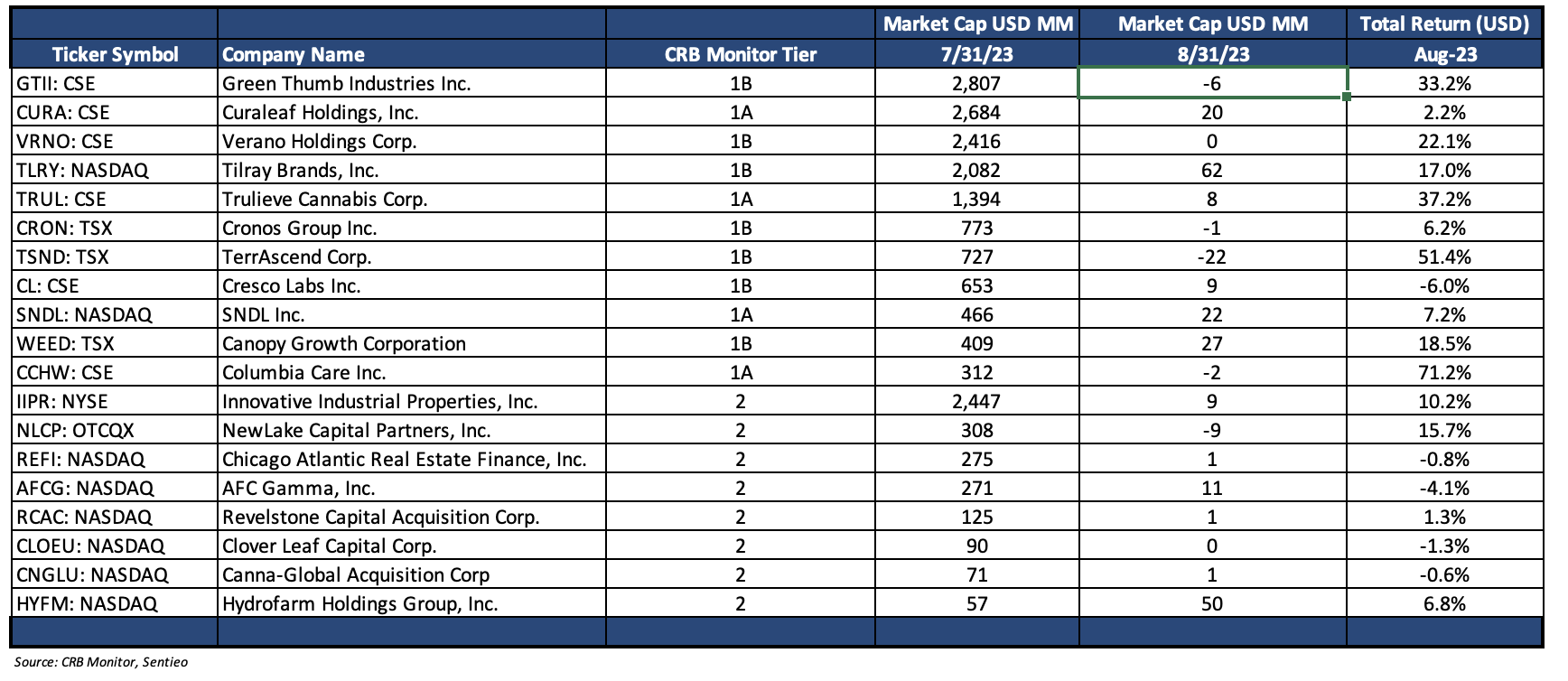

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – September 2023 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities returned +15.5% for September 2023, with the majority of the Canadian and MSO groups continuing to benefit from the optimism that cannabis would, could, or might be rescheduled in the future. With that said, we can see from the chart above that the trend was negative over the second half of September 2023.

We frequently see the Canadian (non-US plant-touching) group deviate from the US multistate operator MSO group, given their individual sensitivities to various factors, with the most profound of these factors being the progress toward US federal legalization (or rescheduling, or SAFER Banking, etc.).

The “legal” Canadian CRB basket was mixed but mostly stellar in the month of September. Tilray Brands, Inc. (Nasdaq: TLRY) (-19.3%) was the worst in this group, appeared to be the victim of profit taking after it was up 95% in July and August. The spike was largely brought on by TLRY’s Q4 and Full Fiscal Year earnings report that significantly beat expectations. Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+6.1%) had its second positive month in a row while Tier 1B Cronos Group Inc. (TSX: CRON) (-1.1%) sputtered.

Experiencing a rebirth of sorts, Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) handed investors another gift with a breathtaking +36.4% return for the month (and a 44% return for Q3). As we have written in recent months, this is no cause for celebration as we would need to see a return of this magnitude several times over for Canopy Growth (and most CRBs) to claw back all they have lost since 2021.

Now a quick look at the MSO basket: This group delivered again for investors, led by Tier 1B Cresco Labs Inc. (CSE: CL), which posted a return of +34.7% as it continues to expand its operations in the US following its failed acquisition of Columbia Care Inc (now known as The Cannabist Company Holdings, Inc.). On that note, Tier 1A The Cannabist Company Holdings Inc. (NEO: CBST) (+21.8%) and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+22.0%) helped the MSO basket while Tier 1B TerrAscend Corp. (TSX: TSND) (-0.4%) finished September essentially flat after delivering investors a return of over 50% in August. Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) returned a respectable 7.0% September while the largest Tier 1 pure play CRB by market cap, Green Thumb Industries Inc. (CSE: GTII) (+19.5%) continued to be of interest to cannabis investors.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a negative 3.0% return for September 2023, which underperformed the equally-weighted Tier 1 basket by 18.5%. Typically these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), and we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically; however, we also feel that there is no need to try to game them as a strategy. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict. And furthermore, the costs required to rebalance these illiquid baskets could eat up any meaningful profits.

Performance across the now-concentrated Tier 2 basket was mixed but more toward the negative in September 2023. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (-11.2%), gave back essentially all of its August gains and as we have written IIPR has a long road ahead if it is to recoup all of its investors’ losses. On August 2nd IIPR reported its 2nd quarter results, with the following highlights and we think it’s worthwhile to report the highlights once again:

- “Generated total revenues of approximately $76.5 million in the quarter, representing an 8% increase from the prior year’s quarter.

- Recorded net income attributable to common stockholders of approximately $40.9 million for the quarter, or $1.44 per diluted share.

- Recorded adjusted fund from operations (AFFO) of approximately $64.0 million, or $2.26 per diluted share, increases of 6% and 5% from the prior year’s quarter, respectively.

- Paid a quarterly dividend of $1.80 per common share on July 14, 2023 to stockholders of record as of June 30, 2023. The common stock dividends declared for the twelve months ended June 30, 2023 of $7.20 per common share represent an increase of $0.70, or 11%, over dividends declared for the twelve months ended June 30, 2022.”

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) was negative (-2.4%) but still finished the quarter up 47%. In early August, Hydrofarm announced its 2nd quarter results, which featured a significant drop (-$34mm) in sales but a slight increase in profit due to a consolidation of expenses. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day. With that said, HYFM’s Q3 return is encouraging.

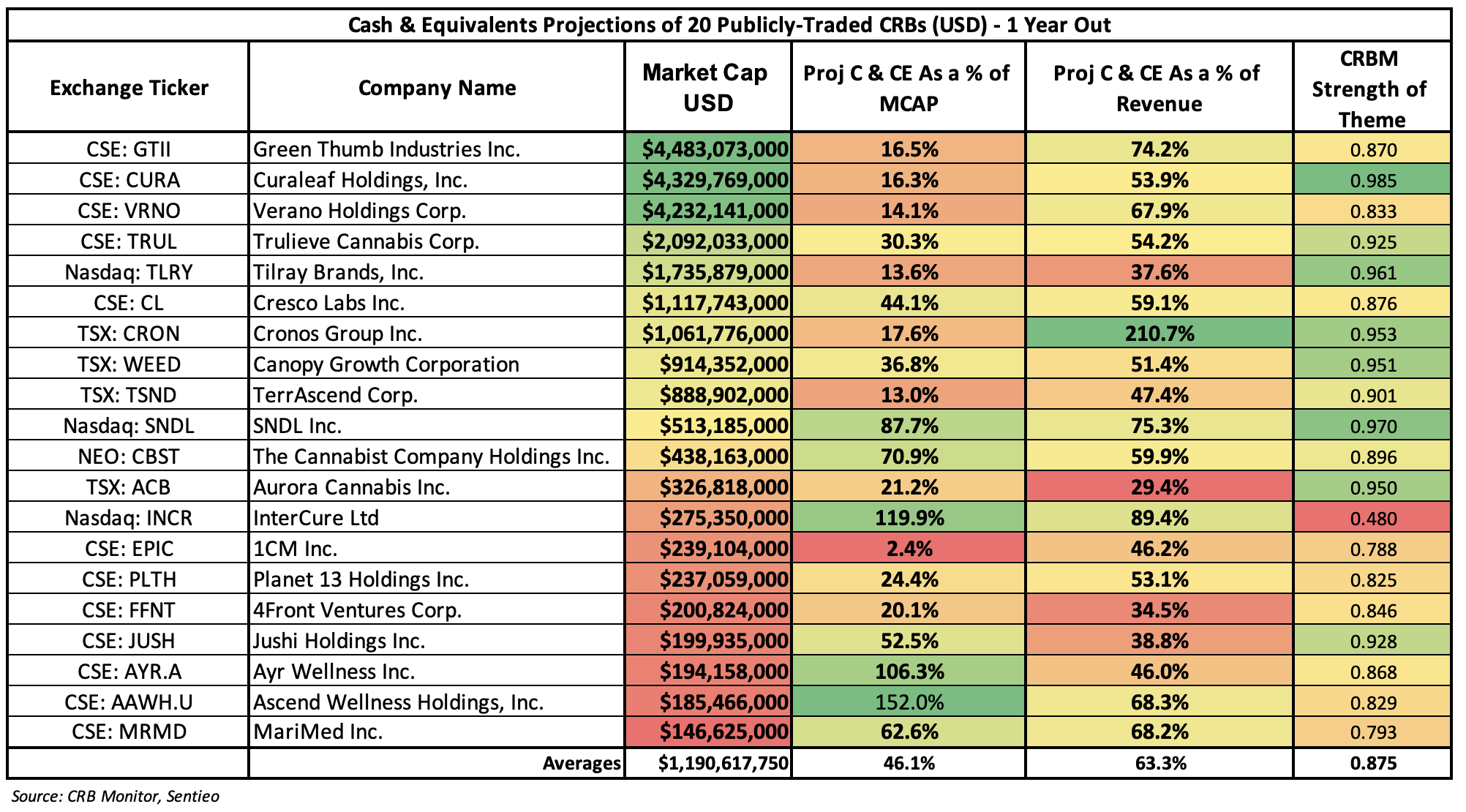

Chart (actually, Table) of the Month: 1-Year Cash Projections for Tier 1 CRBs

This month we take a closer look at the near-term health of the largest 20 pure play Tier 1 CRBs, as we consider what investors have to look forward to given the recent wave of optimism in the cannabis industry. It is no great revelation when we say that cannabis equities have been excessively volatile since their emergence half a decade ago, and it would be an understatement to claim that nearly all of the hysterical trade activity to date has been reactive and sentiment-based. It has. [We will be undoubtedly writing about CRB equity volatility in the months to come].

Truth be told, fundamentals in the cannabis space have not changed radically in recent months and the elephant in the room has been progress (or lack thereof) toward decriminalization, and ultimately legalization in the US. We have written about this quite often and it is no mystery to even the casual observer that there will be very limited value in these companies until cannabis becomes a “mainstream” industry in the eyes of the US federal government.

But with all that said, with the prospect of rescheduling and SAFER banking on the horizon, the survivors are likely to benefit in the long term as legal cannabis evolves and breaks away from dispensary-only sales and ultimately starts making its appearance in pharmacies, package stores, and supermarkets.

Which brings us to the current state of the cannabis industry. We took a plunge into the recent balance sheets and income statements of a list of relevant, publicly traded, pure play Tier 1’s to see how they might be faring today and what their prospects are going forward. We are painfully aware that the immediate future of legal cannabis is still quite uncertain, and as such the best we can do is take a look at what the comparative data might say about the near term prospects of this perennial emerging market.

The ”chart of the month” is actually a table of the largest 20 pure play Tier 1 CRBs. What we have done is extract cash, revenue, and expense data from the last 2 years of balance sheets and income statements in order to project the next 12 months of balance sheet cash and cash equivalents assuming the status quo on the income statement.

What the above table indicates is that there is a varying approach to financial management across this list of the largest Tier 1 CRBs, and the level of cash and cash equivalents on the balance sheet does not necessarily reflect the size of either the company or it’s revenues. With that said, the three largest CRBs (GTII, CURA, VRNO) all have projected excess cash in a range of 14-16.5% of market cap. Others in that general range include TLRY, CRON, and TSND. Companies sporting a higher projected balance of cash and cash equivalents are TRUL (30%), CL (44%), and WEED (36%).

We also thought it might be interesting to add another dimension by cross-referencing these numbers with recent CRB Monitor Strength of Theme data. A critical factor in the construction of the Nasdaq CRB Monitor Global Cannabis Index (HERBAL), Strength of Theme is a comparative measure of operational diversification that is constructed using license data and other information from the CRB Monitor database. While the SOT factors do not appear to have a wide range, there are some noteworthy differences and those CRBs that are green in both the % of cash column and the SOT column might be considered the less risky of the bunch, although we would add the disclaimer that these are projections and therefore please, no wagering!

Said a different way, CRB Monitor is not in the business of stock selection or making buy/sell recommendations; however, our research provides some insight into the overall strength and health of the companies that are fighting this battle every day. And the delicate management of cash is that essential tool that is used by each management team to strike a balance between risk and return in this environment of uncertainty.

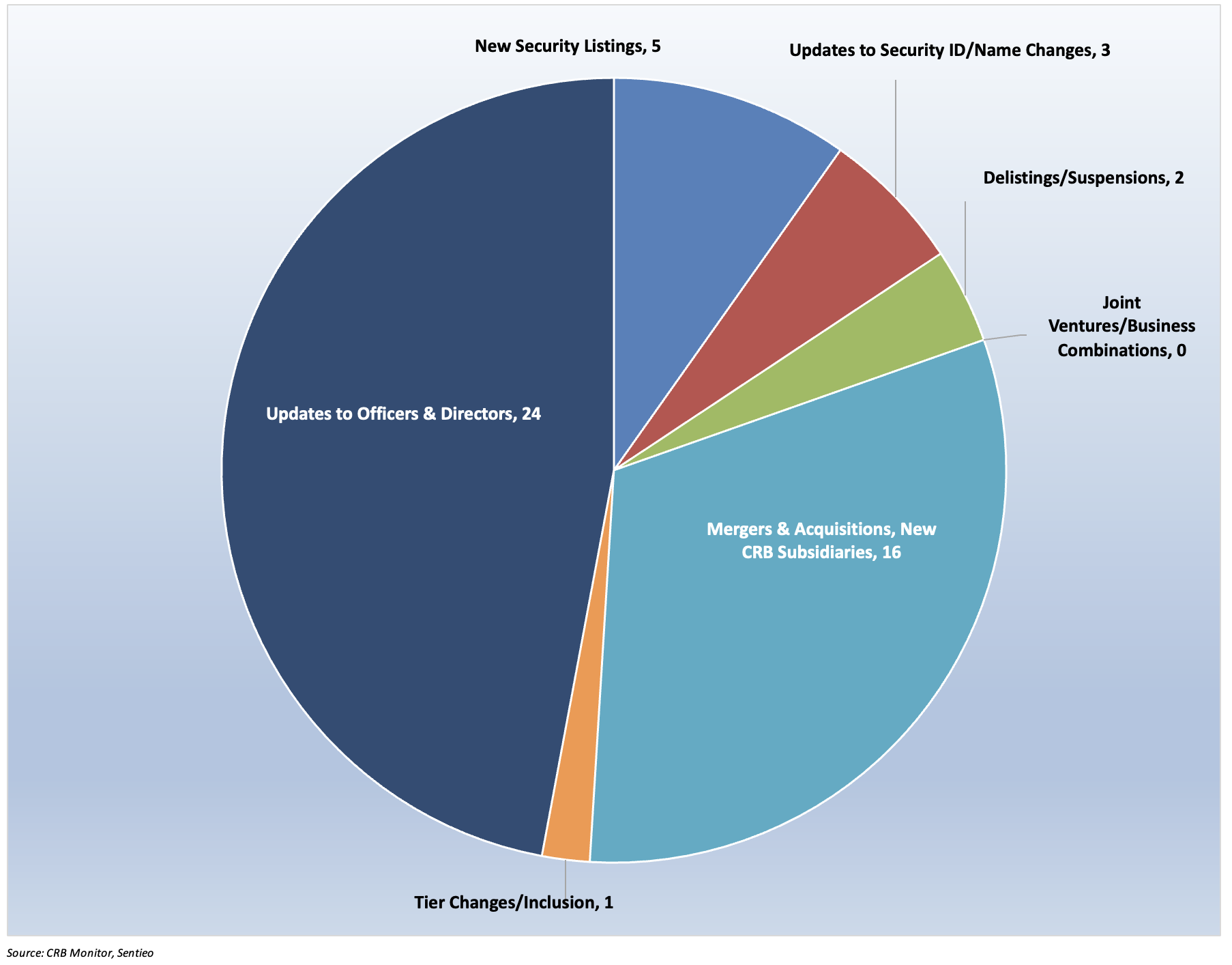

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for September 2023:

Cannabis Business Transaction News - September 2023

Cannabis business activity seemed to pick up in September, coincidentally with the latest revelations regarding HHS’s recommendation for rescheduling and Congress’s renewed efforts to pass SAFE Banking once again. We are also happy to report that there were several new additions to CRB Monitor, largely in Tier 1 (see below). Now for some news:

Tier 1B mega-dispensary operator Planet 13 Holdings Inc. (CSE: PLTH) announced in September that it entered into a purchase agreement on Aug. 28 “for the ownership interests of Jacksonville-based VidaCann LLC.” According to the Orlando Business Journal, “The proposed deal includes 26 VidaCann dispensaries, including two in Orlando and one in Clermont, as well as a distribution and growing facility that can support 60 dispensaries.” This significant operational expansion in Florida brings Planet 13’s total license count to 27 that are either active or pending approval.

Also in September, Tier 1B MSO TILT Holdings Inc. (CSE: TILT) issued a press release announcing that its subsidiaries, SFNY Holdings Inc. and Standard Farms New York LLC “have entered into a membership interest purchase agreement with CGSF Investments, LLC, a wholly owned subsidiary of PowerFund Holdings II LLC, pursuant to which CGSF acquired from SFNY all the membership interests in Standard Farms NY for $1.4 million.”

What is significant about this news is that these transactions were executed so that Shinnecock Nation Will Open Tribally Owned Cannabis Dispensary This Fall. In the words of the press release, “Standard Farms NY holds a 75% interest in CGSF Group LLC, which was formed to establish vertical cannabis operations on the Shinnecock Nations aboriginal tribal territory in the Hamptons on Long Island, New York.” Through its subsidiary businesses, Tilt Holdings currently holds 19 cannabis licenses across 5 states that are either in active status or pending approval.

Meanwhile Tier 1B vertical cannabis operator Leef Brands Inc. (CSE: LEEF) issued a September 20 press release announcing the successful closing of the acquisition of the Salisbury Canyon Ranch LLC, “a 1,900-acre ranch located in Santa Barbara County. Additionally, as previously announced on June 1, 2023, the Company has sold a 60% interest in the Ranch for $7.0 Million through an interest-free loan agreement, of which the proceeds will be used to finance the buildout and operation of one of the largest biomass cultivation sites in California.” And furthermore: “LEEF will remain the 100% owner of the state cannabis licenses and shall exclusively occupy and manage the Ranch and the cultivation operation.” LEEF, a CRB that is generally flying below the radar due to its size ($23mm market cap), is excited about this opportunity for future expansion of its operations. LEEF Brands currently controls, through its subsidiaries, 9 cannabis licenses in California that are either in active status or are pending approval.

From the Canadian CRB group, Tier 1A CRB Flora Growth Corp. (NASDAQ: FLGC) issued a press release announcing that it has entered into a definitive agreement “to acquire Australian Vaporizers Pty Limited to acquire all of the issued and outstanding shares of Australian Vaporizers in exchange for 600,676 Flora common shares, valued at $1.7 million based on the closing price of Flora's common shares on September 15, 2023, subject to working capital adjustments. The transaction is expected to close in the fourth quarter of 2023.” The announcement goes on to say, “Australian Vaporizers is expected to be immediately accretive to Flora and is anticipated to provide annual contributions of $5.2 million in revenues, $1.2 million in gross margins and $0.5 million in net income. For its most recently completed six-month period ended May 31, 2023, Australian Vaporizers achieved $2.5 million in revenues, $0.6 million gross margins and $0.25 million in net income. At closing, Australian Vaporizers is expected to have cash hand of at least $0.3 million, inventories of $0.8 million and working capital of $1.1 million.” As Australian Vaporizers is not a licensed CRB, Flora Growth’s license count remains at 7 (1 hemp license directly held in Colombia, the rest spread among Switzerland, Portugal, Germany, and Denmark).

Also in the month of September, Tier 1B CRB iAnthus Capital Holdings, Inc. (CSE: IAN) issued a press release announcing the opening of medical dispensary MPX-NJ in Pennsauken, NJ and the grand opening celebration at MPX-NJ's Gloucester Township, NJ for adult use sales. According to the press release, the opening of its Pennsauken, NJ dispensary gives iAnthus three (3) locations in New Jersey and 36 across the United States. iAnthus holds 50 cannabis licenses across 9 United States and 3 Canadian provinces that are in either active status or pending approval.

And finally, Canadian Tier 1B CRB SOL Global Investments Corp. (CSE: SOL) announced in a September press release that “portfolio company Andretti Acquisition Corp. (NYSE: WNNR), a publicly traded special purpose acquisition company, has entered into a definitive business combination agreement with Zapata Computing, Inc. which will result in Zapata AI becoming a U.S. publicly listed company”. Furthermore, “SOL Global, a founding investor in Andretti Acquisition, invested US$3.456 million and currently holds 1.430 million shares. Post completion of the transaction, SOL Global will hold 1.208 million shares net of agreements to assign shares to other investors, and 3.450 million warrants exercisable at US$11.50/share that expire 5 years from completion of the Business Combination.” As this combination is unrelated to cannabis (it is related to AI and technology), it will leave SOL Global’s active cannabis license count unchanged at 98 across 13 states and the District of Columbia.

Select CRB Business Transaction Highlights:

|

Company Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1B |

Vegas marijuana company Planet 13 with plans for huge Orlando shop buys Florida-based VidaCann |

||

|

Tier 1B |

Shinnecock Nation Will Open Tribally Owned Cannabis Dispensary This Fall |

||

|

Tier 1B |

|||

|

Tier 1B |

High Tide To Open Second Canna Cabana Location in Brampton, Ontario |

||

|

Tier 1B |

Cresco Labs Opens 33rd Florida Sunnyside in Jacksonville, 70th Store Nationwide |

||

|

Tier 1A |

Trulieve Opening Medical Cannabis Dispensary in Pace, Florida |

||

|

Tier 1B |

|||

|

Tier 1A |

Flora Growth Corp. to Acquire Australian Vaporizers; Expects Immediate Profit Contribution |

||

|

Tier 1B |

Security/Exchange Highlights:

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Action |

CRBM Tier/Sector |

|

Added to DB |

Tier 1B/ Owner/Investor |

||

|

Added to DB |

Tier 1B/Owner/Investor |

||

|

Added to DB |

Tier 3/Professional Services |

Cannabis Regulatory Updates - August 2023

We continue to monitor two stories from the US Federal Government: First, in late August it was reported in Marijuana Moment that the Head of the US Department of Health and Human Services (HHS) issued a recommendation to the US Drug Enforcement Administration (DEA) “officially recommending that marijuana be moved from Schedule I to Schedule III under federal law”. And Second we are following the progress of the eighth (not a typo, eighth) attempt to pass cannabis financial reforms, now aptly named the SAFER Banking Act.

We used considerable space in our CRB Monitor August Securities Newsletter to provide detail on the HHS rescheduling saga, and one month later the progress is still status quo. With that said, CRB Monitor’s content team has published an excellent summary of the HHS recommendation and the various impacts it would have on CRB Monitor’s range of database users: Taking Cannabis Down to Schedule III: What Does It Really Mean?. And we will continue report on this potentially industry-changing event as it progresses.

As for the SAFER Banking Act, who doesn’t believe in that old saying, “eight times a charm”? And it is a certainty that cannabis investors, CRBs, and cannabis consumers alike are united in their hope that this one ultimately makes it to the President’s desk for a signature. But in spite of the considerable optimism out there in the media, this bill will face some hurdles on its journey from committee, to the Senate Chamber, to the House, then to Mr. Biden. In a September article on CNBC.com, it was reported on September 27th that this new version of SAFE Banking “that aims to give the marijuana industry access to banking services” advanced out of the Senate Banking Committee with a bipartisan 14-9 vote and will now move to the Senate floor. In the words of the article, “The bill would provide legal protection to banks or other financial institutions that offer services to state-legal marijuana businesses.”

The opposition to SAFER Banking comes from two flanks: 1) legislators on the left who are pushing for social reforms who are not happy moving this bill forward without their priorities attached; and 2) Republicans on the right who are opposed to handing the cannabis industry or the Democrats any form of a victory. Therefore, SAFER Banking is by no means a slam dunk and we will see how it plays out in Congress in the coming months.

For both of the above game-changing events (rescheduling and financial reforms), we will get ourselves some fresh popcorn and watch them as they play out.

Meanwhile in Ohio, it was reported in September in Marijuana Moment that “roughly three out of five Ohio voters support a marijuana legalization measure that will appear on November’s ballot, according to a newly released poll, with nearly two thirds of respondents saying they believe legalization in the state is “inevitable.”

With several polls pointing toward overwhelming support for legalizing adult use marijuana, the issue heads for the ballot in November in the form of “Issue 2”.

The ballot measure allows for the following:

- Possession of up to 2.5 ounces of marijuana or 15 grams of marijuana extract by adults;

- Ohioans could purchase marijuana at retail locations or grow up to 12 plants in a private residence (where at least two adults reside); and,

- Retail cannabis products would be taxed at 10%.

If this measure passes Ohio could become the 24th state to legalize cannabis for recreational use.

Also in September, and interestingly enough, it was announced in Cannabis Health News that The Netherlands plans to launch a cannabis legalization pilot in December 2023. This might be a surprise to those of us who have visited the Netherlands, where cannabis has been a staple in coffee shops for decades. According to the announcement: “Under current laws, coffee shops are allowed to sell small amounts of cannabis to consumers, but they must operate under strict rules, and suppliers are prohibited from selling any cannabis to the businesses, creating what has become known as the ‘backdoor policy’... the sale and cultivation of cannabis for recreational purposes remains illegal outside of these establishments”.

What has been approved by Netherlands’ officials is a program called Wietexperiment (Weed Experiment), which permits several cultivators to supply legal cannabis to coffee shops in 10 cities throughout the Netherlands.

Now onto Maryland, where it was announced in early September that regulators released the guidelines for social equity applicant eligibility as well as detailed information for an online verification portal, both of which are related to the long-awaited launch of adult-use cannabis in the state. According to the article, “...social equity applicants seeking cannabis business licenses in Maryland must control at least a 65% interest in the company and meet one of the following criteria:

- Lived in a disproportionately impacted area for at least five of the past 10 years.

- Attended a public school in a disproportionately impacted area for at least five years.

- Spent at least two years at a four-year college or university in Maryland where at least 40% of enrollees received a Pell Grant.”

Now for some interesting news out of Thailand, where regulators are pulling back on cannabis: An article in MJ Biz Daily reported that Thailand’s new prime minister announced that there are “plans to rewrite its cannabis laws to allow only medical use, a move that would halt widespread recreational sales and fundamentally alter the industry.” In an interview with Bloomberg, newly-elected Prime Minister Srettha Thavisin, said there is a need to “rewrite the law” to stop adult-use sales from occurring. He is quoted as saying, “The problem about drugs has been widespread lately.”

Apparently this fear of widespread, recreational cannabis usage is a real scourge in the eyes of the current administration and it pledges to turn things around. As such Thavisin said his government would “rectify” the country’s cannabis policies and allow only medical use as part of a “middle ground” solution. According to the article, “Thailand decriminalized cannabis about a year ago but failed to immediately implement comprehensive regulations and enforcement mechanisms to restrict what would be sold and where. Thousands of stores opened in an ensuing regulatory vacuum, promoting politicians to pledge to address the issue.”

Finally, news from New York, the state that seems to struggle at every turn to get its legal cannabis business right: In September reported Bloomberg published an article entitled “New York’s Weed Stores Are Exposing Banks to Illegal Drug Sales” (a headline that essentially says it all). The reality is that consumers of cannabis products in the State of New York have been exposed to the risks of illegal, unlicensed cannabis businesses since CRBs started selling legal, adult-use marijuana there in 2022. In the words of the Bloomberg report, “The proliferation of unlicensed marijuana stores across New York City the last two years has had an unexpected consequence for banks and real estate owners: Many are now intertwined in the cannabis business.” And the end to this nightmare is nowhere near in sight, as the article adds: “The shops appeared slowly and then seemingly all at once, with the unlicensed sellers taking advantage of a regulatory vacuum in the aftermath of the state’s 2021 legalization of recreational marijuana. There are now as many as 2,000 in the five boroughs, even though the unauthorized sale of cannabis products is illegal.”

This illicit activity has had a significant impact on banks that are keen to provide services to legal businesses but have been forced to take a measured approach to lending to CRBs that appear to be legitimate operators. With that said, according to regulators there is a high probability of a financial institution unknowingly lending to a CRB that is unlicensed. The article quotes Sharon Cohen Levin, a former federal prosecutor who serves as a partner in the criminal defense and investigations group at Sullivan & Cromwell: “If a bank provides financing to a customer who leases property to a marijuana business, the bank is likely receiving funds derived from illegal marijuana sales...If a bank has multiple customers who lease property to marijuana businesses and the bank misses that and fails to report the suspicious transactions – it would likely raise concerns about the strength of the bank’s anti-money laundering program.”

Fortunately for customers of CRB Monitor, this risk can be minimized and managed through consistent use of the gold standard in cannabis market intelligence, the CRB Monitor Database.

CRBs In the News

The following is a sampling of highlights from the August 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"