James B. Francis, CFA

Chief Research Officer, CRB Monitor

CRB Monitor Securities Database

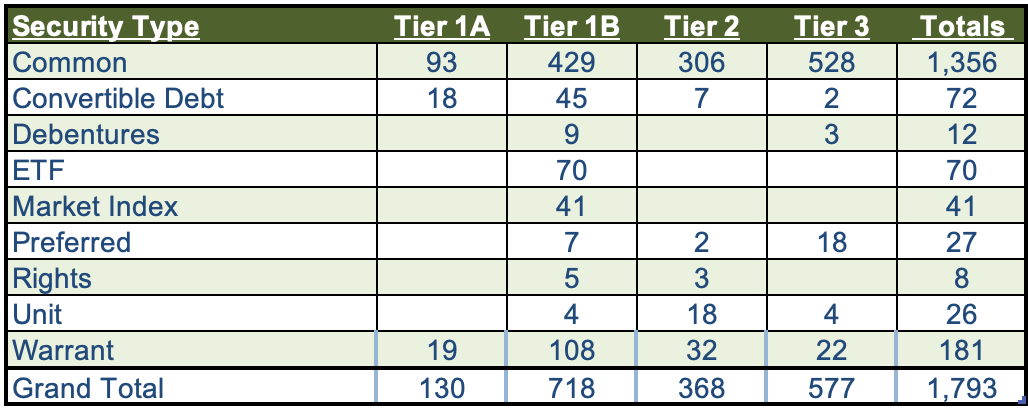

As of March 31, 2022, the breakdown of publicly-traded, cannabis-linked securities was as follows:

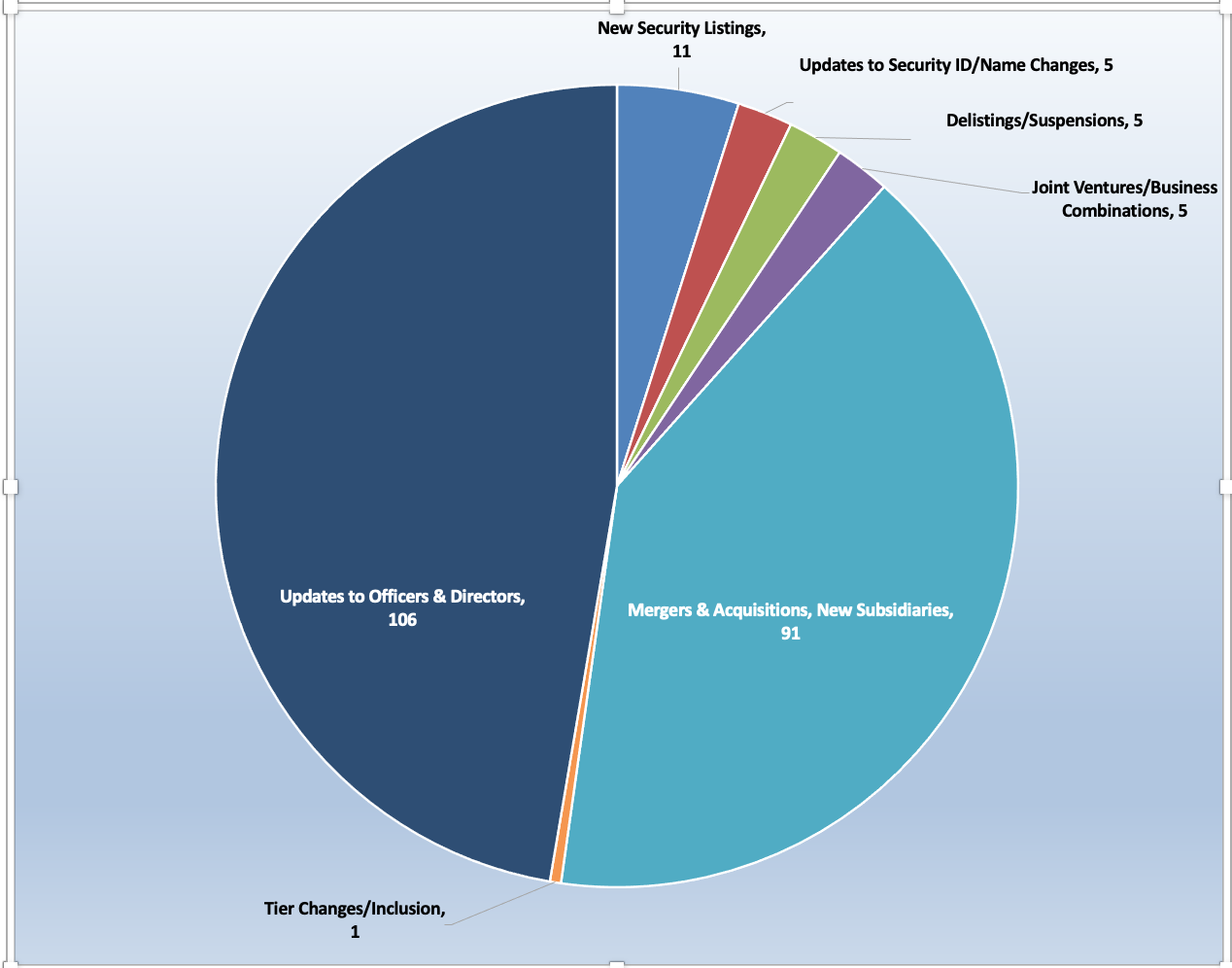

Of the thousands of announcements and filings reviewed during Q1 2022, our daily research resulted in a total of 875 updates to the CRB Monitor database (224 updates to issuers’ records, 651 news releases added). The complete list of securities and detail for these updates can be found in the CRB Monitor database. And for plenty of detail on our updates to the CRB Monitor database, please refer to our monthly newsletters:

CRB Monitor January 2022 newsletter, CRB Monitor February 2022 newsletter, and the CRB Monitor March 2022 newsletter (add link).

News Flash: CRB Monitor Database Enhancements

CRB Monitor is pleased to announce the following securities database enhancements:

- “Pure Play” tag: Primarily for Tier 1 CRBs, a “Pure Play” CRB earns, or intends to earn more than 50% of its total revenue from its participation in the cannabis industry. [By definition, all Tier 2 CRBs are “Pure Play” and all Tier 3 CRBs are “non-Pure Play”.]

- Dividend tag: For Tier 1 and Tier 2 securities, we are adding a “Y” to the security profile if the issuer currently pays a dividend and an “N” if it does not.

- “Pre-IPO” security status. For Tier 1 and Tier 2 CRBs, we will be adding cannabis-related businesses to the CRB Monitor database prior to their initial public offerings with the status “Pre-IPO.”

- License Roll-up For Tier 1 CRBs, we have refined the cannabis license “roll-up” function to exclude relationships that are defined as “related business.” Inclusion in this calculation is now limited to “Owner/Investor” relationships only.

* The Pre-IPO and License Roll-up are effective immediately. We will send out a notification to all CRB Monitor Securities Database clients with the effective date for the new securities extract file that displays the Pure Play and Dividend tags.

CRB Monitor Securities Database Updates – Q1 2022

Source: CRB Monitor

CRBs In the News

We closely tracked the cannabis news cycle throughout the first quarter of 2022, making hundreds of database updates in CRB Monitor related to all types of relevant corporate activity. Cannabis equities suffered early in Q1, then rebounded, and we were there to capture all the critical information necessary to maintain an accurate cannabis-linked securities database. The following is a sampling of highlights, with links to the articles, from the cannabis-linked security news cycle, as tracked by CRB Monitor throughout the period. Included are CRB Monitor’s proprietary Risk Tiers.

In January, Wakefield, MA Tier 1B multistate operator Curaleaf Holdings, Inc. (CSE: CURA), one of leading vertically integrated multi-state cannabis operators in the US, announced the completion of its acquisition of Bloom Dispensaries aka Arizona Natures Wellness, a vertically integrated, single state cannabis operator in Arizona. With the close of the Transaction, Curaleaf's retail footprint has reached 13 dispensaries in Arizona and 121 nationwide. With this acquisition, Curaleaf now operates in 19 states plus the District of Columbia and, through its subsidiaries, holds more than 150 cannabis licenses.

Also in January, 1933 Industries Inc. (CSE: TGIF), a Canada-based vertically integrated cannabis company, announced that it signed a binding letter of intent to acquire 100% of all of the authorized and issued shares of Day One Beverages, Inc., “a disruptive beverage company with a portfolio of next-level CBD-infused sparking water products.” TGIF currently operates in the cannabis industry through its wholly-owned Nevada subsidiary, Alternative Medicine Association LC. Per CRB Monitor, Alternative Medicine Association holds 13 active licenses for cultivation, manufacturing, retail, and wholesale of both recreational and medical cannabis. Day One is a bit of a departure for TGIF, given that its products are non-THC based.

In February, Tier 1B Creso Pharma Ltd. (ASX: CPH), an Australia-based company engaged in developing cannabis and hemp-derived, therapeutic-grade Nutraceuticals and Medical Cannabis products, announced that it has entered the US CBD market, with its acquisition of a Colorado based consumer packaged goods company, Sierra Sage Herbs, LLC. According to the press release, “The acquisition provides Creso

Pharma with its maiden entry into the US, an established product suite of plant-based and CBD products generating strong revenues, as well as an existing 90,000 points of sale with major retailers and over 150,000 direct to consumer relationships in one of the world’s largest and fastest growing markets.”

In March, the MSO world was turned on its head as Cresco Labs Inc. (CSE: CL) announced that it would acquire all of the issued and outstanding shares of Columbia Care Inc. (NEO: CCHW), in a deal worth $2 billion. This represents a consolidation of the operations of two of the largest plant-touching, US marijuana businesses, and could be an indication of things to come.

The press release stated that shareholders of Columbia Care “…will receive 0.5579 of a subordinate voting share of Cresco Labs for each Columbia Care common share (or equivalent) held based on the closing price of CL on March 22, 2022.” Furthermore, the Transaction provides Columbia Care Shareholders with “premiums per Columbia Care Share of approximately 16% based on the closing prices of the Columbia Care Shares and the Cresco Labs Shares, and 19%, based on the 20-day volume weighted average prices (“VWAP”) of the Columbia Care Shares and the Cresco Labs Shares, each on the CSE as of March 22, 2022.”

Once this deal has closed, Cresco Labs’ operations will have expanded to 14 states plus Puerto Rico and the District of Columbia, and its license total will approximately double to 183 that are either in active status or pending approval.

Regulatory Updates

In January, Rep. Ed Perlmutter (D. Colorado), the sponsor of the Secure and Fair Enforcement (SAFE) Banking Act, announced that he is seeking to attach an amendment that provides for research and innovation in the tech and manufacturing sectors. [In short, The SAFE Banking Act seeks to guarantee legal protections for financial institutions that provide banking services to licensed cannabis-related businesses (CRBs).] To enhance the probability that this bill passes in the Senate, Perlmutter is attaching SAFE Banking to another, non-cannabis related bill called the America COMPETES Act (HR 4521). Why is this necessary? Apparently this strategy would make SAFE Banking more appealing to members of congress that are on the fence. Most of us are old enough to remember that in 2021 SAFE Banking was appended, unsuccessfully, to the National Defense Authorization Act (NDAA). What might complicate matters for SAFE Banking are a couple of hurdles, none the least of which is that Rep. Perlmutter has announced his imminent retirement from Congress. There is also the issue that, by itself, SAFE Banking is not appealing to the progressive wing of Congress and will likely struggle to pass in the Senate. In the words of Joel Kopperud, Vice President of Government Affairs for The Council in an article published in January:

“Even this issue that enjoys broad bipartisan support appears to be constrained by progressive advocates who are fighting for more sweeping cannabis reform and holding SAFE hostage. Those efforts, led primarily by Senators Cory Booker (D-New Jersey) and Jeff Merkley (D-Oregon), are countering the SAFE Banking Act with criminal justice reform and descheduling measures. They would ask if the first cannabis reform law should benefit the business community or free incarcerated Americans still serving time for cannabis-related crimes.”

Then it was reported in February that Senate Majority Leader Chuck Schumer announced that he’ll formally introduce his bill to legalize cannabis in the Senate this April, saying that marijuana policy reform “is a priority for me.” Schumer, a Democrat and the senior US senator from New York, made his comments at a February 4th event in New York City attended by fellow lawmakers and drug policy reform advocates. Schumer first said last July that he planned to introduce the Cannabis Administration and Opportunity Act (CAOA) to legalize and regulate marijuana at the federal level.

The news cycle continued to be active in March with plenty of buzz surrounding efforts by members of the Federal government to keep legalization moving ahead. Facing a sharp divide along party lines, legislators continued to soldier on, led by Senate Majority Leader Chuck Schumer (D-NY) as well as (mostly Democratic) members of the House of Representatives. Most of this activity involves two critical pieces of legislation: The Marijuana Opportunity Reinvestment and Expungement (MORE) Act and the Secure and Fair Enforcement (SAFE) Banking Act. While the MORE Act focuses on legalization and decriminalization of marijuana, SAFE Banking is concerned with removing the existing barriers that prevent financial institutions from processing cannabis-related transactions.

According to a March article in Forbes regarding the MORE act: “”We expect the MORE Act to clear the House once again, but we view it primarily as a messaging bill as it has no viable path to passage through the Senate,” said BTIG strategist Isaac Boltansky in a recent note to clients.”

We have also seen quite a bit of activity in several states, as we have reported on legalization measures making progress in Ohio, Rhode Island, Mississippi, South Carolina, Maryland, South Dakota, Texas, Kentucky, and Michigan. For the specifics on these states’ recent regulatory gymnastics, be sure to check out the CRB Monitor January 2022 newsletter, the CRB Monitor February 2022 newsletter, and the CRB Monitor March 2022 newsletter (add link).

Cannabis-Linked Equity Performance

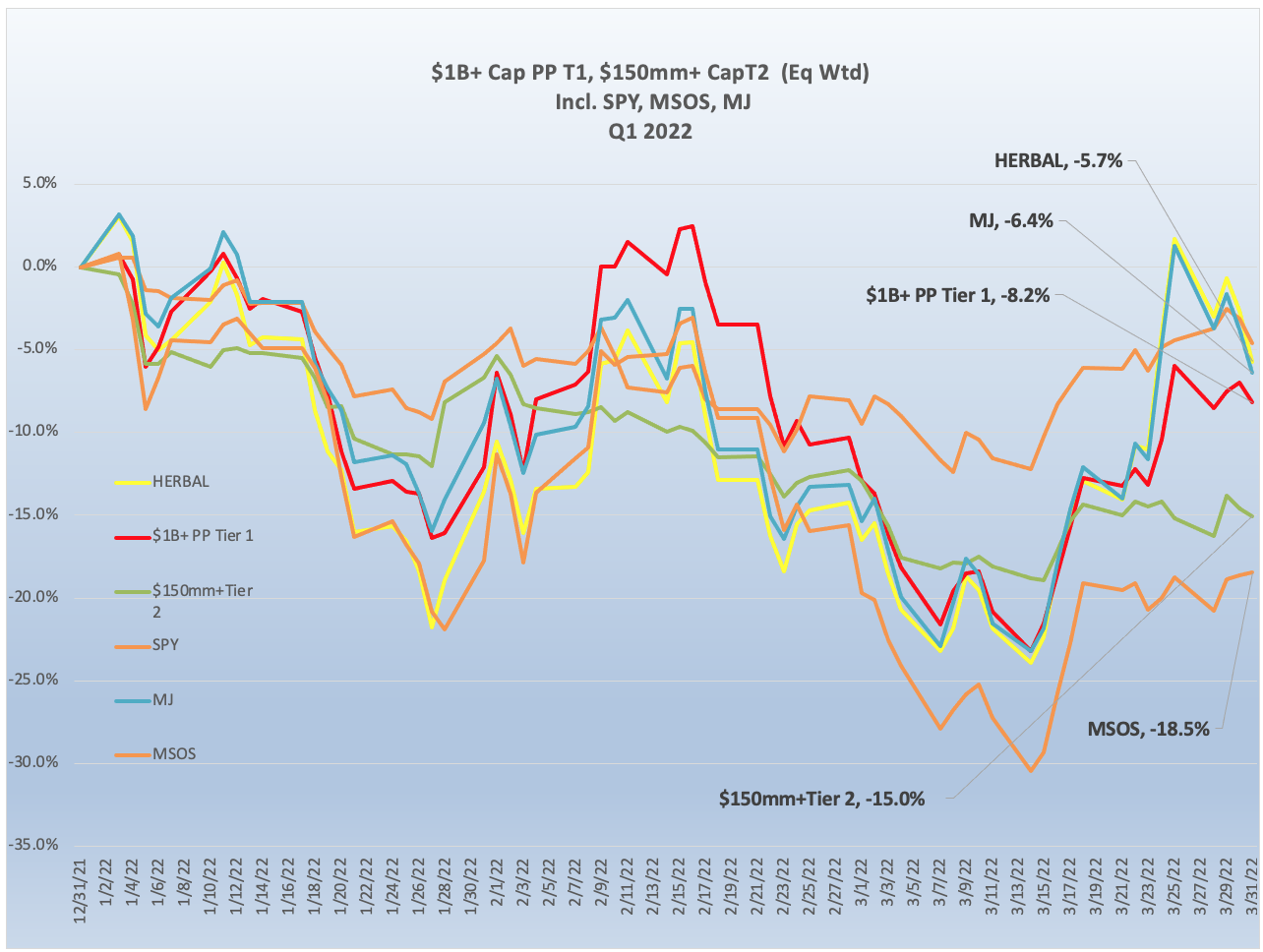

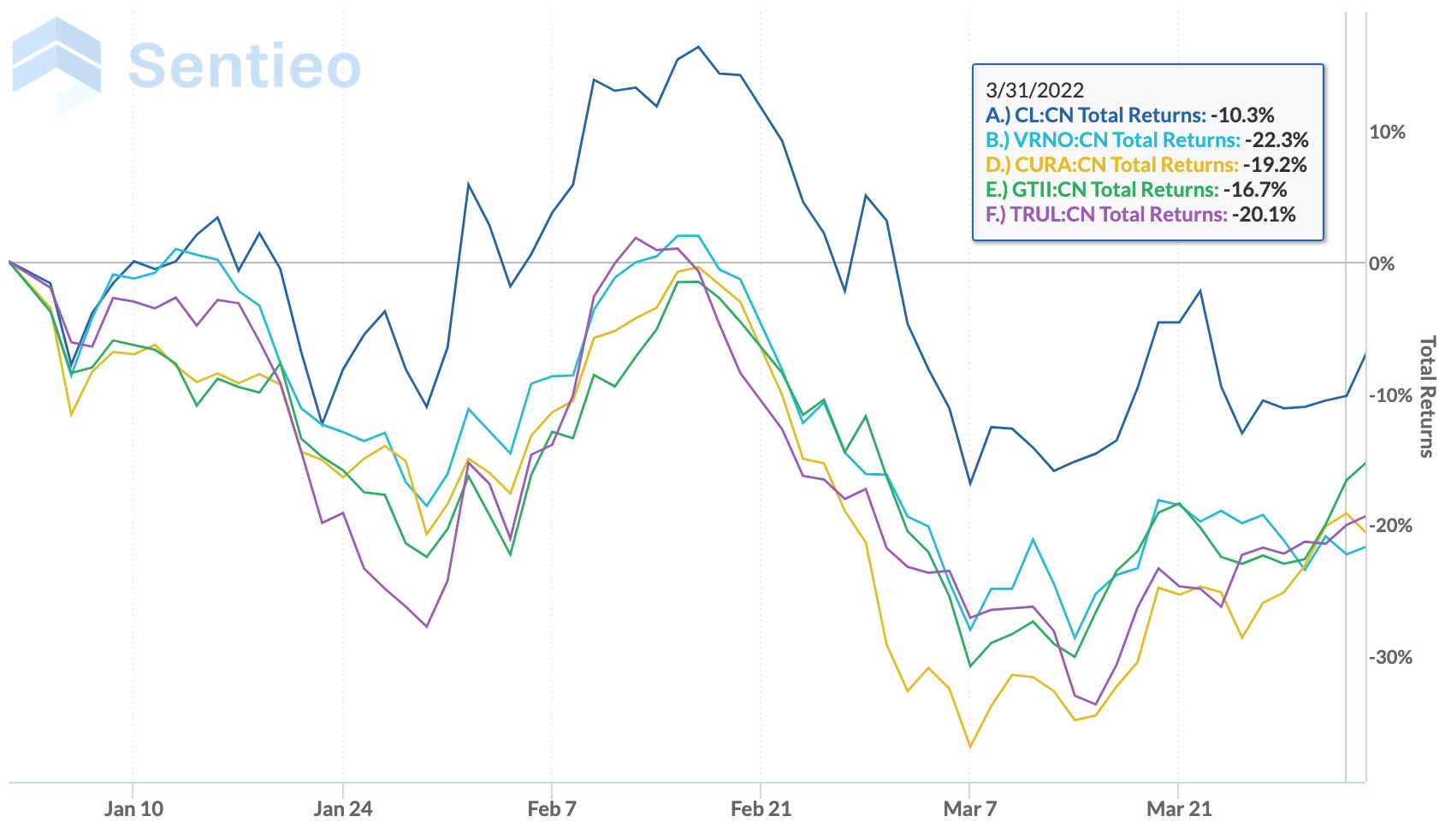

Source: CRB Monitor, Sentieo

The CRB Monitor basket of Tier 1 Pure Play cannabis-linked equities with greater than $1 billion market cap retuned a negative 8.2% in Q1 2022, on an equally-weighted basis. Tier 2’s also struggled in Q1, as an equally-weighted basket of Tier 2 companies with market cap over $150mm returned -15% for the period.

From the chart above, we can see that investors didn’t have an easy ride throughout Q1 2022. While unemployment and wage-related data looked more and more optimistic with each month, investors were distracted by persistent and seemingly unyielding inflation numbers. The economy was bound to overheat at some point, given pandemic-related residual shocks to the supply chain, pent-up demand from bulging savings accounts, and two Covid-related relief packages that inflamed consumer demand even further. Add to that an unscheduled invasion of Ukraine, and we had the perfect recipe for inflation. Finally, in mid-March, the Federal Reserve stated the quiet part out loud by approving its first interest rate hike in the last 3 years.

Historically, cannabis has not exhibited correlation with mainstream equities, or any other asset class, for that matter. One reason for this is its exposure to risk factors that are unique to the cannabis industry: new legalization/decriminalization measures emerging at the state level; the ongoing threat of black market cannabis; and, perhaps the most compelling, the latest developments coming out of the US Federal Government. And as we saw in March, there was hope for progress toward federal legalization (please see regulatory section above) and we witness cannabis equities surge for the last two weeks of Q1 2022.

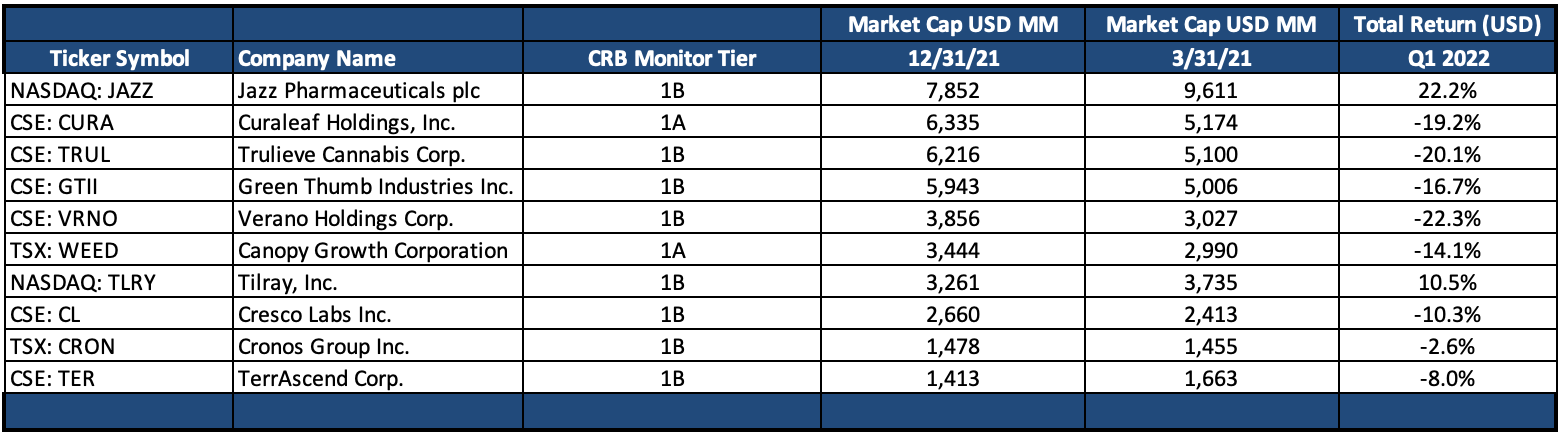

Tier 1 Pure Play CRBs w/Mkt Cap Over $1B – Returns 1st Quarter 2022

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

The best performing stock in the Tier 1 basket was Tier 1B Jazz Pharmaceuticals plc (Nasdaq: JAZZ) (+22.2%). Right out of the gate, JAZZ outperformed the field, posting a 9% return for the month of January. Since their announcement of the acquisition of GW Pharmaceuticals in February 2021, JAZZ has performed about 50% higher than the rest of the cannabis industry. While JAZZ has experienced its own periods of volatility over the last 15 months, risk is dampened by diversification at the product level – revenue from cannabis is significant but not their only offering. In addition, Epidiolex, GW Pharma’s epilepsy drug, is the only FDA-approved cannabis-derived medical product on the market; this has helped to control volatility as well.

Source: Sentieo

Also performing well in Q2 was Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (+10.5%), a stock that is infamously volatile, largely due to a securities lending supply and demand imbalance. TLRY stock skyrocketed in late March, along with the rest of the cannabis industry as investors appeared to look favorably upon regulatory developments at the Federal level.

What was disappointing in Q1? In short, the performance of the larger multi-state operators (MSOs). Why didn’t the news-related rally in March have similar upward pressure on MSOs? From the chart below, we see that there was a fairly significant selloff leading up to March 7th and the March 24th news appeared to have little or no effect on these CRBs. Looking at Cresco Labs Inc. (CSE: CL), we can see that the 3/23/22 announcement of their acquisition of Columbia Care Inc. (NEO: CCHW) caused a positive price move on that day, but that was to be expected given the premium that was built into the deal. But clearly the acquisition was not enough to hold investors’ interest and save Q1 performance, as CL’s price experienced a precipitous drop and closed out the quarter down 10.3%. We witnessed similar performance from Curaleaf Holdings, Inc.(CSE: CURA) (-19.2%), Verano Holdings Corp. (CSE: VRNO) (-22.3%), Trulieve Cannabis Corp. (CSE: TRUL) (-20.1%) and Green Thumb Industries Inc. (CSE: GTII) (-16.7%) (see chart below). This does beg the question, why did MSOs underperform so badly in Q1? It is a bit of a mystery, as by-and-large CRBs had a positive earnings season (ex. Curaleaf Q4 2021 reported in March), in spite of the headwinds they faced over the prior two years.

Source: Sentieo

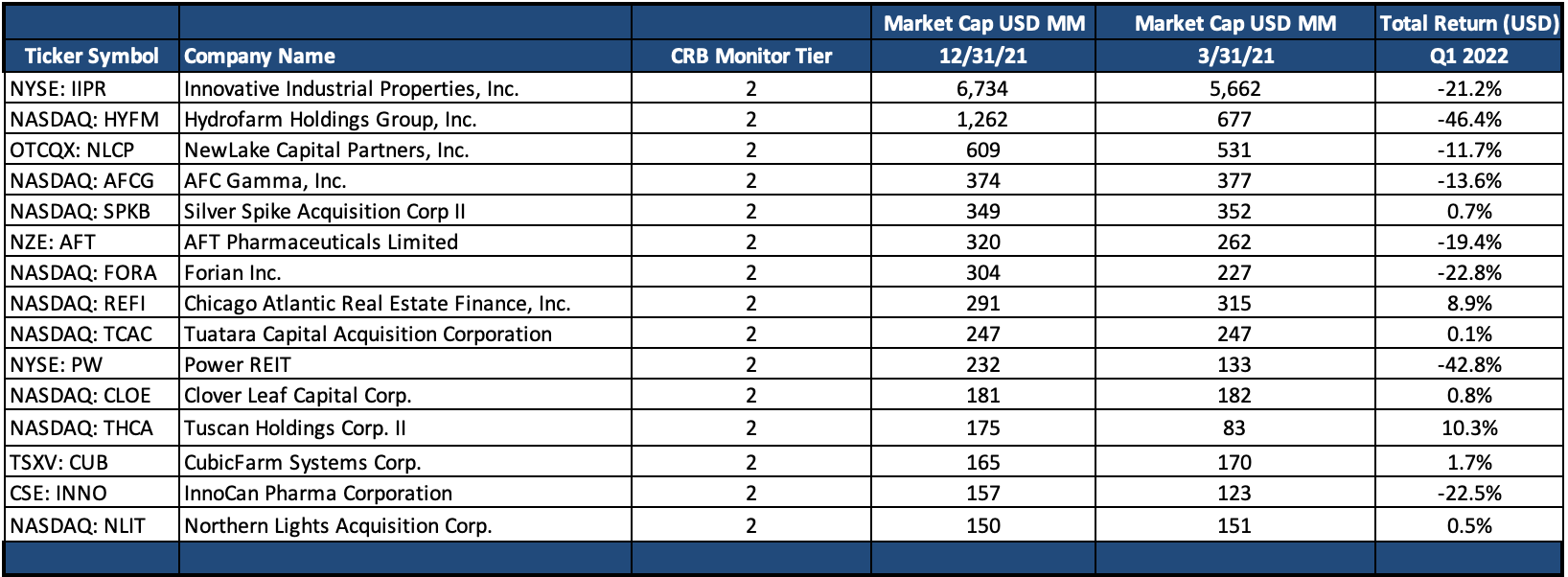

Tier 2 CRBs w/Mkt Cap Over $150mm – Returns 1st Quarter 2022

Source: CRB Monitor, Sentieo

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies had a dismal -15% return for the first quarter 2022, which underperformed the performance of the equally-weighted Tier 1 basket by about 7%. When these two portfolios deviate, it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given the direct revenue relationship, but precisely when these two groups will converge is not so easy to predict. So proceed with caution!

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR, CLS Sector REITs) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” We write about IIPR frequently, largely due to the fact that its stock has defied the volatile price patterns of the cannabis space as it has consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization.

IIPR gave back a large portion of its brilliant 2021 performance in January 2022, returning -24.6% for the month and did not recover in Q1, finishing at -21.2%. In early January, IIPR delivered a quarterly update to its investors, wherein the company stated:

“As of Jan 5, 2022, Innovative Industrial Properties invested roughly $1.7 billion across its portfolio. Moreover, it committed an additional $316.1 million for the reimbursement of some tenants and sellers for the completion of construction and improvements at IIPR’s properties…since the beginning of the fourth quarter through Jan 5, it has made 29 acquisitions for properties in California, Colorado, Michigan, North Dakota and Pennsylvania.”

In spite of all this great news, investors chose to take the money and run, and IIPR sold off steadily for most of January.

Another Tier 2 CRB which struggled in January was Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM, CLS Sector Agricultural & Farm Machinery). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR, HYFM appeared to be in free fall for the entire month of January (-30.7%) and finished the quarter significantly worse (-46.4%). On January 7, Hydrofarm came out with its Fiscal 2021 Outlook, which had this comment:

“…at this time, management continues to expect 8% to 10% organic top line growth for the full calendar year of 2022, which will likely be weighted toward the back half of 2022 as the industry laps strong comps in the first half of this year and several states that have recently enacted pro-cannabis legislation build momentum through 2022. In addition, management expects to benefit from the full year of ownership in 2022 of the five businesses acquired during 2021.”

Apparently this statement was not sufficient motivation for investors to purchase HYFM stock, or at least stop selling it for the remainder of Q1 2022. It is quite possible that Street is looking closely at macro factors (inflation, interest rates) that could continue to have a negative impact on the cannabis ecosystem for much of 2022.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"