James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Related Equity Performance

Cannabis Equity Index Returns - What’s with the Rally?

Pure play cannabis equities surged in mid-July, then slumped, then (in non-cannabis fashion) surged again at the end of the month. What happened? We will go deeper into the possible reasons for July’s peaks and valleys, but first let’s take a look at the range of July’s CRB equity returns.

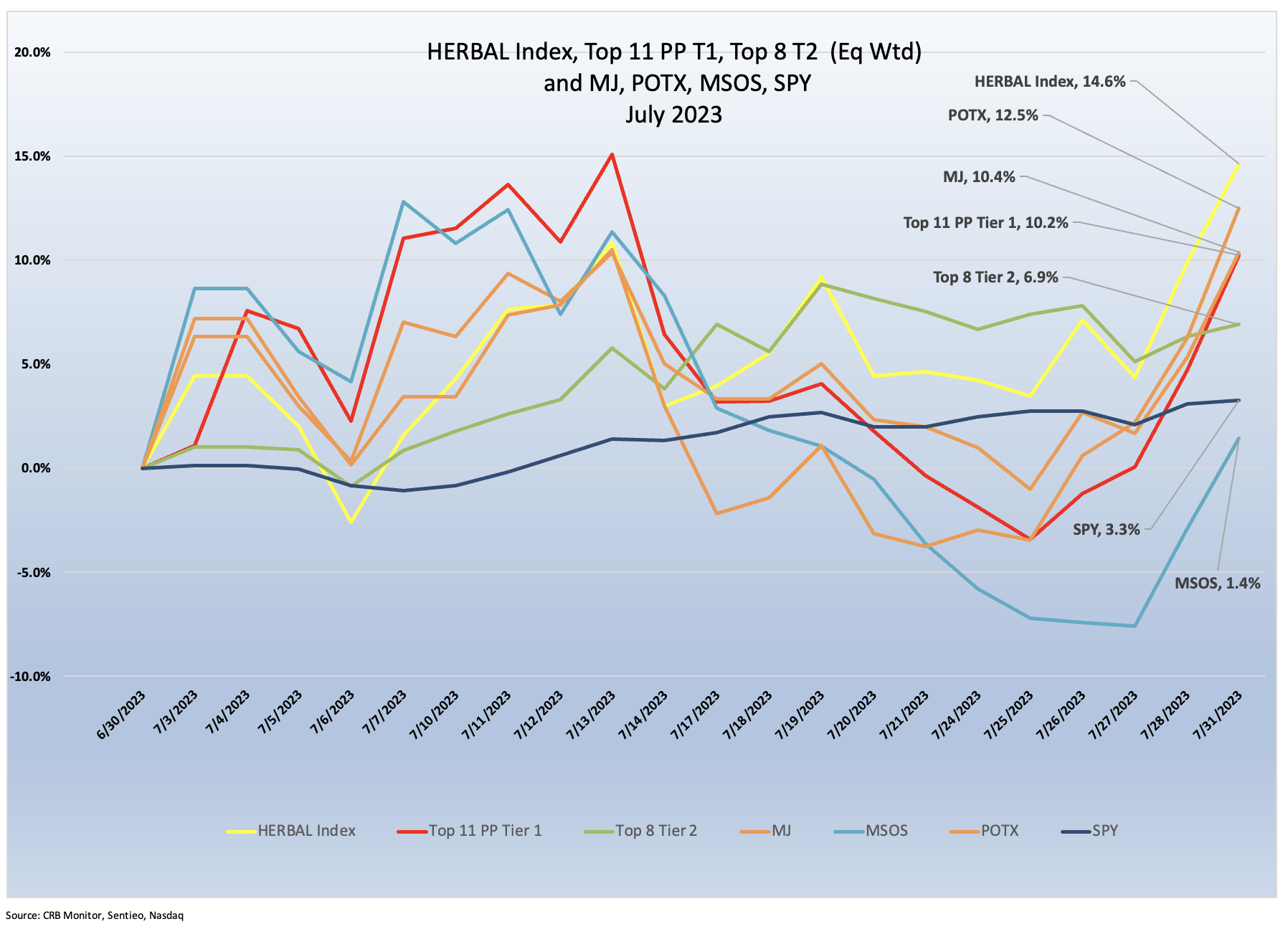

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), significantly outperformed its peers in July 2023. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a positive 14.6% in July 2023 and finished ahead of its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (+12.5%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al).

HERBAL finished substantially ahead of the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+10.4%) and trounced the Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which finished July at +1.4%.

MJ’s performance is likely to deviate from HERBAL’s due to a significant percentage of non-Pure Play cannabis holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. And more recently, MJ added and maintains a 30% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure. There also appears to be a large balance (10%) in a cash vehicle, which will serve as a persistent performance drag if maintained at that level.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can deviate materially from HERBAL’s as well, largely due to its holdings of CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap was +10.2% in July 2023, with the constituents’ returns being mixed between the Canadian (non-MSO) component and the MSO component (see the table below).

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap finished the month lagged behind the Tier 1 CRB basket, posting a positive 6.9% return in July. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group.

US equities were modestly higher in July as the Fed has signaled a likely end to rate increases in the short term and by several indications the US economy is no longer a runaway train. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a positive 3.3% for the month, outperforming the cannabis indexes for the month of July.

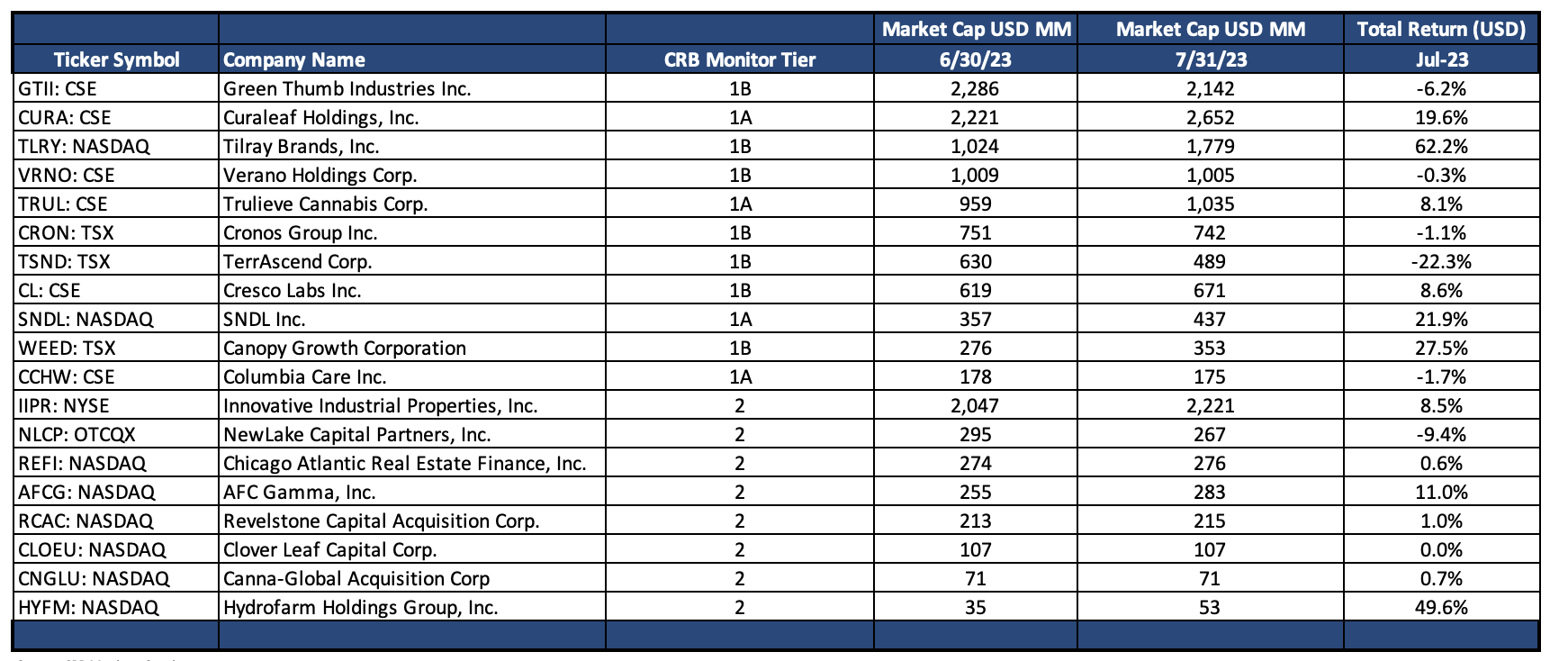

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – July 2023 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities returned +10.2% for July 2023, with a broad range of returns across the Canadian and MSO groups.

CRB equities were overall lower in July, and the abovementioned wide range of returns provided investors with little optimism, particularly those who are invested in the fallen hero Canopy Growth Corporation (TSX: WEED) (-54.9%). We frequently see the Canadian (non-US plant-touching) group deviate from the US multistate operator MSO group, given their individual sensitivities to various factors, with the most profound of these factors being the progress toward US federal legalization. [With that said, this time around the results were a mixed bag and we will take a closer at Canopy Growth in a few paragraphs.]

The “legal” Canadian CRB basket gave investors a few surprises in the month of July. Tilray Brands, Inc. (Nasdaq: TLRY) (+62.2%) was the obvious standout, with essentially all of its upside coming in the last few trading days of the month following their Q4 and Full Fiscal Year earnings report that significantly beat expectations. And while the company was reporting losses, the losses were less negative than analysts had anticipated, which caused the stock to spike on July 27th and continued to rally into the close on July 31st. Meanwhile, SNDL, Inc. (Nasdaq: SNDL) (+21.9%) also finished strong while Cronos Group Inc. (TSX: CRON) (-1.1%) did not seem to catch fire like several of its competitors in Tier 1.

Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (+27.5%) clawed back some of its recent losses but let’s face it, Canopy faces a world of hurt going forward. As we reported in our June Cannabis Securities Newsletter, the July 23 report of Canopy’s Q4 and Fiscal 2023 Financial Results featured a healthy dose of doom and gloom with the general characterized by two words: “losses” and “restructuring”. Canopy is now committed to cost reduction and realignment of business lines. In July the S&P TSX announced that due to its low share price, Canopy Growth would be dropped from S&P/TSX Composite Index, Canada's equivalent of the S&P 500.

Onto the MSO basket: Curaleaf Holdings, Inc. (CSE: CURA) (+19.6%) popped on July 7th amid speculation that they were cozying up to Canadian Tier 1B Cronos Group Inc. (TSX: CRON). While the press release confirmed that there was some indication of interest in a deal, Curaleaf representatives issued their own press release stating that “There is no guarantee that any potential transaction will materialize.” Nevertheless, the market appreciated the rumor, at least as Curaleaf’s shares were concerned. As we stated above, Cronos shares were slightly negative for July. Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) (+8.1%) rebounded in early July as they continued on their campaign to open new cannabis operations in several states (Maryland, Ohio, Georgia).

And Tier 1B MSO TerrAscend Corp. (TSX: TSND) (-22.2%) tumbled in spite of the June 29th announcement of its approval to trade on the Toronto Stock Exchange (TSX). While this approval would be considered a positive, we would compare it to a band that gets its opportunity to play Carnegie Hall but without any fans in town to see them. Said a different way, TerrAscend stock will face the same headwinds regardless of where they trade, as long as there is no discernable path toward US legalization. Investors in publicly-traded cannabis equities do not care nearly as much about the exchange on which they transact as they do the underlying demand for the actual products. Nevertheless, a TSX listing opens the door to TerrAscend’s inclusion in non-US plant touching indexes and ETFs, and we will stay tuned for that development as it happens. Now the largest Tier 1 pure play CRB by market cap, Green Thumb Industries Inc. (CSE: GTII) (-6.2%) was lackluster in July as analysts speculated on the upcoming quarterly earnings report, which drops in mid-August.

Finally, in late June Cresco Labs Inc. (CSE: CL) (+8.6%) and Columbia Care Inc. (CSE: CCHW) (-1.7%) closed the book on their 18-month long adventure together, terminating their pursuit of a deal. What a shame. In the words of the July 30, one-sentence joint press release, Cresco and Columbia Care “today announced that they will not be able to complete the divestitures necessary to secure all necessary regulatory approvals to close the pending transaction by the outside date of July 30, 2023 that is specified in the arrangement agreement dated March 23, 2022 and amended on February 27, 2023. At this stage, Cresco and Columbia Care are working amicably with respect to the next steps in relation to the transaction and will provide further updates in the near future.”

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 6.9% return for July 2023, which underperformed the equally-weighted Tier 1 basket by 3.5%. because these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically; however, we also feel that there is no need to try to game them as a strategy. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict. And furthermore, the costs required to rebalance these illiquid baskets could eat up any meaningful profits.

Performance across the (now down to an 8-company) Tier 2 basket was largely positive in July. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (+8.5%), was positive for the second month in a row; however, it has a long way to go to claw back the last 2 years of disappointing returns. By their own admission, IIPR is “an internally-managed real estate investment trust ("REIT") focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” IIPR’s price chart has resembled a treacherous mountain range, with as many valleys as it has had peaks and overall, the volatility of this stock has been breathtaking. In June, IIPR declared its quarterly dividend ($7.20 per share), which followed its May 8th positive earnings report. Apparently investors were pleased with these announcements, hence the 2-month positive run.

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (+49.6%) who’s shares surged throughout the month of July. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day, as it did in July. With its price now oscillating around 80 cents, HYFM is now in the midst of consolidation and restructuring, and we believe we have seen the exodus of most investors, who took their optimism with them. Stay tuned for HYFM’s quarterly earnings, which will be reported in early August.

Chart of the Month: Psychedelics-related Businesses (PRBs)

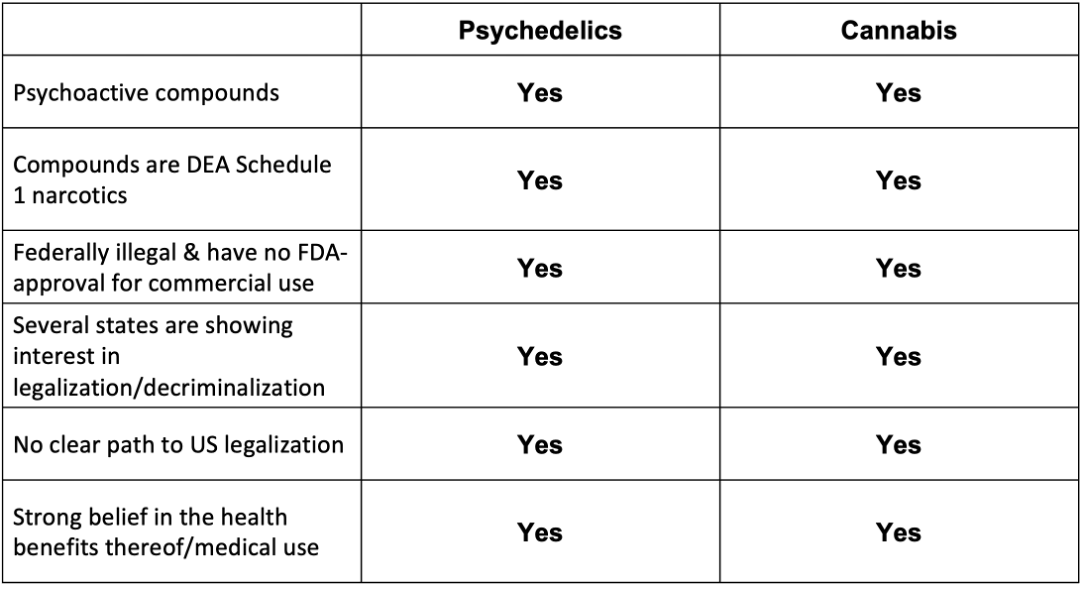

CRB Monitor initiated coverage of psychedelics-related businesses (PRBs) in early 2022. We consider this industry to be early-stage, and it bears a striking resemblance to the beginnings of the cannabis industry. Looking at comparative table below, it is easy to see why PRBs are a natural fit for CRB Monitor’s securities research:

Source: CRB Monitor, https://www.dea.gov/drug-information/drug-scheduling, https://www.greenstate.com/explained/where-are-psychadelics-legal-in-the-us/

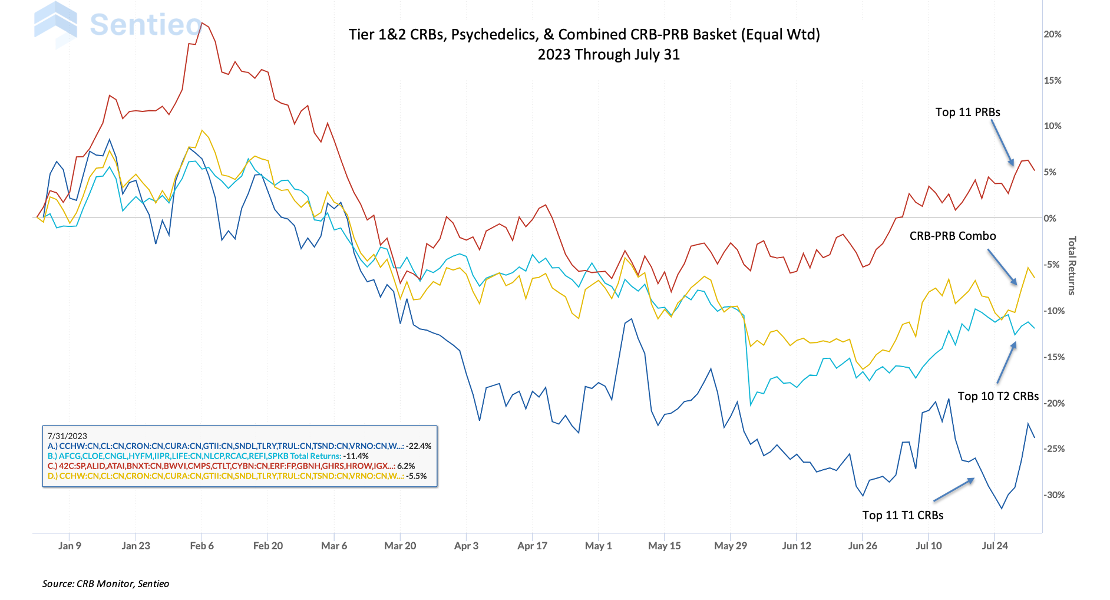

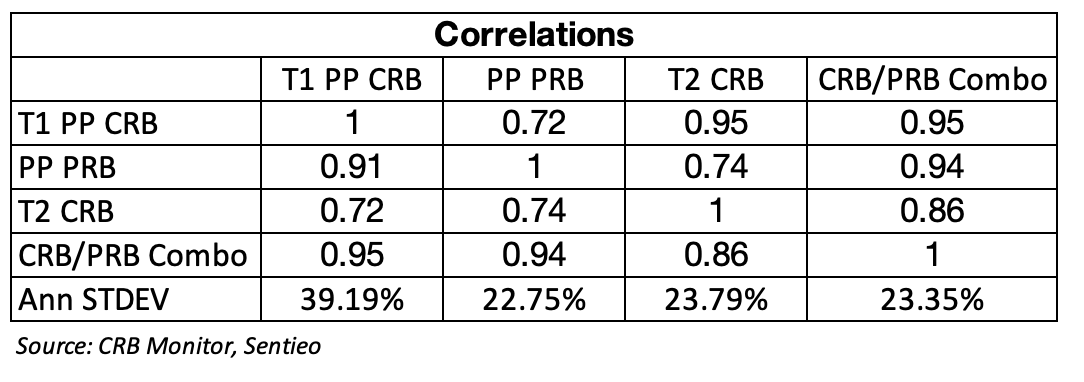

We took a look at year-to-date performance of 4 equity baskets (all pure play, all equally-weighted): 1) Top 11 PRBs, 2) Top 11 Tier 1 CRBs, 3) Top 10 Tier 2 CRBs, 4) PRB/CRB combination.

In terms of equity returns for these two themes, it is important to note that the current supply of investable PRBs is relatively small. While CRB Monitor has identified more than 200 publicly-listed companies in the psychedelics space, there is a significant drop-off in liquidity after the largest handful of companies in the basket. With that said, information can be gleaned from the chart below. What you are looking at is 2023 year-to-date performance for four baskets of equities, all equally-weighted and pure play: 1) the “Top 11 Tier 1 CRBs” and 2) “Top 10 Tier 2 CRBs” from our monthly analysis; plus 3) the Top 11 PRBs by market cap, and 4) a combined CRB/PRB basket, that includes both Tier 1 and Tier 2 CRBS and PRBs:

Not surprisingly, the CRB basket (in spite of the recent July rebound) is under water in 2023, as is the Tier 2 basket (albeit to a lesser extent). The PRB basket has been performing well over the last two months and could be a reflection of recent positive news regarding psychedelic therapy as a viable treatment for a range of mental health issues, like this article from the Sacramento Bee.

Looking at the table below we see that PRBs are not as highly correlated to CRBs as we might expect, which is a good thing as we are looking for this basket to serve as a diversifier while enhancing returns. PRBs also exhibited a lower standard deviation relative to CRBs for this time period and we will reserve judgement until we view the results over longer periods going forward. With that said, the numbers are encouraging.

Given the short time period of this analysis we will take these results with a grain of salt, but as an investment, psychedelics have held their own (while cannabis has struggled) and the combined portfolio diversifies much of the risk of the CRB component while delivering a return that outperforms both CRB baskets. And we are encouraged by the growth in this nascent industry, which shows us that interest in psychedelics as an investment, as well as an area of risk for compliance officers, are here to stay.

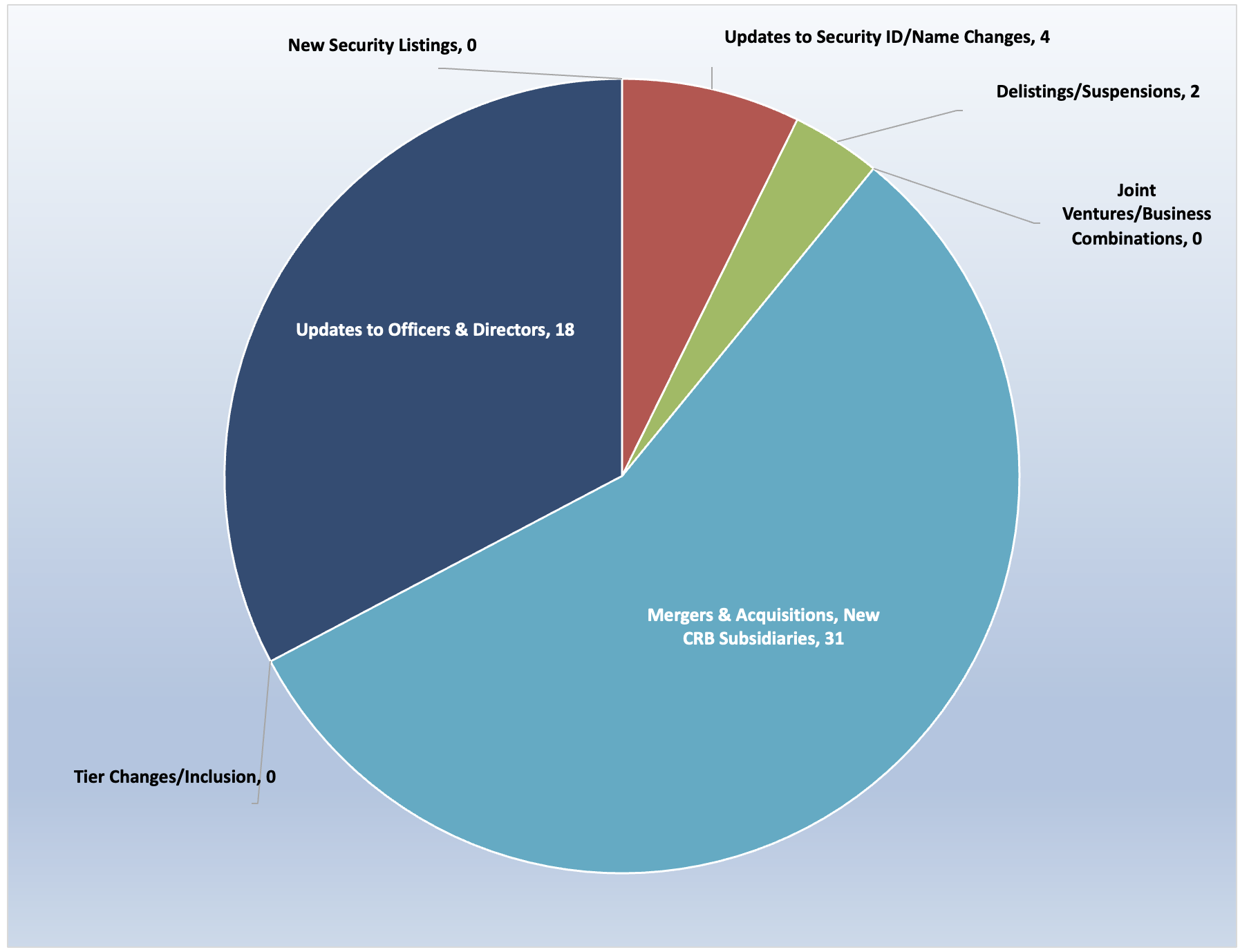

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for July 2023:

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News - July 2023

With the failure of the 18-month journey that was the Cresco Labs/Columbia Care acquisition (see summary below), for the foreseeable future investors are sticking the proverbial fork in any significant M&A activity. With that said, the larger CRBs, particularly the multistate operators (MSOs), continue to expand their operations in cannabis-friendly states. Meanwhile, Canadian operators (those without US touch points) appear to be in a state of limbo as they wait in earnest for any indication of upcoming US Government reforms that would allow them to transact across the US border.

Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) announced in a July press release that the Company intends to commence selling of recreational cannabis sales in Maryland at their four licensed dispensaries located in Aberdeen, Crofton, Ellicott City, and Laurel beginning Saturday, July 1st. According to the announcement, “Ascend acquired these dispensaries on April 28th, 2023 and has since rebranded the four stores to the ‘Ascend’ brand. The Company also made significant aesthetic and operational improvements to the stores, including doubling points of sale at many of the locations in anticipation of adult-use demand.” With these new licensed subsidiary businesses, Ascend holds 71 cannabis licenses through its subsidiary businesses in seven states.

Tier 1B CRB Lifeist Wellness Inc. (TSXV: LFST), announced in a July 21 press release that it closed on its acquisition of Ontario Inc. (“Zest”) for $3,411,707.90. In the words of Meni Morim, CEO of Lifeist "Our primary objective is to improve our profitability through expanding our product portfolio through strategic acquisitions and internal development, offering consumers a diverse range of choices for unique health and wellness experiences. With the addition of high-margin Zest products, alongside Roilty and other high-quality brands, CannMart continues its growth trajectory to provide convenience and satisfaction to both consumers and provincial buyers in the marketplace." Lifeist currently holds 7 active cannabis licenses to operate in 3 Canadian provinces.

Also in July, Legendary Canadian Tier 1A CRB Aurora Cannabis Inc. (TSX: ACB) issued a press release announcing that “a wholly-owned subsidiary of the Company has closed the sale of its Medicine Hat, Alberta facility on July 21, 2023 to Bevo Farms Ltd., a wholly-owned subsidiary of Bevo Agtech Inc. The sale of the Aurora Sun Facility was completed via Bevo Farms’ acquisition of one of Aurora’s wholly-owned subsidiaries.” The announcement goes on to say that “Aurora has a controlling interest in Bevo, one of the largest suppliers of propagated vegetables and ornamental plants in North America.” CRB Monitor includes this private subsidiary business as a Tier 1B CRB, regardless of its connection to the cannabis industry (in this case, Bevo has none other than their relationship to ACB).

And now for the bombshell: Tier 1A MSO Columbia Care Inc. (CSE: CCHW) and Tier 1B MSO Cresco Labs Inc. (CSE: CL) announced in a brief press release on July 31 that “a mutual agreement, dated July 30, 2023, to amicably terminate the definitive arrangement agreement dated March 23, 2022, as amended on February 27, 2023, pursuant to which Cresco agreed to acquire all of the issued and outstanding shares of Columbia Care. There are no penalties or fees related to the mutual agreement to terminate the Transaction.” This roller coaster ride proved to be too high a legal hurdle for both parties, who were required to divest of a number of subsidiary businesses by June 30th in order to satisfy regulators. That hurdle, in addition to the failure of lawmakers at the federal level to make substantial progress on any cannabis-related reforms, seemed to be the dagger in the heart of this deal from the very beginning. With that said, the two companies will continue to operate individually as they attempt to hold the attention of investors, who have had little to celebrate about in the last two years. Following the separation, Cresco’s active license count sits at 69 across 8 states while Columbia Care’s is 115 across 13 states plus DC and Puerto Rico.

An excellent epilogue to the Cresco/Columbia Care adventure, “Failed Cresco-Columbia Care Merger Ices Combs’ Cannabis Deal”, can be found on the CRB Monitor website.

Finally, Tier 1B largely-Florida-based MSO Trulieve Cannabis Corp. (CSE: TRUL) issued a press release in July announcing the opening of s new licensed medical cannabis dispensary in Pooler, GA. While Trulieve has always bragged about its significant operational footprint in Florida (all medical cannabis) it now has cannabis operations in 15 states and 3 Canadian provinces, and has been issued 150 cannabis licenses either directly or through its subsidiary businesses.

Select CRB Business Transaction Highlights:

|

Company Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1A |

SNDL and Nova Cannabis Extend Outside Date for Closing of the Strategic Partnership |

||

|

Tier 1B |

AWH to Launch Adult-Use Sales at Four Maryland Dispensaries on July 1 |

||

|

Tier 1B |

Trulieve Announces Opening of Medical Cannabis Dispensary in Pooler, GA |

||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1A |

|||

|

Tier 1A |

|||

|

Tier 1B |

High Tide to Open Canna Cabana Location in St. Thomas, Ontario |

||

|

Tier 1B |

Clever Leaves Completes Sale of Processing Assets in Portugal to Curaleaf International Subsidiary |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

New Sec ID/Name Change |

Minaro Corp. (MNAO) Completes Rebranding to Pineapple Express Cannabis Company (PNXP) |

||

|

Stock Suspensions/Delistings |

|||

|

New Listings |

Endexx Corporation Announces Uplisting to OTCQB Venture Market |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Action |

CRBM Tier/Sector |

|

Added to DB |

Tier 1B/Owner/Investor |

||

|

Upgraded from Tier 2 to Tier 1B |

Tier 1B/Owner/Investor |

||

|

Downgraded from Tier 1B to Tier 2 |

Tier 2/SPAC |

||

|

Moved to Watchlist |

Tier 3/IT Services & Software |

Cannabis Regulatory Updates - July 2023

Here are some of the cannabis-related regulatory highlights from July 2023:

We begin in Washington State, which has officially launched an online portal that people can use to request reimbursement of their legal fees if they were prosecuted under drug criminalization laws that the state Supreme Court deemed unconstitutional in 2021. A story on marijuanamoment.net reported that the Administrative Office of the Courts (AOC) launched the Blake Refund Bureau website “to facilitate the relief in coordination with courts, county clerks, public defenders, prosecutors, advocates and other stakeholders.” The article goes on to report: “The novel reimbursement fund is being created following the state Supreme Court’s landmark 2021 ruling in Washington v. Blake that found the state’s criminal code for drug possession crimes was unconstitutionally flawed because it didn’t take require proof that a person knowingly committed the offense—creating a situation where people could be criminalized for inadvertent possession.”

Great news out of Missouri: in July an article on the website komu.com reported that since adult-use marijuana sales started in Missouri on 2/3/2023, an average of $4mm of legal cannabis has been sold per day, according to the Missouri Cannabis Trade Association (MoCannTrade). In the words of the article, “Over those five months, total marijuana sales in Missouri have reached over $592 million. In June alone, sales of adult-use and medical cannabis totaled $121.2 million, the fourth month in a row sales reached $120 million, according to Missouri's Division of Cannabis Regulations. More than 16,000 direct jobs in the cannabis industry have been created since February, compared to only 8,571 jobs during this time last year, according to the MoCannTrade.”

Now from the United Kingdom, as reported in July on Hempgazette.com: the Cannabis Industry Council (CIC) says allowing more doctors to prescribe medical cannabis could slash NHS waiting lists. According to the article, “Currently in the UK, patients are unable to have medical cannabis products prescribed by their GP – they must be prescribed by a specialist hospital doctor. This has resulted in the number of patients using legally prescribed medicinal cannabis remaining very low. The CIC has been calling for change, most recently through its ‘Protect Our Patients’ campaign that is lobbying for GPs to have prescribing rights.” And the challenges are real, leaving many patients out of luck as they await treatment. The article goes on to say, “In a new report associated with that campaign, the CIC notes NHS waiting lists have now reached 7.4 million. It says the NHS estimates 34% of adults have chronic pain, and many on its waiting lists would be chronic pain patients seeking treatment for their condition. As medical cannabis can be effective in treating chronic pain symptoms – and improve quality of life – its broader use could help drive down waiting lists.”

News out of Luxembourg: An article in marijuanamoment.net reported that Luxembourg’s Parliament has approved a bill to legalize adult use marijuana possession and cultivation. In the words of the article, “About two years after the government first proposed ending cannabis prohibition, members of the Chamber of Deputies passed the non-commercial legalization bill in a 38-22 vote...This makes Luxembourg the second country in the European Union to enact the reform, following Malta’s vote to legalize in 2021. The law in Luxembourg, which was first proposed by the ministers of justice and homeland security in 2021, will allow adults to possess up to three grams of cannabis and grow up to four plants in a secure location within their private residence.”

Also in July, an article in mjbizdaily.com reported that a Native American tribe plans to open the first adult-use marijuana store in Minnesota on Aug. 1, when the state’s new law legalizing cannabis possession and retail sales takes effect. NativeCare, currently a medical marijuana retailer, will start selling recreational cannabis on the Red Lake Nation to adults 21 and older, the Star Tribune reported.

Finally, in Connecticut it was reported that adults 21 and older can officially start growing their own marijuana plants for personal use, as one of the latest provisions of the state’s cannabis legalization law to take effect. An article published on marijuanamoment.net reported that the following would now be in effect:

- Adults 21 and older can cultivate up to six cannabis plants (only three of which can be mature) for personal use.

- Regardless of how many adults live in a shared space, the household plant limit is maxed out at 12.

- Plants must be grown indoors, outside of public view and in a secure location that’s inaccessible to underage people and pets.

- After the marijuana is grown and harvested, regulators are urging adults to store the product in child-resistant packaging.

In the words of the report, “This home grow option is being legalized about six months after Connecticut’s first adult-use retailers opened shop. And the market has quickly expanded, with recreational sales reaching a record high and eclipsing medical cannabis purchases for the first time in May.”

CRBs In the News

The following is a sampling of highlights from the July 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"